Although it is one of the newer brokers in this space, having only been founded in 2021, 1Market has already managed to build up quite an amount of industry buzz.

Set up with a vision to democratise the financial services industry by providing easy access to live market trading, 1Market leverages the power of technology to deliver what otherwise might seem like a lofty promise. This allows it to offer a unique trading experience, which includes an impressive array of proprietary and acquired trading solutions that provide a comprehensive trading experience.

Some of these technological innovations provide a truly unique trading experience that feels cutting edge in an industry that has felt a little stale for the last year or so. And with tools such as 1nsight, you can leverage the power of intelligent algorithms that provide data-driven insights based on the trading activity of thousands of traders.

In terms of how the 1Market trading experience might best be summed up, it provides a comprehensive trading environment where both new and experienced traders are empowered to achieve their financial goals in a safe and secure environment.

If this sounds like just the kind of trading experience that you are looking for, then we would highly recommend checking out this broker! If you want the full rundown of everything that 1Market has to offer, however, keep reading the following review for a more complete picture.

1Market Review Navigation

What can you trade?

Forex

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $500 | Good | 1:400 | Low |

As a CFD broker, 1Market does not provide access to direct forex trading. If you do want to trade forex CFDs, however, the selection on offer is generally pretty solid. 1Market has a decent selection of currency pairs ready to trade, though they are primarily the major currency pairs. Those who are looking to trade exotic currency pairs might be better served using a forex-focused platform.

The spreads on offer are generally good, though not quite as tight as you might see on other platforms. The spread on EUR/USD, for example, will run from 4 pips with the basic Mini account to 2 pips on the Diamond account. Based on the research conducted for this review, 1Market has upwards of 50 different currency pairs to trade on the platform.

CFDs

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $500 | Good | 1:400 | Low |

As an STP CFD dealer, the CFD selection is pretty decent. Although not quite as extensive as some of the larger platforms out there, 1Market has a solid selection of CFDs to trade, which are spread across a nice variety of asset classes. This includes CFDs on currencies, commodities, indices, stocks, and ETFs.

While the spreads are not super-tight on the two basic account types – the Mini and Standard accounts – they are competitive on the higher end of the scale.

Although the selection of CFDs in certain asset classes is quite good, on others it is more limited. Commodities, for example, only covers gold, silver, crude oil and natural gas. Having said that, for most traders, there should be enough variety to allow you to diversify your investment portfolio across the various asset classes on offer.

Stocks

| Min Deposit | App Support | Max Leverage | Trading Fees |

| 500 | Good | 1:400 | Low |

Of the various asset classes that you can trade on the 1Market platform, the strongest selection by far is the stock CFDs.

In total, 1Market provides access to over 500 different types of stock CFDs. This includes all the major blue chip stock CFDs that you would expect to see – such as Facebook, Google, Amazon, Apple and Microsoft – as well as more niche options such as Turk Ilac.

Generally speaking, the spreads on the stock CFDs are pretty good, though they are not particularly competitive on the Mini and Standard accounts. For more dedicated day traders, however, if you open up a Diamond account, the spreads will be much more competitive, making 1Market a solid option for more experienced traders.

In addition to the stock CFDs, 1Market also provides access to real stock buying and selling on a zero-commission basis.

Social Trading

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $500 | Good | 1:400 | Low |

Although not a conventional ‘social trading’ tool, we were very impressed by the 1nsight trading tool that 1Market has developed. This tool is powered by algorithms that scan the trading activity of thousands of traders and asset movements on the 1Market platform to provide information on real-time trading activity. This could include identifying trends, volume spikes, position bounces, or trend reversals.

The 1nsight tool gives you a live insight into what the market sentiment is at any given moment in time, which you can use to make trading decisions. This is a data-driven take on traditional social and copy trading tools, and we were incredibly impressed by it.

Crypto

| App Support | Max Leverage | Trading Fees |

| Regular | 1:400 | Low |

As an STP CFD dealer, the CFD selection is pretty decent. Although not quite as extensive as some of the larger platforms out there, 1Market has a solid selection of CFDs to trade, which are spread across a nice variety of asset classes. This includes CFDs on currencies, commodities, indices, stocks and ETFs.

While the spreads are not super-tight on the two basic account types – the Mini and Standard accounts – they are competitive on the higher end of the scale.

Although the selection of CFDs in certain asset classes is quite good, on others it is more limited. Commodities, for example, only covers gold, silver, crude oil and natural gas. Having said that, for most traders, there should be enough variety to allow you to diversify your investment portfolio across the various asset classes on offer.

What did our traders think after reviewing the key criteria?

1Market fees

In terms of the fees that a broker might charge you for making trades on its platform, there are generally two approaches. Firstly, brokers might charge you a flat fee on any trade you make. Alternatively, you will not get charged a brokerage fee on individual trades, with the broker making its money through the ‘spread’, which refers to the difference between the bid and ask rates.

1Market opts for the second option, which means that you will not generally have to pay any additional fees on any CFD trades you make using the platform. For this reason, it is important to pay close attention to the spreads on offer, as this is where 1Market generates its revenue!

The 1Market platform is not completely free of fees, however. If you have a trade that is held from the end of one trading day until the beginning of the next, you will have to pay a ‘rollover’ fee. These are pretty much industry standard and will apply to any trade that is left open after midnight. Regular rollover fees will apply only on trading days, which means that the weekends are excluded.

The rollover fees charged by 1Market will depend on the asset class in question, so it is important to check out these before finalising your trade. In general, however, 1Market is very open and transparent when it comes to the fees it charges, so you will never have too much trouble figuring out what they are.

Account types

1Market has a number of different account types on offer, which allows you to select an account type based on what kind of trading strategy you want to take.

This includes five different account types, each of which has a well-balanced fee structure in place. The six different account types are Mini, Standard, Gold, Platinum, Diamond, and VIP.

The Mini account is best suited to the casual trader and has a relatively low deposit minimum of $500. It should be noted, however, that it does have some of the least competitive spreads and does not provide access to some of the more advanced trading tools that 1Market offers. Also, it does not provide access to the MT5 platform and exclusively uses the proprietary WebTrader.

The Standard account has a minimum deposit of $1,000 and provides features such as the 1nsight Live Feed, trading signals, and MT5 access.

The Gold account is a step up from the Standard account and provides slightly more competitive spreads, as well as including personal notifications and market updates.

The Platinum and Diamond accounts offer much more competitive spreads, though they have a high minimum deposit of $10,000 and $50,000 respectively. There is also a VIP account for those willing to pay a minimum deposit of $100,000, which offers by far the most competitive spreads, though it has very high minimum trading lines.

Overall, we were impressed by the variety of the account options on offer, which cater to everyone from beginner to advanced and professional day traders.

Platforms

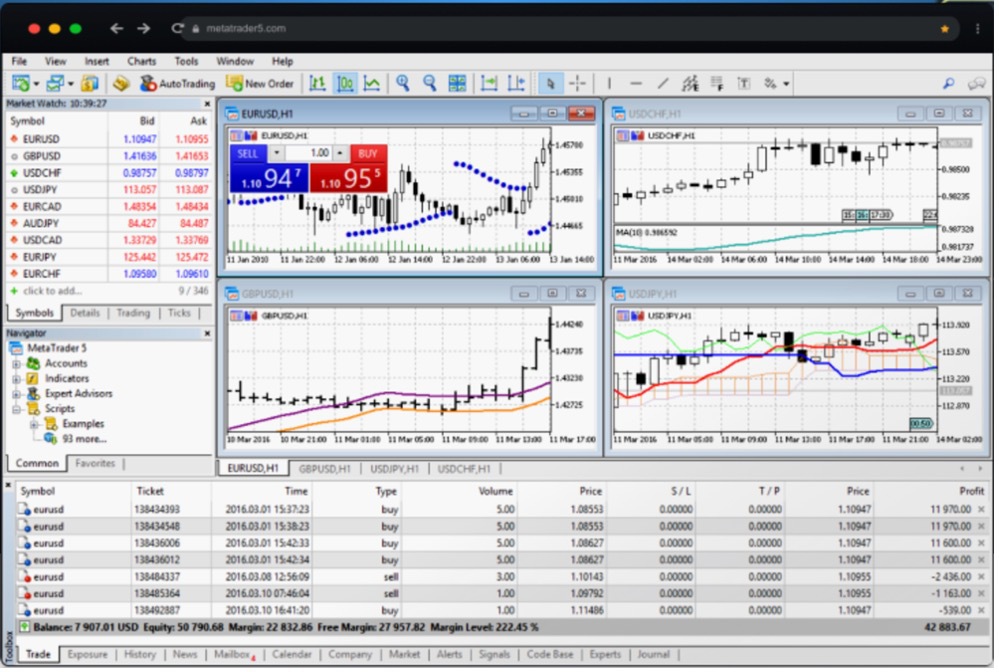

Trading on the 1Market trading platform is primarily delivered through the MetaTrader 5 (MT5) desktop trading terminal. MT5 is the follow-up to the MT4 trading platform, which is by far the most popular retail trading terminal around. Within the industry, however, the uptake of the newer MT5 platform has been quite slow, so it is good to see 1Market leading the rest of the pack when it comes to supporting the newer version.

The MT5 platform retains everything that was great about its predecessors, though it introduces a few new updates and innovations that provide a satisfying, frustration-free trading experience. This includes the ability to trade multiple assets, data-driven trading insights, enhanced charting tools, and full support for indicators, scripts and Expert Advisors. It also includes a built-in community chat platform, economic calendar and internal emailing system. The MT5 platform also allows you to seamlessly manage multiple trading accounts from the same interface and to transfer funds between them with minimal fuss.

Beyond MT5 support, 1Market has also developed a proprietary web trading platform, which allows you to access your account and make trades without the need to download and set up a desktop trading terminal. Although not quite as feature-packed as MT5, the WebTrader is incredibly easy to use and seamlessly integrates with your 1Market trading account.

1Market has also developed a number of other tools and features to help you execute your trading strategy. This includes Trading Central, which is an investment decision support infrastructure, a leverage selector tool, and various other financial market news and market insight resources.

The 1Market platform is packed with useful features that will help you to devise and execute your trading strategy.

Usability

Generally speaking, the user experience that you get on the 1Market platform compares really favourably to even some of the more well-established trading platforms out there.

The website itself is very well designed and uses a friendly, intuitive layout to make information and features incredibly easy to find. When using the 1Market website, you never get a sense of having to go searching for information, with everything laid out intelligently and accessibly. The website is also as responsive as you would hope for and never feels sluggish.

In terms of the usability of the trading platforms, as it is based on the MT5 platform, there is nothing much to write about! If you are at all familiar with the MetaTrader suite of trading tools, then you will know that they are very user-friendly and customisable to your specific needs.

Similarly, the One Web trading platform is also easy to use, and it is clear that the 1Market designers built it from the ground up with beginner users in mind. It is easy to use without ever feeling dumbed down to make it more accessible.

Customer support

Having a proper customer support system in place is essentially for a fully functioning trading platform. As anyone who has ever had any issues with their trading accounts knows all too well, when an issue crops up, you need to know that you have a customer support team who you can not only get in contact with, but who can also provide effective advice.

Thankfully, we are happy to report that 1Market performs well when it comes to customer support. The primary means of getting in contact with the customer support team is through email, but 1Market also has a phone line that is staffed round the clock.

You can send messages and submit technical queries through the ‘Contact’ page, which provides you with a text box where you can set out your issue in full, as well as a facility to attach files if needed. There is also a live help box embedded in the website, which puts you in contact with a member of the support team.

Response times were generally quick, with the knowledgeable and friendly customer support staff always ready to give you a hand.

Payment methods

When it is time to top up your account or withdraw your profits, there are a number of options available to you.

1Market supports a variety of payment methods, which include card payments, traditional bank transfers, and a number of eWallet solutions.

Deposits are usually processed very efficiently, though it will ultimately depend on what method you use. The same is true for withdrawals from the platform, though most withdrawal requests appear to be processed within a working day of submitting the request.

It should also be noted that proof of residence and identification will have to be supplied and verified before you can use the payment and withdrawal facilities. This is to comply with ‘Know Your Customer’ (KYC) and anti-money laundering procedures.

Best offers

At the time of writing this review, 1Market does not provide any specific sign-up bonuses to entice new users to the platform. However, 1Market does provide users of the platform with access to a number of added resources that make signing up for an account an attractive option.

This includes useful trading tools such as the 1nsight market sentiment and trend spotter, the leverage selector, daily market report, and financial market news. These are all excellent resources that will empower you to make sound trading decisions. When combined with the trading conditions offered by 1Market, it makes opening an account an easy choice to make!

Regulation and deposit protection

1Market is owned and operated by Podora Ltd, which is a Marshall Islands-registered company. In addition to being registered as a Marshall Islands company, however, 1Market is also registered as a European financial services provider. Currently, it is licensed and registered by the Cyprus Securities and Exchange Commission (CySEC), which is one of the leading financial services regulators in Europe.

However, beyond the formal licensing and regulation requirements, is this something that 1Market takes seriously, or is it all marketing speak and sales talk?

Thankfully, we are happy to report that based on our research, 1Market clearly takes its regulatory obligations seriously. This is something that we got a sense of based both on how easy it is to find all the relevant regulatory information on the website and the various processes and procedures that it has in place. For this reason, we have no reason to doubt that it is committed to the principles of integrity, skill, diligence, financial prudence, and communication – as it states in its mission statement.

We were particularly impressed by the 1Shield website that 1Market has linked from the platform – this provides you with an accessible portal where you can learn and understand the various types of customer and deposit protections that it has in place. In the many broker reviews that we have written over the years, we have rarely come across a broker so willing to provide traders with actionable information and advice like this. For this reason, we score 1Market very highly when it comes to regulation and deposit protection!

Awards

Although 1Market was only founded in 2021, it has nevertheless managed to pick up a couple of industry awards already! These are a ‘Best CFD Broker 2021’ and ‘Best Introducing Broker Program 2021’ award, both of which were issued by Top Forex Awards.

While two awards do not necessarily mean that the broker can compare with some of the more established players in the online brokerage space, the fact that it has already been able to pick up some industry awards is a really promising sign.

Based on this alone, it is clear that the future looks really bright for 1Market!