All around the investment community, traders ask how do I invest to protect against inflation? The answer isn’t straightforward and depends on each individual’s timelines and risk appetite, but below are some of the ways experienced investors approach the situation.

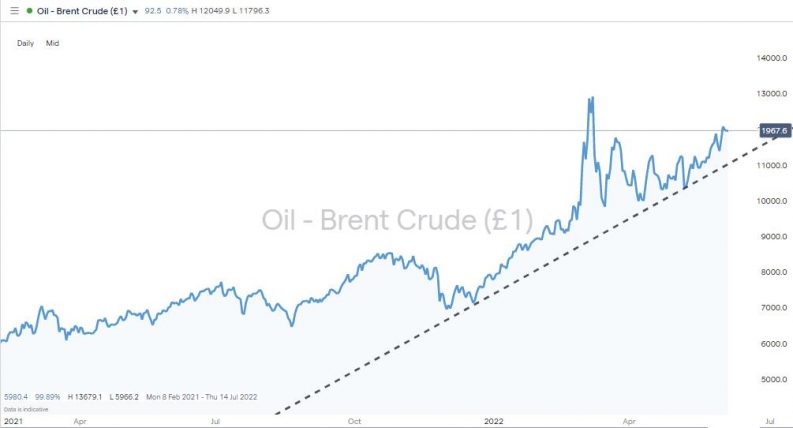

Crude Oil (Brent) – Daily Price Chart – 2018 – 2022 – Bull Market

Source: IG

How To Invest To Protect Against Inflation – Commodities & Commodity Stocks

One way to counteract the erosion of spending power caused by inflation is to invest in tangible assets. The theory is based on the natural reserves of a uranium miner or oil company having pretty much the same intrinsic value no matter how many zeros a paper banknote might have. If inflation is running at 10% and the underlying demand for a particular raw material is unchanged, then the price of that commodity will rise in value by 10%.

The traditional obstacles to using commodities to hedge against inflation have centred mainly on practicalities; few investors can buy and store a ton of copper. Buying commodity futures to hedge against inflation is an alternative approach. Still, anyone holding a position for more than a couple of months will confront the issue of having to ‘roll’ their futures, and the commissions charged can begin to stack up.

Mining stocks offer the most convenient way to use commodities to protect against inflation. Even institutional investors, like pension funds, which aren’t allowed to invest directly in commodities, buy the shares of mining firms to get exposure to the sector indirectly. Trading commissions are low, and large-cap mining stocks have a reputation for returning cash to investors.

BHP Group PLC – Daily Price Chart – 2018 – 2022 – Commodities vs Inflation

Source: IG

The dividend yield on the world’s largest mining company, BHP Group PLC (BHP), is currently at an inflation-beating 9.12%. The firm also offers capital gains, and the BHP share price as of 6th June 2022 was showing a 22.23% year to date gain. The fear that investing in commodity stocks now might represent joining the party too late can be counteracted by research which points to commodity supercycles being multi-year events.

BHP Group PLC – Fundamentals

Source: IG

One other reason to invest in commodity stocks rather than commodities in physical form is a neat accounting feature. A large percentage of mining costs are fixed rather than variable. The significant capital investment needed to establish a mine can be treated as a one-off payment, made before inflation driving up the cost of the project’s start. Once a mine is up and running, the ongoing variable costs, which are inflation-linked, are a relatively small percentage of total operating expenses.

BHP doesn’t disclose the price copper needs to be for it to break even but assuming that price is at $8,000, and the metal is trading at $9,500, the firm is operating on a profit margin of 18.7% [(9500 – 8000)/8000]. If the price of copper increases by 20% to $11,400, then the profit margin will increase by more than 20%. In this example the new profit margin will be 42% [(11400-1500) / 1500].

As equity valuation models are based mainly on future income streams, an increase in the price of commodity results in a proportionately greater rise in the cost of the stocks of mining firms. The accounting procedure works whether the underlying price rise is triggered by economic fundamentals, such as increased demand or inflationary pressure.

How To Invest To Protect Against Inflation – Real Estate

Another market which is a haven during times of inflation is real estate. This strategy works on the same basis as the commodity stocks and reflects that property firms hold tangible assets which will remain in demand regardless of changes to paper prices. The illiquid nature of the property rental market also helps landlords increase charges in line with inflation in a way that manufacturers of consumer discretionary goods just can’t.

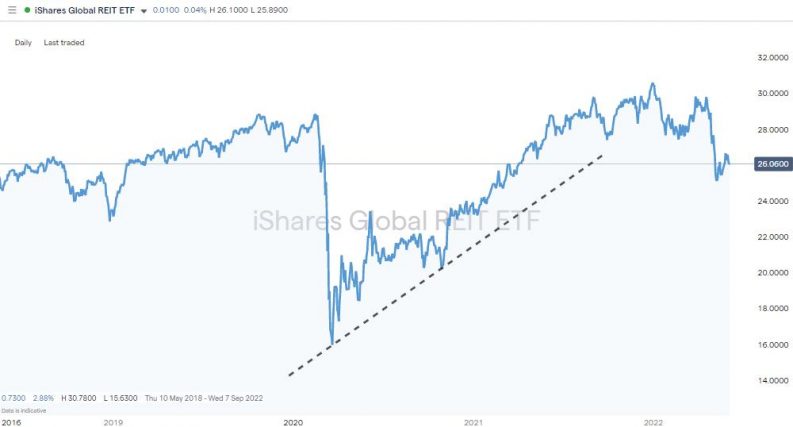

Smaller investors who want to gain exposure to the property sector don’t need to buy actual properties but can take bite-sized positions in investment funds such as REITs (Real Estate Investment Trusts). The convenience of buying an off the shelf position in REITs comes down to them operating in the same way as traditional mutual funds. Brokers such as IG also offer REIT instruments in markets ranging from the UK and Australia to the US, making it possible for investors to diversify their portfolio by region and property type.

The iShares Global REIT ETF (RNXG) is a basket of different holdings that offers exposure to the global commercial property market with the click of one button. As of March 2022, the ETF held 347 positions in developing and emerging markets and was recording a five-year cumulative performance of 42.40%

iShares Global REIT ETF – Daily Price Chart – 2018 – 2022

Source: IG

Land Securities Group PLC (LAND) is the largest commercial property development and investment company in the UK. It faces the challenge of many people working from home, potentially reducing demand for its premises, but that bad news looks to be already priced in. The stock currently offers a dividend yield of 4.38%, and there is potential for a price bounce as traditional working practices come back into fashion.

Land Securities Group PLC – Fundamentals

Source: IG

How To Invest To Protect Against Inflation – Bonds

The boring but important world of bond investing demands attention when inflation takes off. Bonds are by no means a silver bullet, but governments and corporations are obliged to offer higher interest rates to bond buyers if they want to ensure their funding targets are achieved.

One of the attractive features of bonds is that the income payments to holders keep coming regardless of inflation, interest rates or geopolitical events. That secure income stream can play a vital role as part of a diversified portfolio. Having some guaranteed returns makes it easier to hold on to other positions which might suffer short-term price dives.

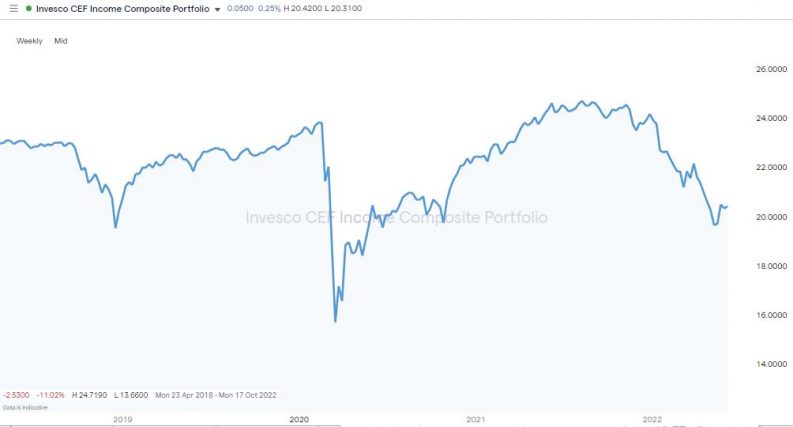

The Invesco CEF Income Composite Portfolio applies a variety of strategies specifically designed to try and mitigate the impact of inflation and interest rate rises. It invests in investment-grade bonds, high-yield bonds and the writing of equity options. As of 6th June 2022, its 30-day SEC yield was 8.24%, and the 12-month distribution rate to investors was 7.80%. Both numbers are in line with the headline US rate of inflation which for April 2022 was 8.3%.

CEFs are becoming more popular due to concerns about inflation. To meet consumer demand, online brokers are offering markets in CEFs so that investors can take positions in an inflation-busting instrument from the same account in which they trade other asset groups.

Invesco CEF Income Composite Portfolio – Daily Price Chart – 2018 – 2022

Source: IG

How To Invest To Protect Against Inflation – Gold

Gold is seen as a hedge because its price has at times tracked those of other assets. More recent price moves suggest that the link might be weakening, so investors might want to approach the situation with some caution.

A classic argument for gold is a good hedge is based on the money supply. The reasoning goes that as central banks increase the supply of cash in an economy, demand for products and services outstrips supply. At the same time, an ounce of gold tracks the price of other commodities, such as oil, so those holding gold don’t see their real wealth being eroded.

In recent years, an astonishing amount of cheap money has been pumped into the financial system. In September 2008, when Lehman Brothers collapsed, the Federal Reserve Bank engaged in a programme of printing money that doubled the money supply to approximately 1.6 trillion dollars in less than three months.

The inflation of 2022 is partly a product of a further burst of quantitative easing, which the government used to tackle the Covid pandemic and lockdown; however, the real driver of the current surge in inflation appears to be cost-push factors. The breakdown of crucial global supply chains has left manufacturers scrabbling around for products, and prices have been driven up as a result.

Gold – Daily Price Chart – 2019 – 2022

Source: IG

Empirical data highlight gold’s patchy relationship with inflation. Between 1988 and 1991, when inflation was 4.6%, gold yielded a negative return of 7.6%. It posted another negative return of 10% between 1980 and 1984 when the annual inflation rate was about 6.5%. Goldbugs will point out that between 1973 and 1979, when inflation rates were higher, in the region of where they are now, the CPI stood at 8.8%, whereas the return on gold was an impressive 35%.

How To Invest To Protect Against Inflation – Stocks

The devastating way inflation can eat into corporate earnings explains why by mid-May of 2022, the S&P 500 index and Nasdaq 100 index were down on the year by 20.34% and 29.90%, respectively. The rout started in January, triggered by fears over inflation rather than the release of hard data relating to price rises. The bad CPI data didn’t hit the newswires until March 2022.

Despite this, there are two ways to take a positive approach to the question of whether inflation is bad news for stocks. The report How Does Inflation Affect The Stock Market outlines the stocks that can offer a route to navigating an environment full of rising prices. For example, rotating out of growth stocks and into value stocks is one way to maintain exposure to stocks while hedging against the threats posed by inflation.

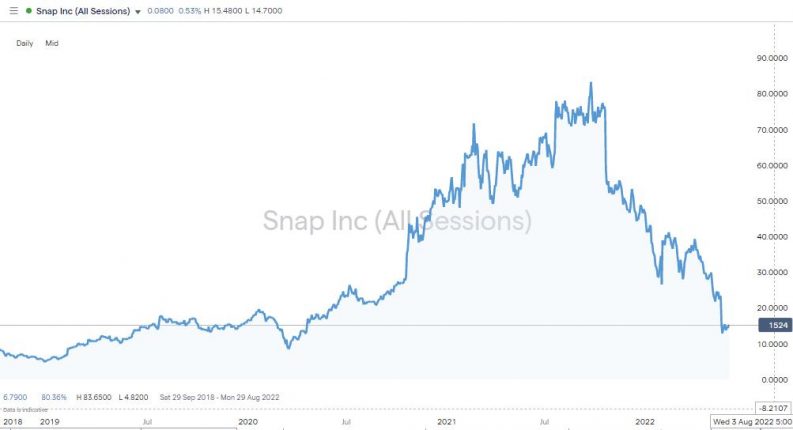

Snap Inc – Daily Price Chart – 2018 – 2022

Source: IG

The second approach is to accept that inflationary pressures do eventually subside. When signs of that happening begin to appear, high beta stocks can be picked up at bargain prices. Tech stocks have been battered by inflation-averse investors bailing out of positions.

As of mid-May 2022, Netflix Inc was at 46.28% from its all-time highs of November 2021 and Snap Inc was down 67.7% on a year-to-date basis. There are various strategies to use to trade a bear market, and buying the dips and waiting for a high-octane rebound is one of them. Stocks might not necessarily offer protection from inflation, but they do offer a way to try to profit from the situation.

Final Thoughts

Whichever approach you take to investing in a way that protects you from inflation, it is worth keeping in mind that one certainty is that price volatility can be expected to increase. That is because inflation rates are hard to forecast, and as different analysts draw different conclusions, there will be increased divergence in terms of valuations.

That means risk management techniques need to be recalibrated so that you don’t get kicked out of positions during short-term price drops. Whether you’re an experienced investor or a newbie attracted to the idea of picking up a bargain, it’s essential to also factor in operational risk. Inflation creates uncertainty and instability. If you are investing, choose one of these well-regulated safe brokers. They have been operating long enough to know how to chart a course through the market turmoil.

Taking the long-term view can also help, but whichever of these potentially protective investments you choose to go for, you must prepare for what at times could be a bumpy ride. Wild price swings can be opportunities to buy into cheap assets, so keeping some capital in reserve until prices bottom out can optimise returns.