Key points:

- Rolls Royce reported a trading update Thursday

- The company maintained full-year guidance

- RR. shares fell fell over 4%

Rolls-Royce (LON: RR.) shares are down around 4% in early Thursday trading after the company reported a trading update, maintaining full-year guidance.

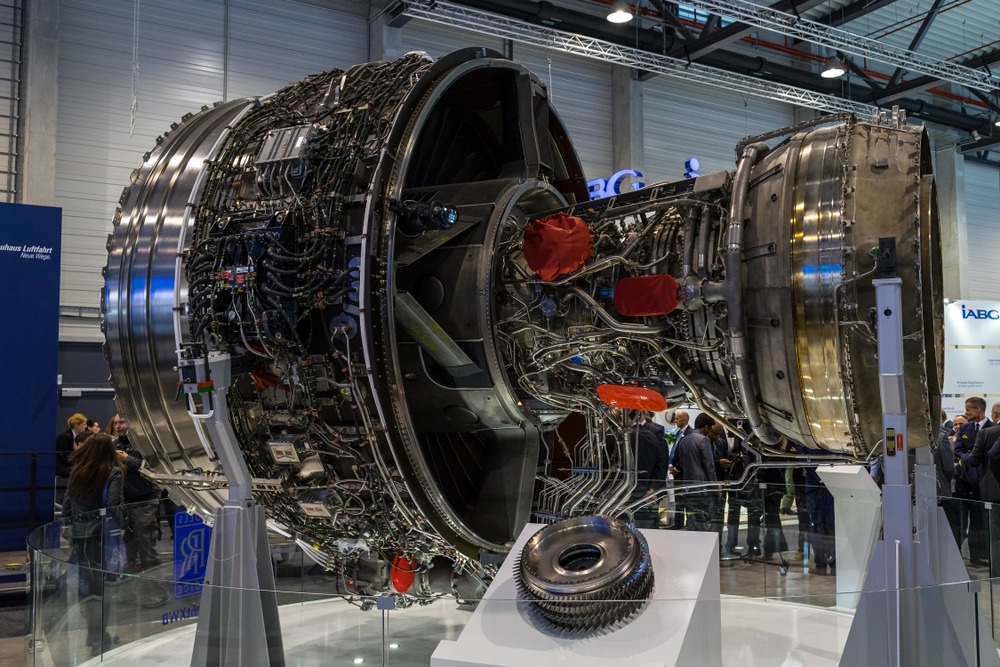

The aero-engine manufacturing business and luxury car manufacturer told investors that it continued to recover with record order intake in its Power Systems business and large engine flying hours at 65% of 2019 levels in the four months to the end of October. Large engine flying hours are also up 36% year to date.

Also Read: How To Buy Rolls Royce Shares

Commenting on the current macroeconomic uncertainty, Rolls-Royce said its “more agile operations and sustainably lower cost base” positions it well for the uncertain pace of the recovery from the pandemic, market volatility, and changes in economic conditions.

“The continued recovery in large engine flying hours, record order intake in Power Systems and a resilience in the Defence business give us confidence in the future,” stated Chief Executive Warren East. “We continue to focus on operational execution and delivering on our commitments and we have maintained our Group financial guidance for 2022.”

Looking ahead, the company said its focus is on operational and contractual discipline in an inflationary environment. However, many of its long-term contracts have inflation-linked pricing clauses to mitigate cost increases.

Rolls-Royce paid off £2 billion of debt it took on during the pandemic and said it aims to return to an investment-grade credit profile in the medium term supported by free cash flow generation.

Following the update, Rolls-Royce shares declined, with Bloomberg putting the fall down to new engine deliveries and maintenance visits coming in at the low end of the expected guidance range.