Stocks that pay a monthly dividend offer the best of both worlds. If the prospects for a company look good, increased buying pressure from investors can drive the stock price up and generate a capital gain. Even without any growth catalysts coming to light, these firms can continue their day-to-day business, simultaneously churning out income streams for shareholders.

YOUR CAPITAL IS AT RISK

There’s something of a win-win feel about buying cheap dividend stocks under $15. With global interest rates near zero, they offer a convenient way to gain exposure to annual dividend yields that far exceed the rates of return provided by savings accounts.

Table of contents

- BEST FINANCE SECTOR MONTHLY DIVIDEND STOCK UNDER $15

- AEGON NV (EURONEXT: AEG, NYSE: AEX)

- MONTHLY DIVIDEND STOCK WITH THE BEST GROWTH PROSPECTS

- PEARSON PLC (NYSE: PSO; LSE PSON)

- BEST MONTHLY DIVIDEND TECH STOCK

- UNITED MICROELECTRONICS CORP (NYSE: UMC)

- MONTHLY DIVIDEND STOCK WITH A YIELD THAT IS INCREASING

- ITAÚ UNIBANCO HOLDING SA (ADR) (NYSE: ITUB)

- WHY INVEST IN MONTHLY DIVIDEND STOCKS NOW?

- WHAT TO KNOW BEFORE INVESTING IN MONTHLY DIVIDEND STOCKS

- HOW TO BUY MONTHLY DIVIDEND STOCKS

- BEST BROKER FOR TRADING STOCKS ONLINE

BEST FINANCE SECTOR MONTHLY DIVIDEND STOCK UNDER $15

AEGON NV (EURONEXT: AEG, NYSE: AEX)

Amsterdam-based Aegon NV has a strong position in the life insurance, pensions and asset management sectors. It’s a big and globally recognised operation with 26,000 employees and a dividend yield of 5.33%.

The dividend yield of Aegon may not quite match that of some other dividend stocks under $15, but the firm is a relatively safe bet and capital gains could also come into play. Between March 2020 and May 2023, the Aegon stock price skyrocketed from 1.69 to 4.32, representing a capital gain to shareholders of 154%.

AEGON NV – SHARE PRICE CHART 2019-2023

YOUR CAPITAL IS AT RISK

MONTHLY DIVIDEND STOCK WITH THE BEST GROWTH PROSPECTS

PEARSON PLC (NYSE: PSO; LSE PSON)

Pearson had a ‘good’ pandemic as many day-to-day activities, including learning, went online. This provider of educational materials was able to take advantage of the scalability of its business model, and from March 2020, its share price rallied by 94% in less than 12 months.

The stock has continued to perform well in the post-Covid era, and dividend hunters will appreciate the capital growth as a nice-to-have feature. But it does not distract from the consistent cash returns to investors, which equate to a dividend yield of +2.59%.

PEARSON PLC – SHARE PRICE CHART 2018-2023

YOUR CAPITAL IS AT RISK

BEST MONTHLY DIVIDEND TECH STOCK

UNITED MICROELECTRONICS CORP (NYSE: UMC)

United Microelectronics is a Taiwanese microchip manufacturer with a New York Stock Exchange listing. The ADR has shown significant price strength over the last 12 months, demonstrating that picking the right dividend stock can also result in capital gains and that the chip sector is a hot topic.

UMC’s P/E ratio has risen to 6.52, but the dividend yield of 6.24% is an impressive return for a stock in a high-growth sector.

UNITED MICROELECTRONICS (ADR) – SHARE PRICE CHART 2020-2022

YOUR CAPITAL IS AT RISK

Demand for chips will continue to increase thanks to there always being a new way of doing things. The metaverse may not yet be part of day-to-day life, but big corporations are already making plans for it to be so. That is why United Microelectronics’ revenues are predicted to remain strong through 2023.

MONTHLY DIVIDEND STOCK WITH A YIELD THAT IS INCREASING

ITAÚ UNIBANCO HOLDING SA (ADR) (NYSE: ITUB)

Itaú Unibanco is the largest banking firm in Brazil, with ADR shares listed on the NYSE, providing a convenient way for international investors to gain exposure to the potential of Brazil’s economy.

As the Brazilian economy is still emerging, price moves in ITUB can be volatile. Still, the recent dip highlights how investors who get into a position at a lower price enhance the yield they get on their position. If a firm’s cash payout is relatively stable, buying cheap dividend stocks under $10 or at a lower price level means investors get a higher percentage return.

ITAÚ UNIBANCO (ADR) – SHARE PRICE CHART 2017-2023

YOUR CAPITAL IS AT RISK

The low P/E ratio of 9.73 suggests that those willing to take on a long-term prospect could factor in regular dividend payouts and the possible kicker of the share price rallying.

WHY INVEST IN MONTHLY DIVIDEND STOCKS NOW?

Many economists, analysts, and investors are bracing for a global environment of higher interest and inflation rates. This kind of macroeconomic shift would require asset markets to adjust their valuations to factor in the change in underlying conditions.

Equities will be challenged by the new market conditions that are predicted. Inflation and higher borrowing costs are eating into the disposable expenditure of consumers, driving down the revenues of firms.

Not all equities are likely to suffer to the same extent. As the selloff in the Nasdaq 100 index in 2022 proved, likely to be hardest hit are growth stocks that skyrocketed in value during the low-interest rate years. On the other hand, dividend stocks will be better positioned to weather the storm, if only in relative terms.

WHAT TO KNOW BEFORE INVESTING IN MONTHLY DIVIDEND STOCKS

Dividends are paid at the discretion of a firm’s management. While some stocks ‘typically’ pay dividends and even have long track records of doing so, any downturn in fortunes could see payments to investors dry up as the firm protects its balance sheet.

It is also possible that a firm will adjust the frequency of dividend payments from monthly to quarterly, semi-annually, or annually. That shouldn’t make too much difference to total returns, and the price of dividend stocks usually factors in an element of dividend premium regardless of how frequently dividends are paid. In addition, any payments made to investors may incur a taxation charge, so personal T&Cs need to be checked.

The final potential issue with dividend stocks is that returning cash to investors, while a sign of a successful business, also signals limited growth potential. If the management were aware of exciting new opportunities that would boost the share price over the long term, they would use the spare cash to invest in those projects instead of returning it to shareholders.

YOUR CAPITAL IS AT RISK

HOW TO BUY MONTHLY DIVIDEND STOCKS

Finding the right dividend stock to invest in is the first stage of the process, but choosing a trustworthy broker is equally as important.

1. CHOOSE A BROKER

This broker shortlist includes firms with a track record of supporting traders of monthly dividend stocks. They are all regulated and have been reviewed by the AskTraders team.

TIER-1 REGULATORS

- US Securities and Exchange Commission (SEC)

- Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

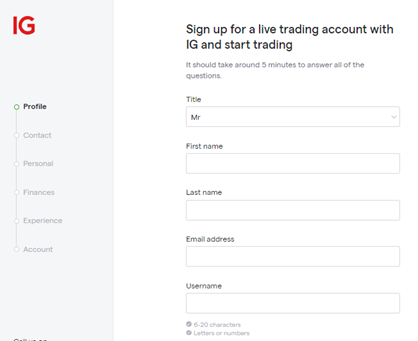

2. OPEN AND FUND AN ACCOUNT

Opening an account takes minutes and can be done using a handheld or desktop device.

Depositing funds to a new account can be done in various ways. Using debit and credit cards is popular, but most brokers offer at least ten payment options. It is important to double-check the T&Cs to avoid paying unnecessary processing commissions or suffering time delays.

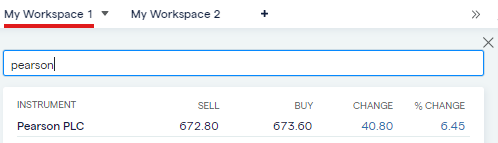

3. OPEN AN ORDER TICKET AND SET YOUR POSITION SIZE

Once your brokerage account is active, buying your selected monthly dividend stocks is the next step. The trading dashboard for each market is located using the ‘search’ function.

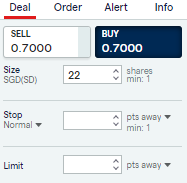

Buying is as simple as entering the number of shares you want to purchase into the appropriate data field and clicking or tapping ‘Buy’.

4. SET YOUR STOPS & LIMITS

Stop-loss instructions and take-profit orders are risk-management tools that instruct a broker to automatically close out some or all of a position if price reaches a certain level.

Investors running long-term strategies often decide not to use stop-loss and take-profit orders. Their approach is to ride out short-term noise in the share price and even potentially buy into any dips to enhance the yield on their position.

Alternative approaches to risk management include diversifying your investment across several companies to avoid single-stock risk.

5. MAKE YOUR PURCHASE

Once you’ve bought your new stock, its performance and the regular payments of dividends can be monitored using the Portfolio section of the platform. Some firms allow dividends to be collected in the form of more stock rather than cash – in this instance, instead of seeing your cash balance increase, you’ll see your stock holding grow in size.

YOUR CAPITAL IS AT RISK

BEST BROKER FOR TRADING STOCKS ONLINE

Dividend stocks are at the lower end of the risk-return spectrum. It’s still possible to lose all your money, but the target firms tend to run well-established business models. That makes them popular with both experienced and new investors.

Good brokers now allow you to access thousands of different stocks in a wide range of sectors, and they provide online reporting in user-friendly formats so that it is easy to track your positions. The cherry on the cake is that regulated brokers provide a safe and secure trading environment and all the trading tools you need to get started, book your first trade, and generate a steady income return.