Key points:

- Rolls-Royce shares are down 41% in 2022

- However, the airline industry’s recovery has gathered momentum

- Defence contracts are also improving

- Still, there are several macro headwinds to consider

Rolls-Royce (LON: RR.) shares are down 41% in 2022 and over 48% in the last 12 months, but it is still one of the most actively traded London stocks, and many investors believe that, over the long term, it will be a winner.

Even before the pandemic, in 2019, Rolls-Royce shares were trending lower. However, they were still trading around 184p before pandemic restrictions really took hold — they now trade at 74p per share.

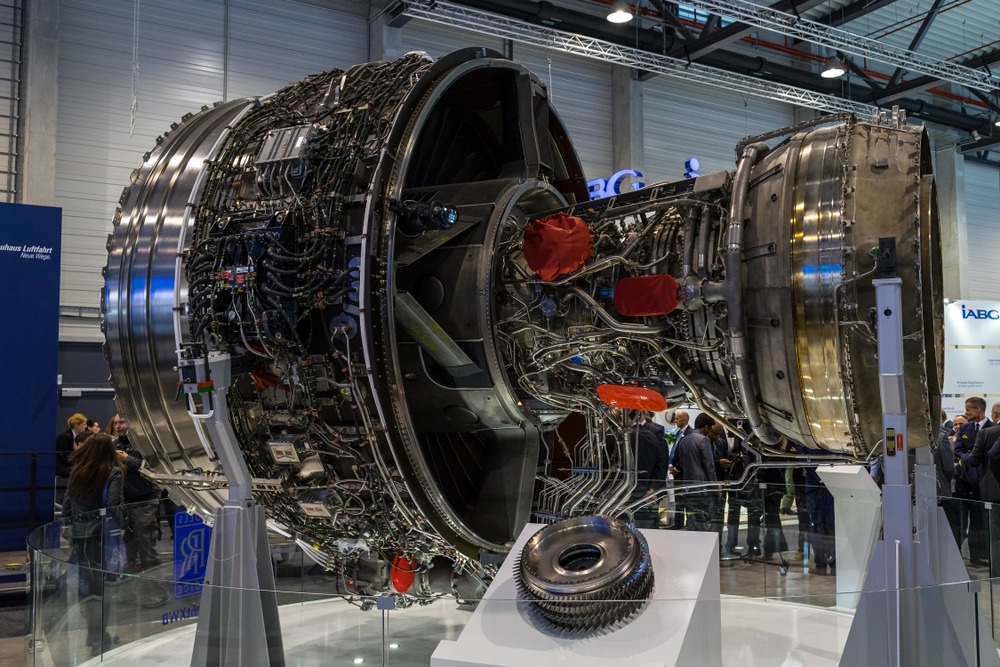

The aero-engine manufacturing, power systems, and defence engineering company derives the majority of its revenue through the sale and maintenance of jet engines. Maintenance of those engines is charged per flying hour, making it a primary revenue driver.

As a result, strict travel restrictions during the pandemic meant revenue flow for its aerospace business was depleted. In addition, following the lifting of travel restrictions, inflation and supply chain challenges have impacted the company further.

Also Read: How To Buy Rolls Royce Shares

Nevertheless, the aviation recovery, despite getting off to a slow start, with further disruptions from factors such as staffing issues, seems to be gaining momentum. For example, airline IAG recently stated that trading during the third quarter has been better than expected, and it sees no indication of weakness in forward bookings, while EasyJet said demand remains strong. In addition, Delta Air Lines said last week that it aims to restore capacity to pre-pandemic levels by next summer due to rising business and leisure demand.

In early August, Rolls-Royce reported its half-year results, falling in the aftermath as its underlying operating profit decreased from £307m to £125m, but that was put down to £371 million in research and development costs. In addition, the company said it saw increased engine flying hours and commercial discipline in Civil Aerospace, although it acknowledged “a number of challenges, including rising inflation and ongoing supply chain disruption.”

Even so, it is working at the margins and expects them to improve in the second half.

Elsewhere, defence contracts are improving “with a strong order book” and a rising number of small modular reactor (SMR) orders.

However, it’s not all positive, with the company still facing some headwinds, including over £5 billion in debt. At the same time, macroeconomic and geopolitical factors have weighed on the overall market, further pressuring Rolls-Royce shares.

The Rolls-Royce positives are enticing, especially if market sentiment changes, as it has in the last few days, but for now, until we see a more positive macroeconomic environment, it is just on the one-to-watch list.