** Content does not apply to US users**

eToro is a leading online trading platform that allows you to trade on over 2,000 CFD financial instruments, as well as ETFs, stocks and crypto-assets.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

In this guide to eToro fees and commission charges, we’ll be taking a look at the various trading and non-trading fees you need to be aware of before you start trading.

Before We Get Started, Take A Look At Our Other eToro Guides:

- Read our eToro review

- Read our eToro demo account guide

- Check our eToro app test

eToro Trading Fees

Let's first take a look at some of the day-to-day trading fees you need to be aware of. These include fees related to day-to-day trading activity such as:

- Deposit Fees

- Transaction & Commission

- Spread Cost

- Currency Conversion Fees

- Overnight Funding

- Cryptocurrency Fees

Deposit Fees

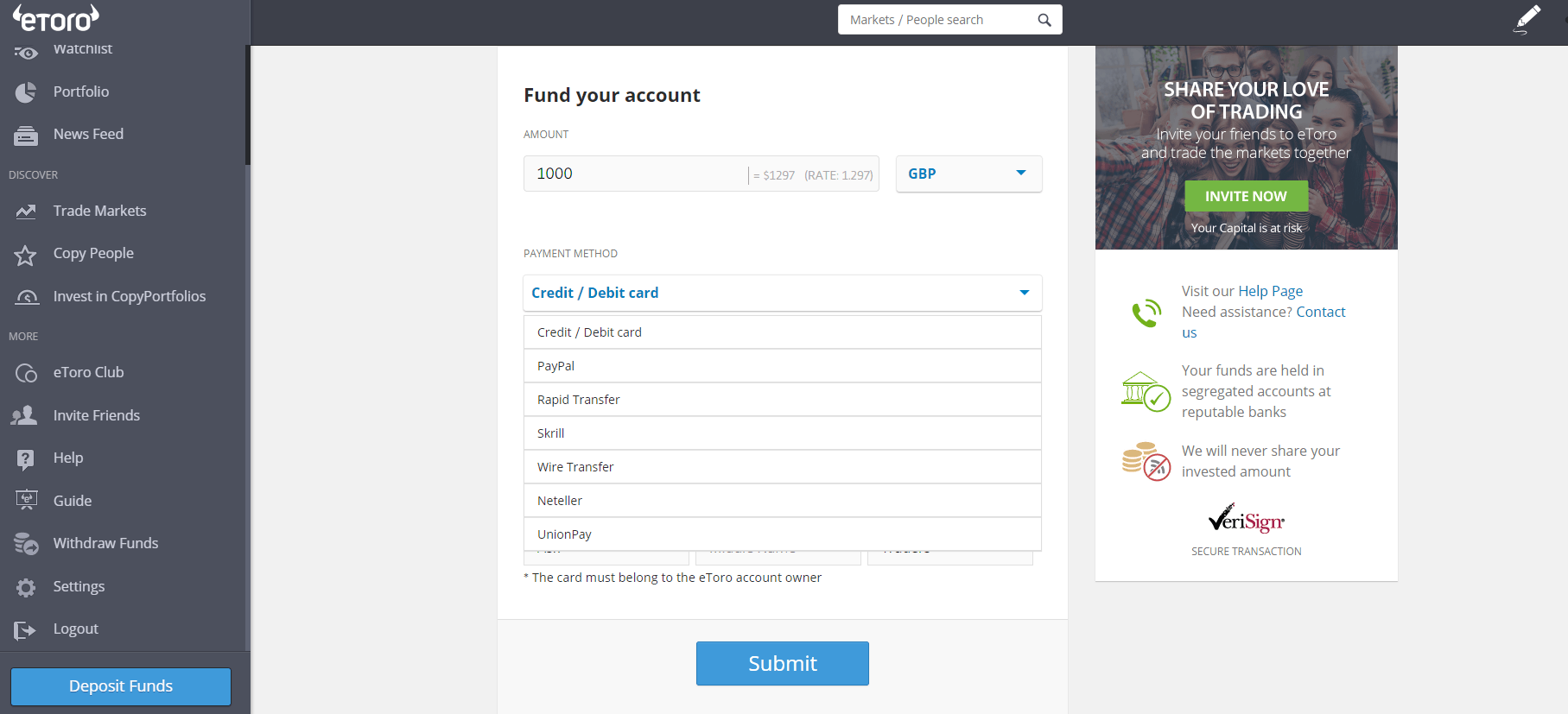

eToro does not charge deposit fees. All deposits to your eToro trading account are only in US dollars and would, therefore, incur a conversion fee if you fund your account in any other currency.

You can deposit funds into your trading account via:

- Bank wire, online banking

- Debit/Credit cards

- iDEAL, Sofort, Giropay, PayPal, Skrill, Neteller, RapidTransferAll the fund deposit methods are easily accessible on the eToro CFD platform

All fund deposit methods are easily accessible on the eToro CFD platform. Simply click ‘Deposit Funds' and choose your payment method in the dropdown menu.

Transaction and Commission Fees

eToro does not charge a commission on investments in stocks. When it comes to CFDs, although the broker states that they do not charge ticket fees, we suggest you check with the broker before signing up.

Low-Cost eToro Alternatives

Pepperstone: FCA and ASIC regulated

Take A LookAdmiral Markets: Impressive range of assets

Take A LookPlus500 | CFD provider: 82% of retail investor accounts lose money when trading CFDs with this provider

Take A LookIf you are looking for a reliable broker with low fees and fair conditions then this is who we recommend. All have been reviewed by our team and have been found to offer a low cost way to trade

Spread Cost

Clients signing-up with eToro would find that the spread contributes significantly to total trading costs. The bid-ask difference varies across financial instruments, asset classes and the charges are visible while exiting positions.

Unlike a majority of CFD brokers who include the fractional pip to calculate spreads, eToro does not. So, you might find the bid-ask difference a little higher compared to the other brokers.

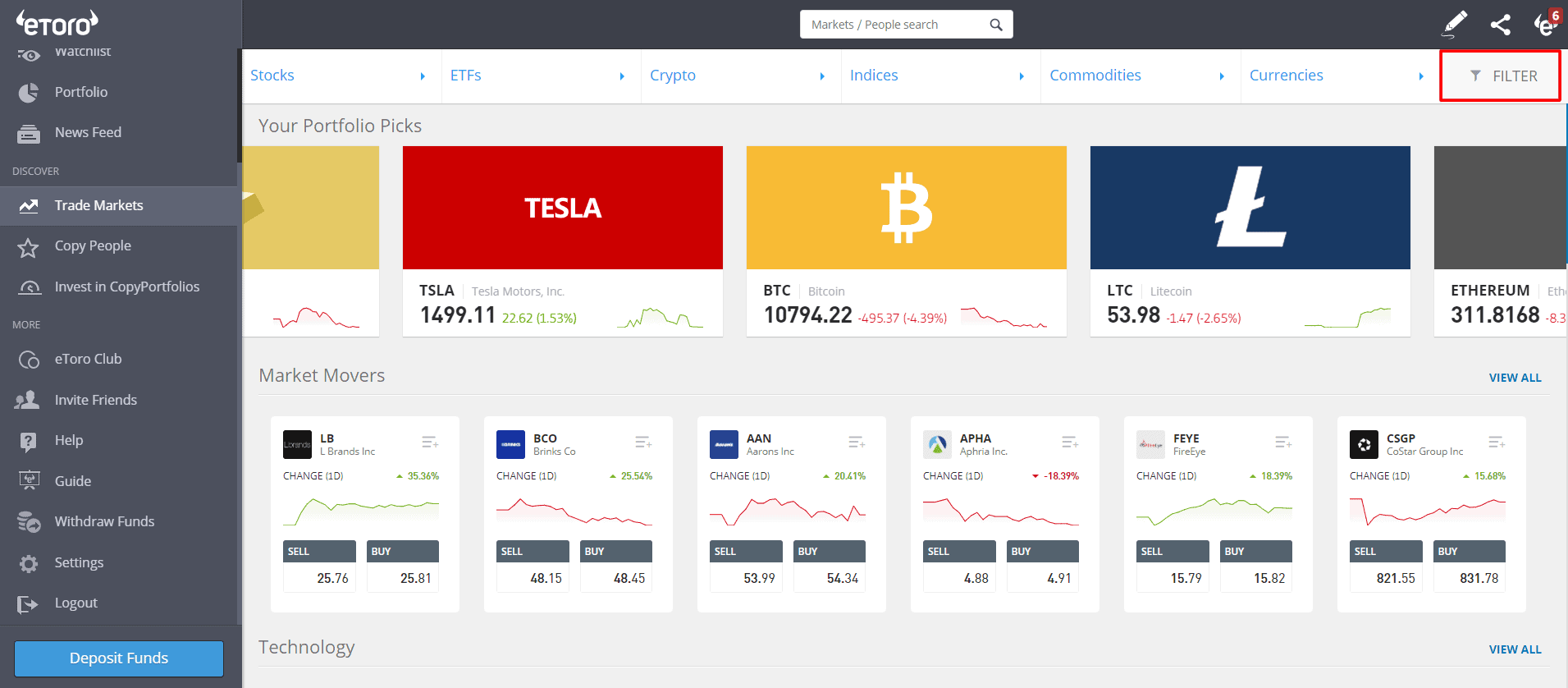

eToro makes it incredibly easy to see the spread cost on any given instrument, from crypto to indices and stocks.

To view spreads, head to ‘Trade Markets' and select the filter option in the top right-hand corner and select your instrument of choice:

We really like the fact that spread costs update in real-time:

Currency Conversion Fees

All deposits and withdrawals are in US dollars. So, if you fund your account in any other currency, there would be a currency conversion fee. The conversion fee varies on the payment method, is charged for both deposits and withdrawals and could range from 50 pips to 25,000 pips depending on the currency pair.

Diamond members depositing/withdrawing funds in EUR, AUD, or GBP do not have to pay currency conversion fees while Platinum and Platinum+ members receive a 50% discount.

Bank Wire Transfer, iDEAL and Sofort

| Instrument | Conversion Fee Upon Deposit & Withdraw |

| AUD USD | 50 pips |

| EUR USD | 50 pips |

| GBP USA | 50 pips |

When depositing or withdrawing AUD, EUR and GBP via wire transfer, iDEAL, Sofort and Giropay, Diamond members are automatically exempt from conversion fee. Platinum and platinum members receive 50% discount. Read more about the offers of the eToro club.

Credit Card, Paypal, Skrill, Neteller, Rapidtransfer and Union Pay

| Instrument | Conversion Fee Upon Deposit | Conversion Fee Upon Withdrawal |

| AUD USD | 100 pips | 50 pips |

| EUR USD | 150 pips | 50 pips |

| GBP USD | 50 pips | 50 pips |

| MYR USD | 200 pips | 200 pips |

| RMB USD | 400 pips | 400 pips |

| PHP USD | 2500 pips | 2500 pips |

| THB USD | 35 pips | 35 pips |

Rollover or Overnight Funding

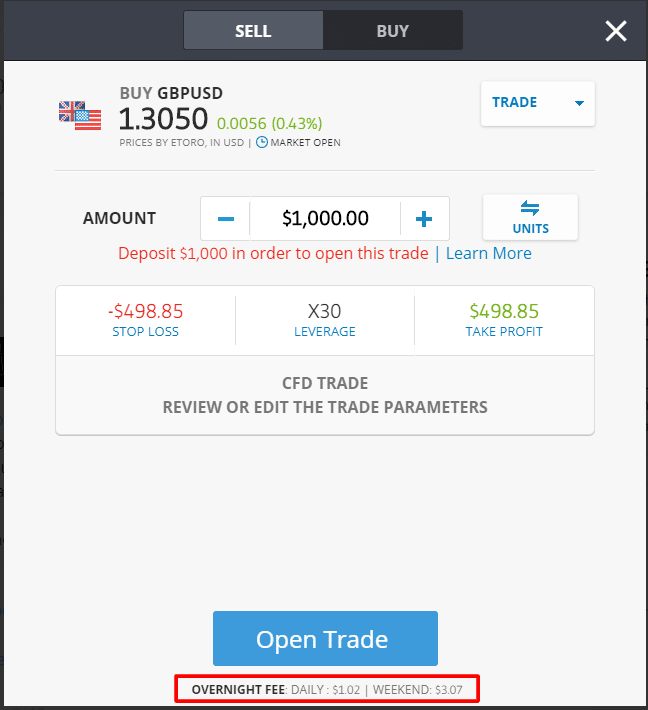

The rollover or overnight fee is applicable for all open positions on CFD products. The overnight fee comes into effect at 21:00 GMT, Monday-Friday. The 3X weekend fee is payable on Friday for stocks, ETFs, index CFDs and every Wednesday for currencies, commodities, cryptocurrencies.

In the case of non-leveraged long positions in equities, ETFs and cryptocurrencies, eToro does not charge the overnight or rollover fees. This fee structure is available to all eToro clients except those in the US.

The charges are clearly visible at the bottom of the trade window on the eToro platform:

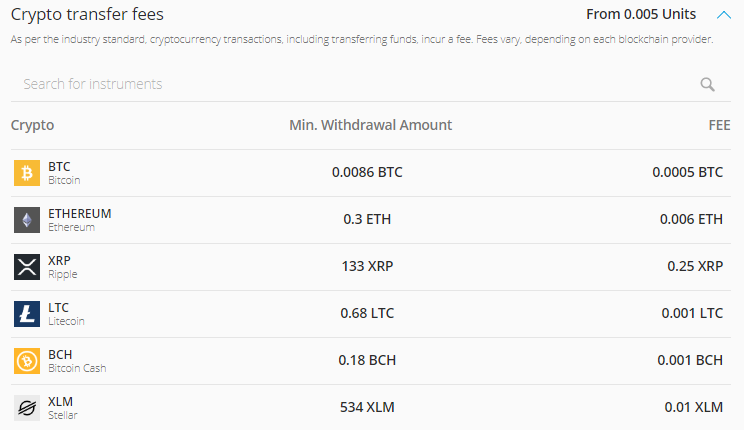

Cryptocurrency Fees

Depending on which cryptocurrency you're trading, you will be charged a fee on your transactions. This also includes transferring funds. The table below highlights the transfer fees for various cryptocurrencies:

eToro Non-Trading Fees

Non-trading fees are fees that occur related to some operations you make in your account, such as depositing money to your account, withdrawing money from it or not trading for an extended amount of time.

eToro non-trading fees include

- Withdrawal Fees

- Inactivity Fees

- Crypto Transfer Fees

- Management Fees

Withdrawal Fees

While eToro does not charge a deposit fee, there is a $5 withdrawal fee that the broker charges to cover its international money transfer expenses.

Inactivity Fees

eToro charges an inactivity fee of $10 per month which is billed after twelve months of inactivity on your account. To avoid paying this fee, remember to regularly log in to, or close your eToro account.

Inactivity Fees vs. Other Brokers

| eToro | Plus500 | Markets.com | |

| Inactivity Fee | Yes | Yes | Yes |

| Inactivity Fee | $10 per month after 1-year inactivity | $10 per month after three months inactivity | $10 per month after three months inactivity |

eToro Crypto Transfer Fees

eToro allows traders to transfer cryptocurrencies from the platform to the eToro Wallet. Irrespective of the digital currency, a transfer fee applies.

eToro Management Fee

eToro does not charge management fees for holding assets in the stock investing account.

eToro Fees Summary

Our review of the eToro fees shows that the broker’s primary revenue stream is from the spread. The broker does not charge a transaction fee regardless of whether you sign-up for CFD trading or an investment account. Besides, you do not have to pay separately to copy trades of other investors nor does eToro charge for deposits. However, the other fees linked to currency conversion, crypto transfers and fund withdrawals certainly lead to higher trading costs.

People also viewed

- How to buy bitcoin on eToro

- What are eToro dividends

- eToro Deposit Guide

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or

down. Your capital is at risk.

Don’t invest in cryptos unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.