In this guide, we’re going to answer the question, ‘what is options trading?', run through the basics and show you an example in practice. You’ll learn to spot trends and reversals when to buy and more.

Ready? Let’s get started!

The dilemma that any trader faces when presented with a price chart to decide whether to enter the market or stay out. One may analyse and look at all kinds of information to form an opinion of what the market should do next. Using various means such as technical indicators or fundamentals to form an opinion, each trader still faces the challenge to commit money – to buy whatever the market represents, or to stay out.

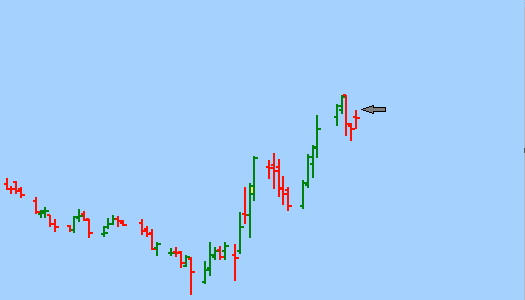

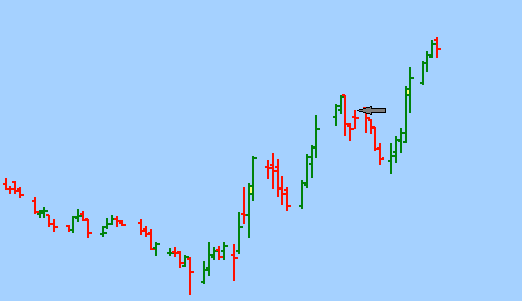

Image 1.1: Buying the market

Let's say, for example, that you decided to BUY the market at the arrow in the previous image, and the following happens:

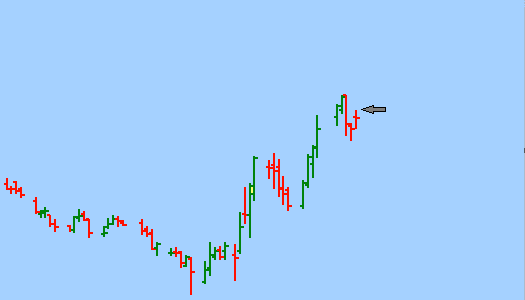

Image 1.2: Market moves higher

The market moves higher and you are in a profitable position – exactly what you wanted.

But what if it drops?

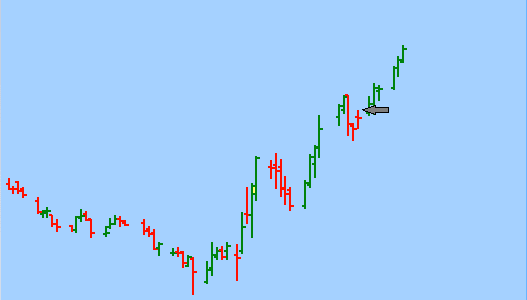

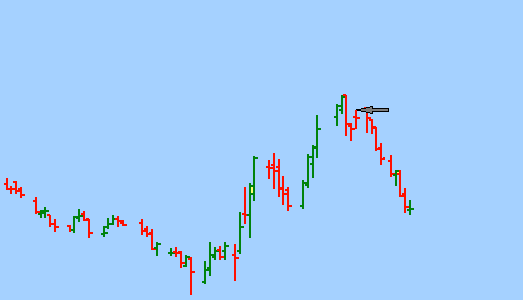

Image 1.3: Market continues lower

Well, this is exactly what you feared could happen and why you might have hesitated to get into the market in the first place. The question then becomes:

“..this is too much for me, the risk I’m facing is too high, I am getting out…”

And as soon as you exit, the market may do this:

Image 1.4: Bullish trend continuation

The moment you exit your position the market turns around and goes higher again – leaving you frustrated and confirming that your original analysis was right all along.

So, the next time around, thinking that you have learned from your “mistake”, you decide to stay in the market a while longer but then the following happens:

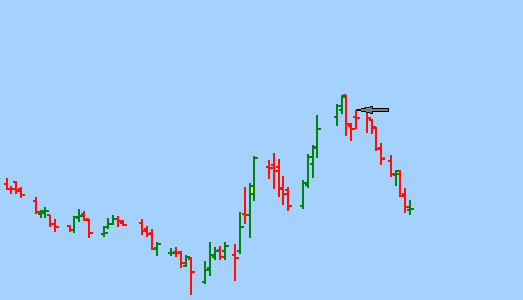

Image 1.5: Trend reversal

In this scenario, the market proved you wrong and what should have been a small loss turned into a big loss because you failed to get out.

Do all of these scenarios sound familiar?

As traders, we face similar situations all the time and we, therefore, must follow rules – when to stay in a trade and when to get out.

Is Trading Options A Good Idea?

Since this guide is all about options, let’s now look at the same market behaviour we mentioned above but discuss why options trading can give you a powerful alternative means to trade the markets.

Reference Image 1.1

What if you could choose to buy the market at the price indicated by the arrow but before you make that decision you would like to wait and see what the market does first? In other words when the market does this:

Reference Image 1.2

It would then make sense to buy the market down at the arrow, so you make use of your choice and you buy at the arrow. And if the market does this:

Reference Image 1.5

It will not make sense to buy – so you stay out of the trade and avoid a loss.

And if the market now does this:

Reference Image 1.4

Well, here too it will make sense to buy at the arrow, so you make use of the choice you have and buy.

If you had these choices, how would it change your trading?

- You will be passively trading the market (since you will not be physically in the market)

- You will have the choice – the option – to buy the market at the specified price at any time you like, if you like. This offers you the luxury to first see what the market does first before you decide whether you would like to enter or not.

- You will not experience the emotional stress of the market turning against you

- Your risk will be lower

What we have described above is the business of options trading. You do not enter the market but instead, you buy an option that gives you the choice (the option) to enter the market at a specified price or not. Doing this allows you to observe what the market does first before you decide what to do next.

Options trading, therefore, is a method to reduce risk or to manage the risk in trading.

Having such a choice – an option – to enter the market at a specific price whenever you feel like it is a very powerful choice to have and it would have been great if you could get such “choices” for free. Unfortunately, the trading world does not work that way but if you are willing to pay for

such a choice though, then someone might be willing to give you such a choice.

We can call it a “choice”, or we can call it an “option” – it is the same thing, you have the choice/option to enter the market. Since we are talking about “options trading” and not “choices trading”, let us use the term “option” – you have the option to enter the market.

So, if you pay a certain amount of money to someone, they might be willing to give you an option to enter the market. The “money that you pay for the option” is called the premium – you are “paying a premium” to get the option (get = buy). Once you have the option, you cannot give back the premium to get out of the option but you can, however, sell the option back to someone else if you can find someone willing to do so.

Consider the following conversation as an example:

Let’s say Jack approaches Jim, his Broker, and asks him:

- Jack: “Jim, I would like the option to buy the market at this price”

- Jim: ‘Sure Jack. If you pay me $500, I will give you such an option'.

Jack agrees, but the next day he changes his mind:

- Jack: “Jim, I changed my mind, can we cancel this option and return my money?”

- Jim: “No, sorry. You know that premium is not refundable, but I'll give you $400 for that option”

- Jack: “But why? Didn't you ask $500 for this option yesterday?”

- Jim: “Yes, I did, and you were willing to pay that. But today, if I look at where the market currently stands, I am not willing to pay more than $400”.

Of course, should there be a sharp rise in the market price, then Jim's story might change – he may be happy to pay Jack $500 to make the option go away but in this case, Jack could also be a bit more greedy and instead ask $700 from Jim to tear up the option.

An option is, therefore, a binding contract and if Jack wants to buy the market at the specified price, he may do so, legally. However, for Jack to be able to buy at the specified price, someone must be willing to sell the market to Jack at that price – there must be a seller.

Who in their right mind will sell the market down there at the arrow (Image 1.2) when the market is trading above that arrow? Well, the guy who wrote the option, the guy who gave Jack the option in the first place – that guy, Jim – he will have to sell the market down there to Jack.

An option does exactly what we described above – it gives you the choice to enter the market at a certain price, whenever you like but you have to buy such an option for a premium. The option becomes a legally binding contract and you may trade in this contract and sell this contract onto someone else. So, once you have paid a premium to get the option, you can never lose more money than the premium you have paid.

Should the market move down:

Reference Image 1.5

Then you will never make use of the option that you have, it would not make sense, but you will lose the premium you paid for the option (unless you can sell it to someone else). The maximum loss that you can make in the market is capped at the premium and you can never lose more than that because you never entered the market. Instead, you can just sit on the side-line and decide what to do next.

Should the market go up though, then you could enter and hopefully make back the money you had to dish out for the option.

Therefore, with options trading, you pay a fixed premium to get the option to enter the market. Your loss is capped to the premium you have paid, and you can never lose more than this amount. However, your potential profit will be uncapped – the market can go as high as it wants and you will always be able to enter down at the specified price if you would like (it is your choice).

PEOPLE WHO READ THIS ALSO VIEWED: