The enduring popularity of Snap stock is due to the multi-media platform’s ability to make significant returns for investors. The stock gained 639% gain in 12 months following March 2020 and has experienced other strong rallies before and after that period, despite the more recent weakness.

YOUR CAPITAL IS AT RISK

Snap Inc., if timed right, can be highly profitable. As ever, risk management needs to be incorporated into your strategy, as buying Snap shares can be a rollercoaster ride. The following factors should be considered if you’re thinking of getting on board.

Table of contents

Overview of Snap Shares

Snap first came into existence as Snapchat in 2011. It’s the product of cooperation between three former Stanford University students who hit on the idea of developing a photo messaging service with messages that disappeared shortly after being received.

The added privacy of Snap struck a note with certain users of messaging services, and the platform has grown to be one of the most popular social media apps in the world. It generates most of its revenue from on-screen advertising targeted at users.

The company's Snapchat app has more than 300m daily active users, with the number consistently rising QoQ over the last few years. The growth rate is impressive enough, but of equal importance is that many users are in the much sought-after 15–35-year-old demographic.

The firm first came to the market in 2017 as part of a blockbusting IPO, which, at the time, was the largest US tech launch since Facebook. When Snap shares launched, the firm had a valuation of $23.8bn. The stock shot up a further 44% before it completed its first day of trading.

The initial float price of Snap shares was $17. Despite the first day’s euphoria, the stock eventually headed south and spent much of the last couple of years trading under the psychologically important $10 per share threshold.

Snap is now at a tipping point, and those considering buying shares in the company would do well to consider developments in the nature of the messages that form the core of its business. Depending on your view, changes to messaging protocols either represent Snap losing its ‘edge’ or coming full circle to be in a better position to expand market share and monetise its brand.

YOUR CAPITAL IS AT RISK

In terms of user functionality, the Snap system is often referred to as ‘conversational’ rather than ‘transactional’, with the disappearing messages resulting in more personal interaction. In other respects, the Snap system is like many others. Photos and videos can be edited to include filters, text, captions, and drawings.

Snap started life as Snapchat, a messaging system set up so that messages disappear after a period ranging from one to 10 seconds.

Building off its strong brand, the firm introduced additional services, such as Snapcash in 2014, that allowed users to transfer funds. In 2016, a ‘Memories’ feature was introduced, which edged towards conventional messaging by enabling messages to be saved in a private storage area. The ‘My Eyes Only’ functionality ensured privacy levels were maintained by allowing users to set PIN code access on specific areas of their accounts.

It was in 2017 that the firm went full circle and upgraded the system protocols to allow messages to be sent with unlimited lifespans. So far, allowing users to set their accounts to adopt a conventional messaging approach hasn’t diminished Snap’s growth.

Snap Shares: The Basics

Snap Inc, the owner of Snap, is still headquartered in Santa Monica, California. The stock is listed on the Nasdaq Exchange under the ticker SNAP. Snap Inc's market cap is hovering around the $14bn mark.

The Class A stock is what most investors trade. It has historically been excluded from some stock indices, including the S&P 500 and FT Russell. That is because of governance concerns – Class B and Class C classes of SNAP stock are primarily owned by the founders and have greater voting rights.

Founder Evan Spiegel owns 3% of Class A stocks, 25.7% of Class B stocks, and 53.4% of Class C stocks, which results in him controlling 53.2% of the voting power. Robert Murphy owns 6% of Class A stocks, 25.7% of Class B stocks, and 46.6% of Class C stocks and has 46.6% voting power.

The interests of Spiegel and Murphy are broadly aligned with ‘everyday’ investors who trade the A Class stock, but they do have greater influence over the direction the company takes.

Steps to Buy Snap Shares

Any stock that posts a seven-fold increase in value in less than 12 months deserves to be considered part of an investment portfolio. The first question to ask is, should you invest in Snap stocks? The second is when, and the third is how? This step-by-step guide will outline the route experienced traders take when buying shares in firms like Snap.

Investing in Snap or learning how to buy Snapchat shares from almost any country in the world is possible, even if you’re not a US citizen. Online brokers have revolutionised the investment industry and now provide a trustworthy, cost-effective, and user-friendly trading experience. If you want to buy Snap stock, it can take minutes to set up an account using a desktop or a mobile device.

YOUR CAPITAL IS AT RISK

1. CHOOSE A BROKER

This review of trusted brokers offers a user-friendly breakdown of the pros and cons of well-regarded firms that can help you buy Snap shares. They all have impressive track records, a solid client base, and are regulated by financial authorities.

The newbie-friendly trading platforms they provide can be tried using demo accounts, allowing you to experiment with trading using virtual funds. If you are keen on buying Snap stock, practising using a demo account can help you become familiar with site functionality and iron out any beginner’s errors.

2. OPEN & FUND AN ACCOUNT

Setting up an online account is an exceptionally user-friendly process. By entering personal information, you enable the broker to build a client profile that allows them to comply with Know Your Client regulations set out by the authorities, such as the Financial Conduct Authority (FCA).

After verifying your email address, you’re in a position to transfer funds. You can choose between various payment methods, including bank transfer and debit/credit cards. When a deposit is made, your account is ready to convert some of your cash into Snap shares.

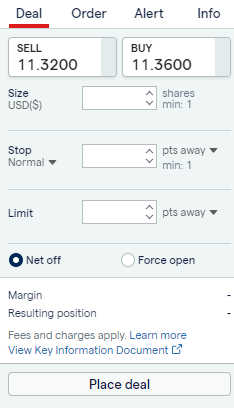

3. OPEN AN ORDER TICKET AND SET YOUR POSITION SIZE

Thanks to the interest in Snap shares, you may find them on your broker’s ‘Popular Markets’ page, but if that’s not the case, you can find the Snap market using the stock search function.

There are only a few data fields to complete, including the amount you want to buy and if you wish to purchase or sell. One neat feature found at some brokers, including eToro, is that you can input the amount you want to trade as a nominal amount of shares or expressed in cash terms. If you go for the latter option, the broker will buy the number of shares equivalent to your designated cash amount.

4. SET YOUR STOPS AND LIMITS

Conventional wisdom encourages new traders to set a stop-loss and, to a lesser extent, take profit orders. These automated instructions built into the system will trade you out of positions if the price of Snap shares reaches a certain level.

Stop-losses and take-profits mean you don’t have to watch the markets 24/5. Instead, you can let the system do some of the work for you. If your Snap position is a very small percentage of your wealth, you might want to consider a different approach.

By trading at a small size, you will have already managed your risk, and not using additional orders means you avoid the possibility of getting stopped out during a ‘flash crash’. The choice of which approach to take is yours and yours alone.

5. SELECT AND BUY SNAP STOCKS

Once you’re happy that you’ve got your trade instruction set up correctly, buying Snap shares is as easy as clicking a button or tapping a screen.

At that point, your cash balance will decrease, and your stock balance will increase. The P&L (profit and loss) on your account will fluctuate according to the live market price of Snap stock. As you’re now trading the markets, it’s worth running some final checks, the kind that even experienced pros run.

Make sure you buy Snap shares, not CFDs – If you are looking to invest in Snap for longer than three weeks, you will probably find it more cost-effective to buy the shares outright. Contract for Difference (CFD) trading is increasingly popular, and CFDs have some additional client-friendly features, but they incur overnight financing costs. This article explores that subject in greater detail.

After you buy Snap shares – Check the portfolio section of your account to ensure you purchased what you want (Snap) and that you didn’t make any other errors, such as inputting the wrong trade size. Any errors are best spotted and corrected as soon as possible.

YOUR CAPITAL IS AT RISK

Fees When Buying Snap Stock

The boom in online trading and investing has been good news for retail investors. Increased competition between brokers has driven down trading costs, but it’s still worth checking the T&Cs on your account.

The chart below shows details of trade execution costs at trusted brokers. These firms make most of their revenue on the difference between the buy and sell prices they offer their clients – the bid-offer spread – so separate ‘commissions’ are essentially a thing of the past.

| eToro | Plus500 | Markets.com | AvaTrade | IG | |

|---|---|---|---|---|---|

| Live Account Fee | No charge | No charge | No charge | No charge | No charge |

| Demo Account Fee | No charge | No charge | No charge | No charge | No charge |

| Bid Offer Spread – Sainsbury’s shares | 0.12 | 0.44 | 0.16 | 0.77 | 0.07 |

| Cash Deposit Fee | No charge | N/A | No charge | No charge | No charge |

| Cash Withdrawal Fee | Yes – $5 per transaction | N/A (a charge may be incurred on the 5th withdrawal of the month) | No charge | No charge | No charge |

| Inactivity Fee | Yes – $10 per month after 12 months of inactivity | Yes – $10 per month after 3 months of inactivity | Yes – $10 per month after 3 months of inactivity | Yes – $50 per quarter after 3 months of inactivity | Yes – £12 per month after 24 months of inactivity |

| FX Conversion Fee | Offers accounts in USD, only | Offers accounts in USD, GBP and EUR | Offers accounts in 14 base currencies, incl. USD, GBP, EUR | Offers accounts in USD, GBP, EUR, CHF | Offers accounts in 6 base currencies, including USD, GBP and EUR |

| Minimum Deposit | $50 (or equivalent) | $100 (or equivalent) | $100 (or equivalent) | $100 (or equivalent) | £250 (or equivalent) |

There’s little point in being penny-wise and pound-foolish. Considering you could have thousands of pounds worth of cash at stake, the priority is to ensure your broker is appropriately regulated rather than marginally cheaper. A common trick used by scammers is to promise something too good to be true, which extends to pricing.

There’s no point in paying charges you don’t need to, and shopping around and trying different brokers by using their Demo accounts can help you find a cost-effective fit.

Final Thoughts

Whether you are an experienced trader or new to investing, Snap stock does have a case to be included in your portfolio. Snap shares are at the higher end of the risk-return ratio, so some care is required, but significant trading profits are also possible.

The sell-off in tech stocks in 2022 brought the shares of firms like Snap back to levels not seen for several years, resulting in many seeing it as an opportunity to buy the dip. However, it remains at lows as the current market uncertainty continues.

Economic cycles influence all stock prices, but the long-term prospects of Snap also need to be considered. While the nature of the business means there are a lot of variables in play, the outlook remains positive, and a well-timed trade could result in extraordinary returns.

To help with that process, we’ve created a shortlist of brokers reviewed by AskTraders analysts. Their research established which brokers offer the necessary features to help your trading get off to the best possible start.