There are only a handful of companies that have as dominant a hold over their market as Google does. The search engine accounts for a substantial number of internet searches in Europe and in Asia, while Alphabet (the Google parent company) also owns YouTube, another dominant player in its field.

YOUR CAPITAL IS AT RISK

The Google share price performance since the firm was listed in 2004 reflects the power and influence the firm has over the internet, and the path of least resistance for the share price still appears to be upwards.

Alphabet (Google) Overview

The foundation of Google set out the blueprint that many innovative tech start-ups would follow. Larry Page and Sergey Brin met in 1995 when Brin gave Page a tour of the Stamford University campus. The story goes that they had a series of strong disagreements at that first meeting. Yet, by the following year, they were working on a research project that would end up shaping the world.

They still hold about 14% of the company’s value and 56% of the voting rights and have overseen Google’s rapid expansion and growth into one of the world’s dominant brands.

When all the different share classes are added up, Alphabet Inc is found to currently have a market capitalisation of well over $1tn. It’s one of the largest firms in the world with a proven and profitable business model but still has the excitement associated with tech growth stocks.

The beauty of the Google operation is that the customer-facing interface has a pleasing aesthetic and allows users to navigate the web without feeling overwhelmed by adverts. At the same time, Google’s iron grip on the internet search market allows it to generate incredible revenue streams from firms desperate to use Google to reach potential consumers.

The firm’s willingness to flex its muscles extends to its corporate structure. It has set itself up with three types of shares, each with its own characteristics, so investors need to be aware of the quirks involved. This review will break down such issues and provide a step-by-step guide on how to buy Google shares online.

Alphabet (GOOGL) Shares: The Basics

While Google is the trade name of the firm, the shares you actually need to buy to tap into this success story are in the parent company Alphabet Inc., which is headquartered in Mountview, California, USA.

Things then get a little bit more complicated because Alphabet Inc. is listed on the Nasdaq Exchange under two different tickers:

- GOOGL – Known as Class A shares or Google Common Stock. These give you a share in ownership of Alphabet Inc. and voting rights on a one-share-one-vote basis.

- GOOG – Known as Class C shares. These give you a share in ownership of Alphabet Inc. but have no voting rights. As they have less influence over the management of the company, they typically trade at a discount to Class A / GOOGL shares.

- Class B shares – There is also a third type of share, which is unlisted. Held by the founders, Larry Page and Sergey Brin, they have ten votes per share.

This setup is somewhat controversial as it dilutes the voting rights of mainstream investors. The founders have greater control over the firm than in a standard corporate setup, but that allows them to manage the ‘direction’ of the firm.

For many investors, this structuring is a price worth paying, and putting faith in the guys who came up with the successful idea in the first place makes sense. For others, there’s a sense of unease that the fifth-largest firm in the world is, in some ways, being run like a tech start-up.

Stock splits are a common practice used by successful firms whose share price has performed so well that they become too expensive for some smaller investors to buy. Stock splits follow simple supply and demand principles – the number of shares increases, but as the actual day-to-day business of the firm hasn’t changed, the value of the firm remains the same. As a result, each individual share has a lower list price and is more accessible to smaller investors.

YOUR CAPITAL IS AT RISK

Background to the Google Stock Splits

The GOOGL shares that were listed in 2004 underwent a stock split in 2014 when holders of GOOGL received 2,002 new shares for every 1,000 existing. The new shares were the Class C (non-voting) variety, so the firm managed to keep the market capitalisation the same but reduce the share price by approximately half.

A second smaller-scale split took place in 2015 when investors were credited with 10,027,455 new shares for every 10,000,000 shares they previously owned. There was a further stock split in 2022.

Stock Split Technical Note 1:

- The share price history charts provided by brokers factor these splits in. This is so clients get a clearer visual representation of how the Google share price has performed.

YOUR CAPITAL IS AT RISK

Steps to Buy Google Shares

It’s possible to invest in Google from almost any country in the world, even if you’re not a US citizen. Online brokers have revolutionised the investment industry and now provide a trustworthy, cost-effective, and user-friendly trading experience. If you want to buy Google shares from the UK and many other countries, it’s simply a case of choosing the right broker and following some easy steps. This can be done using a desktop or a mobile device.

1. Choose a Broker

There are hundreds of online brokers to choose from, but this review of trusted brokers is a handy shortlist of firms that are experienced and regulated. They all have multi-year track records and offer their own take on providing clients with what they think is important.

Buying Google shares at our chosen broker is an incredibly straightforward process. The platforms on offer have been designed with beginners in mind but also offer easy-to-use research and analysis tools to help you develop your trading skills. One quick win is to devote some time to trying out free demo accounts with a few different brokers. These are risk-free ways to practice trading using virtual funds and allow you to, at the same time, try out different platforms.

2. Open & Fund an Account

You need little more than an email address to set up a demo account. Opening a live trading account requires you to share a greater amount of personal information and upload some documentation to verify your identity. This is so that brokers can comply with Know Your Client (KYC) rules set out by the regulators, which is a sign you’re registering with a trustworthy broker.

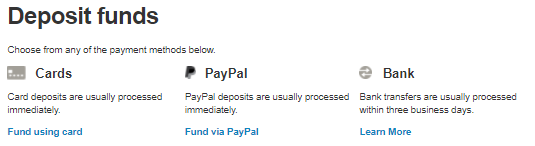

Most brokers offer a variety of ways to pay funds into your new brokerage account, including bank transfer and debit or credit card. If you’re in a hurry to buy Google shares, it’s worth noting the processing times differ for each of the payment methods.

3. Open an order ticket and set your position size

As soon as funds are credited to your online account, you are ready to trade. Locating the different right market can be done using the ‘stock search’ function, which will take you to the trading dashboard for that stock, but do note that some brokers interchange the use of the terms ‘Google’ and ‘Alphabet Inc’ shares.

The trading dashboard is the heart of the buying process, where you’ll also find price charts and news reports on the stock. Opening an order ticket and getting ready to buy Alphabet shares involves simply entering the number of shares you want to trade.

One feature to look out for is ‘All Sessions’ shares. Some brokers, IG included, offer markets in Alphabet shares on a 24/5 basis. While the Nasdaq exchange is officially open only during market hours, the broker provides a non-stop market in the stock. This helps minimise ‘Gapping Risk’, which occurs when news events provide an out-of-hours price shock. This would normally not be reflected in price until the exchange opened on the morning of the next trading session.

4. Set your stops and limits

Stop Loss and Take Profit orders can be put on your positions before or after you click the ‘Buy’ button. These risk-management instructions instruct the system to automatically sell some or all of your positions if the price reaches a certain level. If the price moves against you, Stop Losses will come into play. If it goes in your favour, Take Profits orders will crystalise some of your gains. This means you can manage your account on a 24/5 basis but without having to watch the price all the time.

5. Select & Buy Google Shares

Once you’re happy that every box has been ticked, all it takes to trade Google shares is a click on your mouse or a tap of the screen.

There are two common-sense but important tips from experienced traders to keep in mind.

- Before you click ‘Buy’ or ‘Sell’ Google shares– Check if you are buying the shares outright or in Contracts for Difference (CFD) form.

CFDs offer greater flexibility as you can use leverage and scale up the risk-return on the trade or short-sell. They do, though, incur overnight financing fees. If you’re looking to buy Google shares and hold them for more than a few weeks, then it will be more cost-effective to buy Google outright. This article explores that subject in greater detail.

- After you trade– Be sure to check the trade details. ‘Fat finger’ errors, such as buying the class of share are best corrected before the Alphabet share price moves too far.

YOUR CAPITAL IS AT RISK

Fees When Buying Google Shares

The boom in online trading and investing has resulted in fierce competition between brokers and drastically lower trading costs.

The below chart details trade execution costs at trusted brokers. These firms make the majority of their revenue on the difference between the buy and sell prices they offer their clients – the bid-offer spread. This means separate ‘commissions’ are largely done away with.

| eToro | Plus 500 | Markets.com | AvaTrade | IG | |

|---|---|---|---|---|---|

| Live Account Fee | No charge | No charge | No charge | No charge | No charge |

| Demo Account Fee | No charge | No charge | No charge | No charge | No charge |

| Bid Offer Spread – Google shares | 3.15 | 17.37 | 6.33 | 29.82 | 4.66 |

| Cash Deposit Fee | No charge | No charge | No charge | No charge | No charge |

| Cash Withdrawal Fee | Yes – $5 per transaction | No charge | No charge | No charge | No charge |

| Inactivity Fee | Yes – $10 per month after 12 months inactivity | Yes – $10 per month after 3 months inactivity | Yes – $10 per month after 3 months inactivity | Yes – $50 per quarter after 3 months inactivity | Yes – £12 per month after 24 months inactivity |

| FX Conversion Fee | Offers accounts in USD, only | Offers accounts in USD, GBP and EUR | Offers accounts in 14 base currencies incl. USD, GBP, EUR | Offers accounts in USD, GBP, EUR, CHF | Offers accounts in 6 base currencies, including USD, GBP and EUR |

| Minimum Deposit | $200 (or equivalent) | $100 (or equivalent) | $250 (or equivalent) | $100 (or equivalent) | $250 (or equivalent) |

There are other charges to factor into your cost-benefit analysis. These include account inactivity fees, which, in reality, are more about platforms ensuring dormant accounts don’t build up in size. At Plus 500, for example, you can avoid the charge simply by logging on to demonstrate you are an active user.

YOUR CAPITAL IS AT RISK

Final Thoughts

Google has found success by following a simple set of principles, and it is yet to face any kind of serious competition (despite concerns about Microsoft and AI aiming to take Google’s place). This is reflected in the soaring share price. While some have held off and have wondered, ‘is now a good time to buy Alphabet (Google) shares’? The price has continued upwards.

The different share classes are a concern for some, but as the founders keep making the right calls and generating more profits, others are happy to put their trust in them. However, investors do need to make sure they are buying what they intend to.

The firm’s domination of the all-important search engine market is a more direct reason to consider adding the firm to your portfolio.