Markets don’t top on bad news, they top on good news.

I have always said one shouldn’t call the top, as nobody has those skills, but thinking about cheap hedges is becoming more important by the day.

After such a great run up we have had in equities, it would be naïve to expect the market reversing down in a straight line (people will continue buying the dip for some more), but I consider we are entering the phase where you can buy extremely cheap hedges.

Everybody loves equities, especially European equities, everybody is bullish and very few expect any kind of correction. Personally, I believe the psychology of the aggregate market is at very extreme levels and while the buy the dip has been the best strategy until now, one should actively start looking at downside protection.

People have been taught to buy irrespective of the actual belief of the assets they have been buying.

The theory of cognitive dissonance in social psychology proposes that people have a motivational drive to reduce dissonance by altering existing cognitions, adding new ones to create a consistent belief system, or alternatively by reducing the importance of any one of the dissonant elements. Cognitive dissonance is the distressing mental state that people feel when they “find themselves doing things that don't fit with what they know, or having opinions that do not fit with other opinions they hold.” A key assumption is that people want their expectations to meet reality, creating a sense of equilibrium. Likewise, another assumption is that a person will avoid situations or information sources that give rise to feelings of uneasiness, or dissonance.

The psychology of people is usually similar at all major turning points. The same greed and fear is played out as the last buyer/seller decides to give up on the conviction trade.

As I have been arguing recently, I believe it is time to start thinking about putting on some serious hedges. Volatilities are still low, and with correlations having imploded and reached new extreme lows, index options provide a great opportunity to put on hedges.

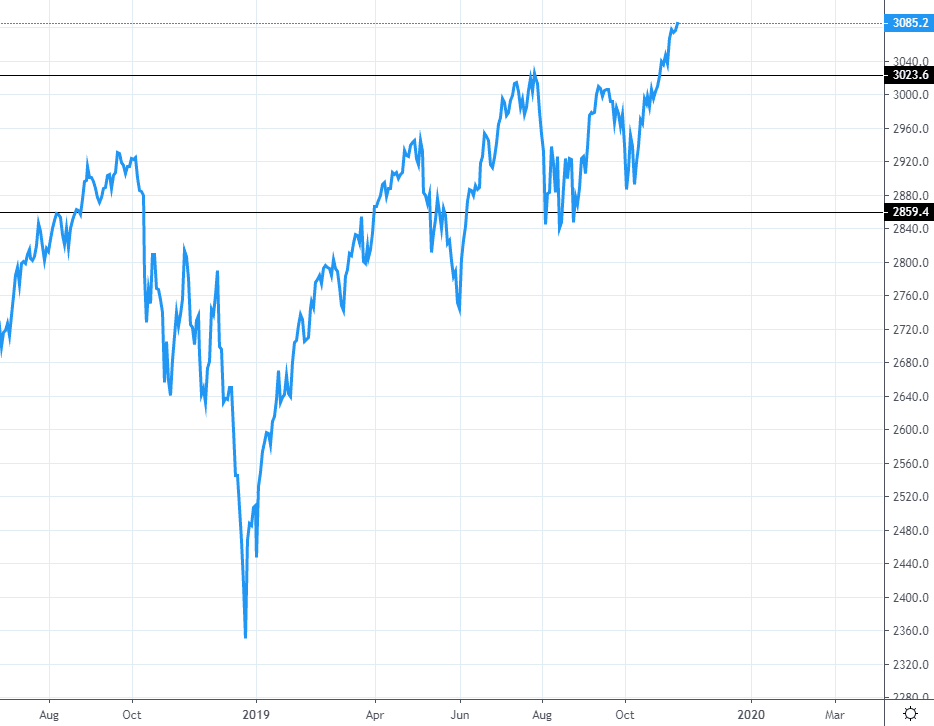

SPX has continued surging and yes playing long has been the right strategy, but I would be dancing close to the exit, just in case.

Source, Tradingview

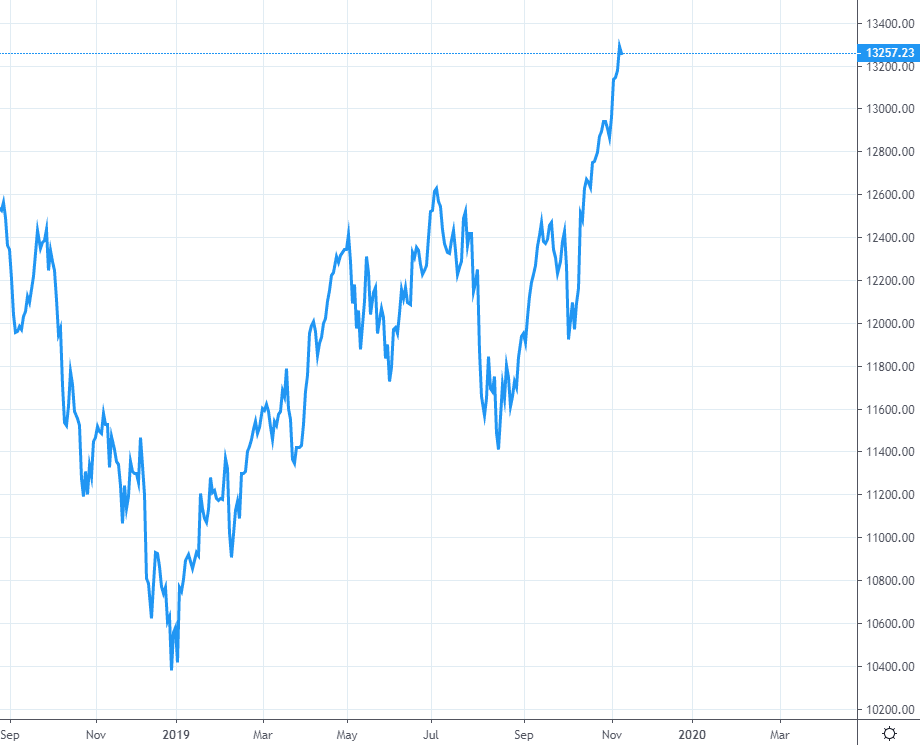

DAX has been the true outperformer, but a bit of caution here as well.

Source, Tradingview

I guess the relevant question one should be asking is what are the actual reasons behind buying the highs again. I know it is extremely hard, but don’t fall victim for the classical crowd behaviour. They never make money, at least not in the long run.