You must understand Ethereum if you consider adding it to your cryptocurrency portfolio. Read on to learn about Ethereum for beginners to get an idea of precisely what Ethereum is and whether it's a sound investment for you.

- Ethereum – Essence

- Ethereum – Brief History

- How do you start trading ether?

- Ethereum Wallets

- Advantages and disadvantages of Ethereum

What is Ethereum?

Ethereum is an open-ended decentralised software platform and also a programming language. It is the largest and most established platform of its kind, running a peer-to-peer network of virtual machines and allowing developers to build and publish distributed applications. Ethereum runs via its decentralised public blockchain, using similar technology to Bitcoin and other digital currencies while providing users with much more than a digital currency to trade.

So, what exactly is the Ethereum you have probably seen available to trade at cryptocurrency exchanges and online brokers? In 2014, when Ethereum was launched, its founders also launched a pre-sale for a platform-related cryptographic token, or coin, called ether. Ether is used for a couple of fairly broad purposes. Firstly, it is used inside the Ethereum network to run applications and monetise work done by developers. As Ethereum puts it, ether can be used to “codify, decentralise, secure and trade just about anything.” It can also be traded on crypto exchanges as a digital currency. Although ether is being traded, it is commonly referred to as Ethereum, with the ticker (or shortened code) of ETH.

To further complicate things, the applications that can be developed via Ethereum can also create their own unique digital currencies or tokens. This means that on exchanges with a wide range of altcoins available, you will see other minor digital coins such as EOS, Veritaseum and Iconomi, which may state that they are built on the Ethereum platform. Ethereum is, in fact, one of only two major platforms on which new digital coins are developed. The other one is Omni, which is built on top of the Bitcoin blockchain. This means that many of the now 1,000+ digital coins available on the cryptocurrency markets have grown out of the same platform as Ethereum and Bitcoin.

That said, when you see Ethereum (or ETH) available to trade and quoted as the actual name or ticker for the currency, you will be trading ether. It is the main Ethereum currency, which is invariably one of the most popular and frequently traded coins when it comes to cryptocurrency trading. ETH tends to stay in the top five most popular traded digital currencies along with others such as Litecoin and, of course, the ever-popular Bitcoin and Bitcoin Cash.

ETH can be bought, sold and traded against other currencies, on online exchanges and through online brokers who specialise in cryptocurrencies or include them in what will often be a wide range of financial instruments. Ethereum, like other cryptocurrencies, really is a virtual currency. Each coin is basically just a computer file with a private key. That means you must store your coins (or your private keys) online in an Ethereum wallet, which we discuss in detail below.

Ethereum – Brief History

As already mentioned, Ethereum was first publicly announced in 2014, following a 2013 Ethereum white paper published by Vitalik Buterin. The original development team included Vitalik Buterin, Mihai Alisie, Anthony Di Lorio and Charles Hoskinson. The actual release happened in stages, with Ethereum's “Frontier” released in July 2015 with 72 million ETH pre-mined. “Homestead” (the first stable Ethereum release) went online in March 2016.

Ethereum is often compared to Bitcoin; indeed, both have become popular tradable instruments on cryptocurrency exchanges. However, in truth, the two currencies differ significantly in purpose. While Bitcoin was developed as a potential alternative to cash and is, therefore, a form of online payment of interest to the general public, Ethereum was created as a platform to enable peer-to-peer contracts and applications and allow for monetisation of work within the platform. Ether was, therefore, never intended or designed as a general payment alternative.

Another important difference in the way Ethereum and Bitcoin have been developed is that with Ethereum, there is an unlimited supply. The software Bitcoin runs on was set up in such a way that only a set amount of Bitcoin can ever be mined or created. It is like a real-world resource such as gold or oil. There will never be more than 21 million Bitcoins available, which is what potentially makes the currency so valuable. With Ethereum, on the other hand, the supply is not restricted. New virtual ETH coins will continue to be created indefinitely.

How do you start trading Ether?

As we have established, developers are mining ETH and even creating their own unique altcoins within the Ethereum network. Still, the only thing of interest for the average cryptocurrency investor will be how to start investing in Ethereum on a cryptocurrency exchange or via an online broker. To start trading, you must identify a suitable cryptocurrency trading platform and create an account.

There are two main ways to trade Ethereum online. You can easily buy and sell the currency directly on cryptocurrency exchanges, which operate as peer-to-peer marketplaces. It is also possible to trade Ethereum and other cryptocurrencies via an online brokerage as long as they offer cryptocurrencies among their tradable assets. Cryptocurrency exchanges are popular and work the same way as other financial exchanges, allowing customers to trade digital coins with other exchange members. They generally operate 24/7 throughout the year, which can be a significant advantage, bearing in mind how volatile digital currencies can be. Setting up an account is usually quicker and less involved at an exchange than at a broker. Some exchanges will not ask for verification as most brokers will, and they will also facilitate very small trades, which can be attractive for beginners. Brokers may have a minimum deposit that they will require to clear before trading can begin, although, to be fair, this is often very low when trading cryptocurrencies.

Cryptocurrency exchanges come in different forms. There are crypto-to-crypto, fiat-to-crypto, peer-to-peer marketplaces, and centralised and decentralised exchanges. Peer-to-peer exchanges (also known as P2P exchanges or P2P marketplaces) let buyers and sellers trade their digital coins directly with one another. These exchanges tend to be very secure, with the exchange itself acting as escrow, holding digital funds until the payment for them has been made and therefore ensuring that if payment is made, the trade is completed.

You can also use a centralised exchange, which allows buyers and sellers to place orders and then matches those who want to buy ETH at a certain price with those who wish to sell. Trading on a centralised exchange can be a very similar experience to using a P2P exchange, but more of the work is done for you as you are pre-matched with a suitable seller or buyer. For this reason, fees will be somewhat higher.

Trading Ethereum and other digital currencies through a broker has advantages and disadvantages. It is less straightforward than using a currency exchange but may allow you to use contracts for difference (CFDs) to speculate on the value of digital currencies without ever owning the underlying assets. If you've traded using CFDs, you will already know the pros and cons. One pro, of course, is leverage. However, crypto traders will find they won't be offered the leverage they get on fiat currencies or other assets when trading Ethereum and other cryptocurrencies.

Ethereum Wallets

It is essential to use a secure online wallet to store your Ethereum. As your coins are entirely virtual, this is a case of securely storing your private keys associated with your purchased currency. Losing your private key is both possible and highly undesirable. Keys cannot be easily ‘recovered' like a lost password or other types of lost data. If you lose or delete your keys, you lose your currency permanently.

You can choose from desktop wallets that run on your computer or mobile wallets that can be downloaded to a mobile device, which is more convenient but less secure. It is also possible to store your Ethereum in “cold storage,” meaning your keys are held on a device that is not connected to the internet. That method is significantly more secure as it is impossible to hack a cold storage wallet, making it an attractive choice for storing large holdings or if you want to hold your Ethereum for an extended period.

There is also something known as a “hardware wallet.” These are small devices similar to memory sticks or cards. Your keys can be stored there and detached from the internet for high-security levels. It is, however, possible to lose a physical hardware wallet like this if it is not stored somewhere safe. Always be aware that you are fully responsible for keeping your private keys safe, and if you lose them or your system is hacked, they are gone for good.

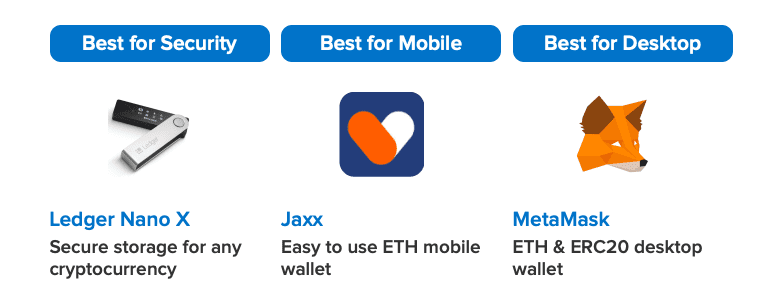

Here are some of the most popular wallets for Ethereum as of 2022:

- Ledger Nano X: This wallet is the newest crypto hardware device that is easy to use. It connects to Android, desktop PCs and iOS.

- Jaxx: Jaxx is a multi-cryptocurrency wallet both for Android and iOS use.

- MetaMask: This is an ERC20 & ETH desktop wallet. It's an add-on for Firefox.

Advantages of Investing in Ethereum

- The platform provides a full-package service and can facilitate very complex agreements as ETH transactions do not necessarily require third-party involvement. It's also a self-locked system, which means various goods and services can grow together in the blockchain.

- In addition, it is an open platform that anyone can join, facilitating constant developments and improvements.

- ETH is a stable and well-planned digital currency. That is often not the case with cryptocurrencies, with many launching and quickly disappearing. ETH has been developed with the future in mind, and the NFT craze of 2021 primarily took place on the Ethereum platform. The functionality of the Ethereum blockchain makes it the natural home for new digital industries, even some which haven't been invented yet.

- ETH also has a lot of support within the business community, and relatively low Ethereum transaction fees will make it attractive for investors to use ETH to invest in new initial coin offerings.

- Ethereum is currently putting through a massive system upgrade called The Merge. This will move the platform from using energy-heavy proof-of-work protocols to using proof-of-stake technology. This approach will result in coin owners rather than miners creating blocks, and it is estimated that the switch could reduce Bitcoin energy consumption by 99.95%.

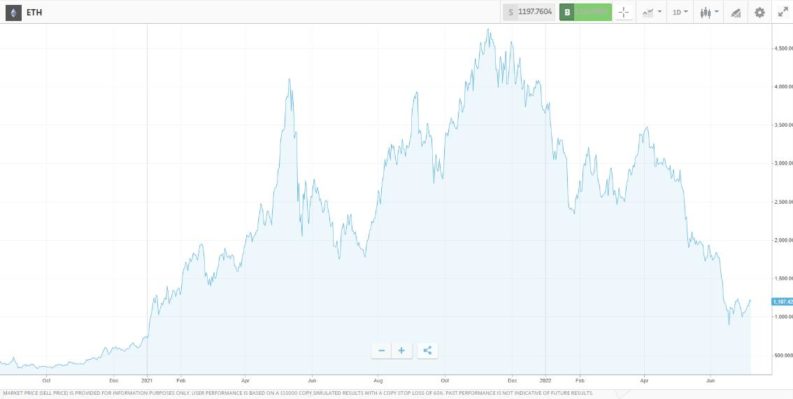

- Some of the best returns on crypto investments have come from traders buying the dips. Crypto markets are notoriously highly volatile, and the crypto price crash of 2022 acted as a reminder of the risks involved. Being high beta instruments means coins like ether can overshoot to the downside and create lifetime buying opportunities.

- Crypto staking is a relatively new development in the crypto space. It allows investors to receive an annual return of new coins if they agree to tie their position up for a while. Ethereum's system upgrades are paving the way toward staking being more easily accessible, allowing investors to receive passive income on their positions.

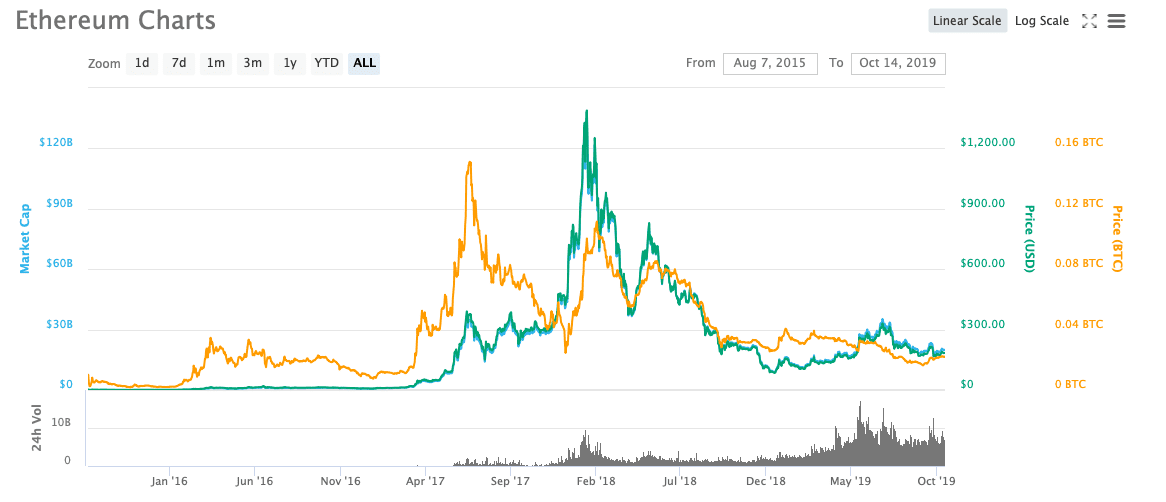

Ethereum Price Chart – 2019 – 2022

Source: eToro

Disadvantages of Investing in Ethereum

- While digital currencies are generally more secure than many investors assume, some security issues exist with all virtual coin systems, including Ethereum. It is possible, for example, to lose your Ethereum wallet or delete your private keys accidentally and lose them permanently.

- There is also the security problem for online Ethereum wallets, which can be a target for hackers. It is mainly a concern for those who store their ETH online.

- Like other digital currencies, Ethereum is highly volatile and completely unregulated. The lack of regulation around cryptocurrencies has always attracted and excited less risk-averse traders. Still, it is certainly something to keep in mind when considering investing in Ethereum and other digital coins. Cryptocurrencies are generally decentralised and unregulated currencies, and as such, they carry a complex set of risks and many opportunities.

- The Merge has been repeatedly delayed. This is bad news for investor sentiment but also flags up that some analysts believe proof of stake protocols are not as secure as proof of work ones.

FINAL THOUGHTS

When it comes to investing in Ethereum, the question is whether the platform's complex nature is a positive or negative factor. Ethereum, in short, may simply have too many platforms and functions. It is a ledger, a network, a smart contracts generator and much more. While this is a fascinating concept, many investors believe it makes the platform weaker than, for example, Bitcoin, which is simply a digital coin designed to fulfil one specific function.

On the other hand, the platform is agile enough to capture the ‘next big thing' such as NFTs. The fact that the business community is so generally supportive of Ethereum means it does have the potential to become the dominant global payment system of the future.

Ethereum still ranks as the second-largest cryptocurrency by market capitalisation. For many, the competition to become the world's dominant crypto is a two-horse race between bitcoin and ether. It is still a risky proposition in terms of operational and market risk. Crypto markets are not regulated, so choosing a broker with a solid reputation is key to protecting your funds. Choosing one from this list of trusted crypto brokers will put you in the best position to start your Ethereum trading journey.