What happened to sleepy oil?

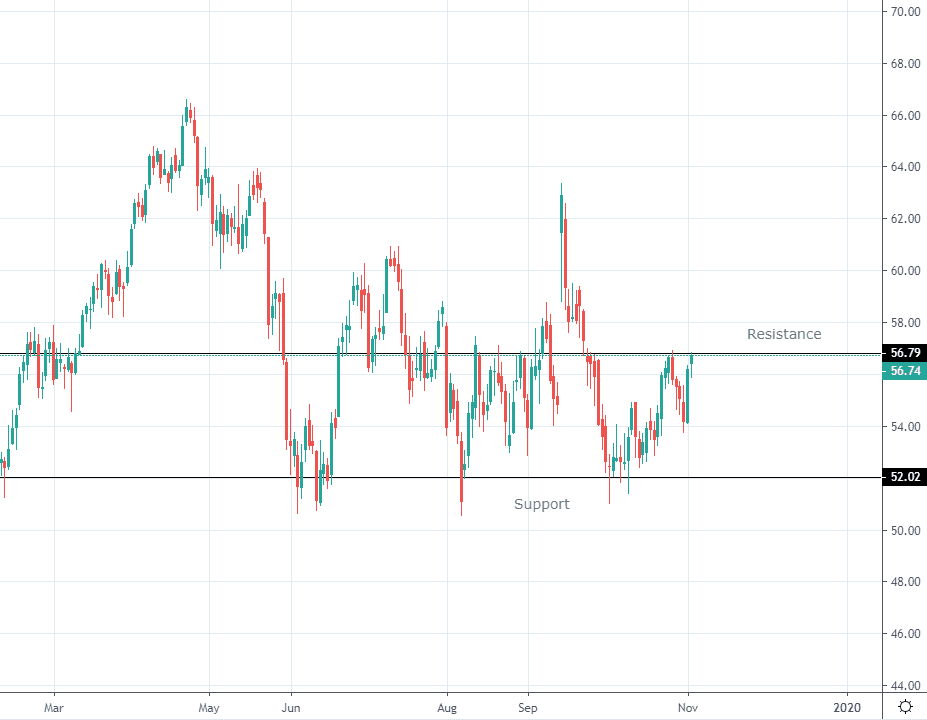

Oil has been one of the worst performing assets lately and is definitely one of the most boring assets to trade at the moment. A lot of the focus has been on the recession story, but that story has faded during the past month. Oil on the other hand, remains stuck in no mans land.

With the Aramco IPO, we are probably getting some new oil focus, although Aramco itself is not affecting oil.

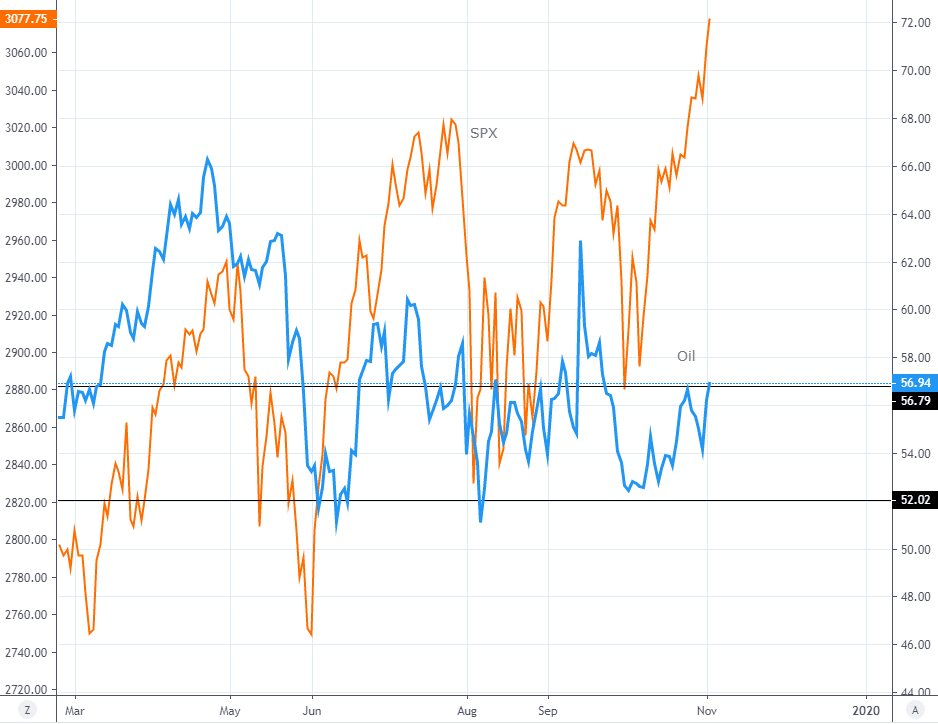

We have seen a fade in the recession story and fear for crashing PMIs and other economic stats slowly diminish over the past weeks. The reaction in equities with the fading fear of the recession has managed creating a squeezy touch to equities and the break out continues.

This could be creating an interesting dynamic in oil space. Oil is back to resistance levels, but if we are to follow the equities “logic”, things could be about to change. Watch the big 57 level in the coming days. A close above it and I would be re-entering longs.

SPX and oil do move in tandem, especially when a global story is the focus. The most recent fade in the bearish economy story has created the melt up in equities. The chart below shows how oil and SPX have been moving in tandem. The question here is whether or not the same “equities logic” will spill over to oil. All things equal, a fade in the recession story in one asset should be spilling over to other assets, especially as they move in tandem.

I would not dare putting on the long oil versus short SPX, but that could be a play possibly as well. I would play it more “clean”, basically betting the recession fade story to spill over to oil.

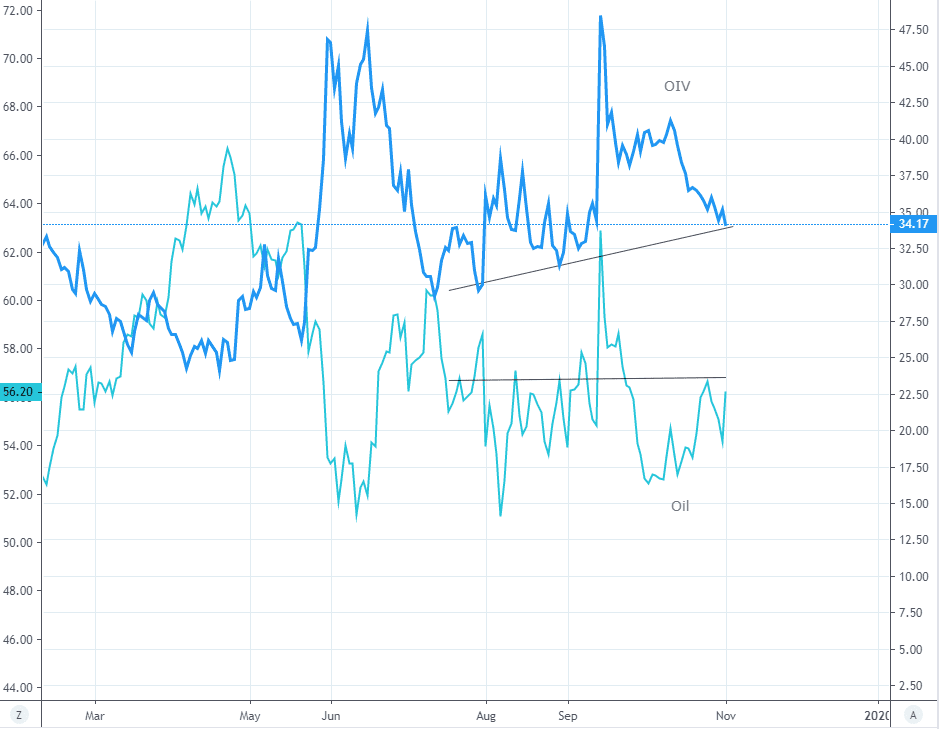

While oil has done very little since August, oil volatility, OIV index has been climbing steadily. The Aramco attack really managed making people reshuffle risk. The old memories of huge oil risk is still in people’s memories, hence the elevated volatility.

One way to play the possible break out higher is by looking at covered call strategies. Long the USO ETF with selling the 115% call option, depending on your view. There are other strategies to consider, but given the elevated volatility levels I would be looking to sell OIV related volatility.

To sum it up, oil could be looking to join the squeezed move higher in equities as the recession theme continues fading. Oil is a huge bellwether of the economy, and could be benefitting from the change in the global risk story.