Shares of TP ICAP (LON: TCAP) fell 3% on Friday after the company announced it fully agreed a deal to acquire the equity dark trading specialist Liquidnet in a deal worth $700 million.

TP ICAP will pay $575 million in cash, with $100 million used from existing debt facilities and a $425 million rights issue. An additional payment of $50 million of unsecured loan notes will be paid on the third anniversary after the deal is officially completed.

Liquidnet, which is specialized in dark trading, is due to receive another $125 million, which is dependent on its revenue performance in the next three years.

TP ICAP hopes to boost its group profit margins by 3% with Liquidnet acquisition. The British company hopes to complete the deal in the Q1 next year. It is prepared to invest up to £30 million in the new business over the next two years.

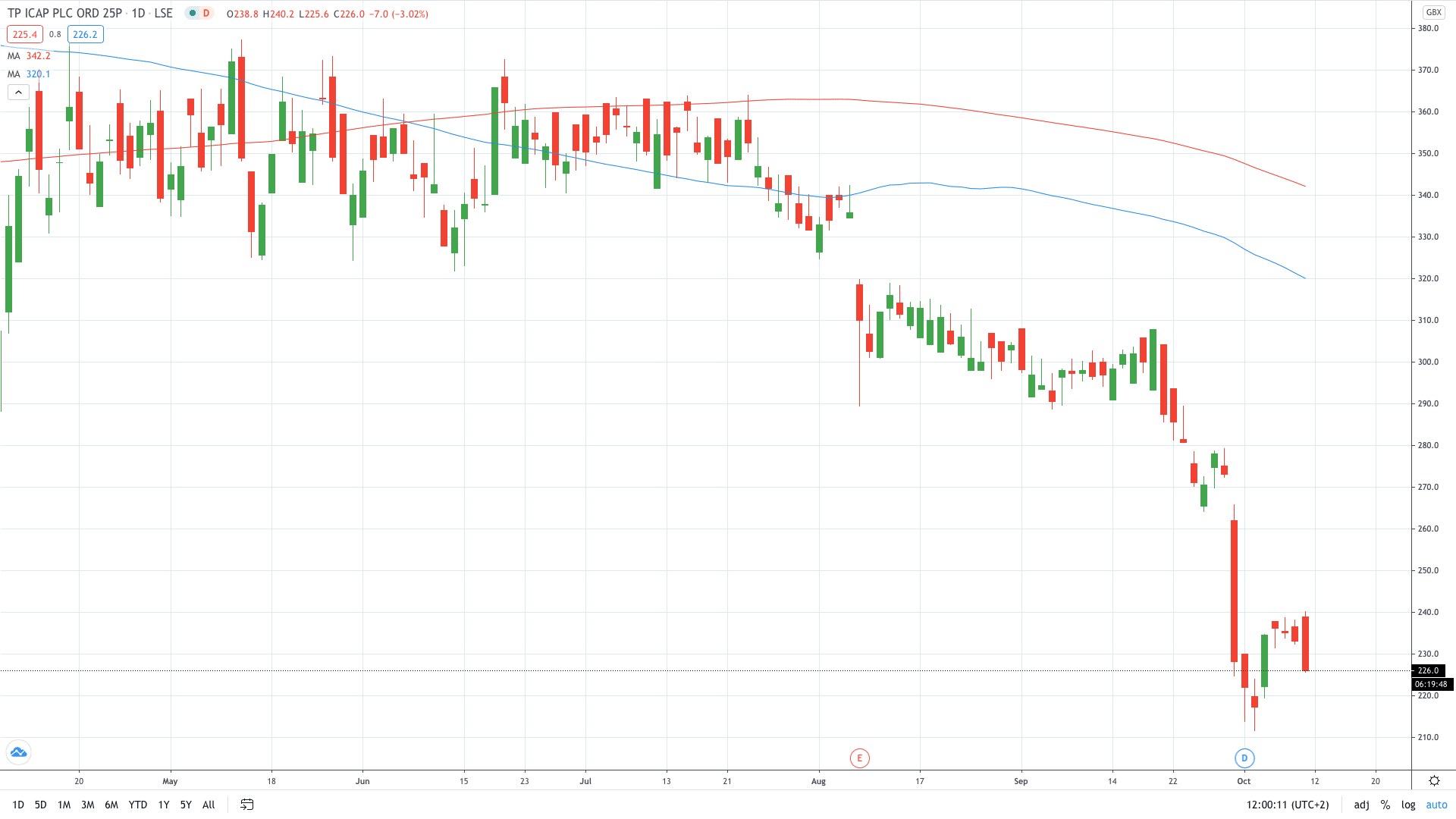

TP ICAP share price fell 3% today as it nears the recent multi-month lows. Shares of the company previously tumbled around 15% in September once speculation over Liquidnet takeover emerged.

PEOPLE WHO READ THIS ALSO VIEWED:

- Aston Martin share price up 15% in two days. Here’s why

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan