You don’t have to look too far to find stories of early-day investors buying cheap tech stocks and making life-changing amounts of money as a result. There was a feeling that such opportunities had passed by, but the sell-off in tech stocks in 2022 has brought prices of stocks in the sector down to bargain-basement levels.

YOUR CAPITAL IS AT RISK

Fears about inflation and a recession hit the tech sector particularly hard because growth stocks are especially sensitive to downturns in the economy. For those who consider the current environment to be a buying opportunity, we’ve carried out technical and fundamental analysis on small-cap tech stocks to help you find the best cheap tech stocks for under $10.

Table of contents

- What Are Cheap Tech Stocks?

- Best Cheap Tech Stocks to Buy Now

- United Microelectronics Corp ADR (NYSE: UMC)

- iClick Interactive Asia Group Limited ADR (NASDAQ: ICLK)

- Wipro Limited ADR (NYSE: WIT)

- BlackBerry Limited (TSX: BB, NYSE:BB)

- Nokia Corporation ADR (HSE: NOKIA, NYSE: NOK)

- Why Buy Cheap Tech Stocks Now?

- What to Know Before Investing in Cheap Tech Stocks

- How to Buy Cheap Tech Stocks

- Final Thoughts

What Are Cheap Tech Stocks?

The term ‘cheap’ is obviously a relative term. It refers to stocks that are considered to be undervalued either because their intrinsic potential has not been recognised by investors or because the broader market has fallen due to an overreaction to macroeconomic events.

Stocks or sectors that overshoot to the upside or downside during an economic cycle are considered high beta. Trading these comes down to following the advice of investment guru Warren Buffett, who stated that traders should be “fearful when others are greedy, and greedy when others are fearful.”

Identifying undervalued stocks requires understanding some of the basic principles of stock valuation models. Most use future revenue as a way of determining the stock price now. This ties in with shareholders having a right to a share of future profits.

Metrics used to establish if a stock is priced correctly include earnings per share (EPS), price-earnings (P/E) ratio, price/earnings-to-growth (PEG) ratio, and dividend discount model (DDM).

The tech sector has ballooned since it first came onto the scene. It has moved away from being just about software and hardware and new industries such as AI, renewable energy, EVs and cyber security. Tech is so all-invasive that it’s possible to find a firm with a competitive tech edge in a wide range of industrial sectors.

YOUR CAPITAL IS AT RISK

Best Cheap Tech Stocks to Buy Now

To help you find the right stock for your investment profile, AskTraders has compiled the below list of the best cheap tech stocks. Each one is priced under $10 and has a plausible reason to be included in your portfolio.

United Microelectronics Corp ADR (NYSE: UMC)

Founded in 1980, Taiwan-based semiconductor chip manufacturer United Microelectronics Corp is listed on the Taiwan and New York stock exchanges. International investors can trade the US listing, which is in ADR form, and which currently trades in the region of $7.40 per share.

UMC makes computer chips that are used in tech devices ranging from iPhones to aircraft navigation systems. It is the third-largest chipmaker in the world with an approximate 7% share of the global market.

Investor sentiment has recently turned bullish. Microchips are such a critical part of modern-day activities that when UMC was trading at $5.38 in October 2022, it looked cheap – despite its recent price rally, it still does. It has a P/E ratio of 6.68 compared to the tech sector average of 25.78, and it also has a dividend yield of 6.64%.

Buying at the bottom of the market is a nice feeling but waiting for technical indicators to point to further upward price movement taking place is a better option. The UMC Daily Price Chart points to just that, with the break of the downward trendline indicating that the stock is starting out on another bull run.

iClick Interactive Asia Group Limited ADR (NASDAQ: ICLK)

Online marketing platform iClick provides data analysis and other digital services. It has a strong position in the booming China market, and the ADR form of the stock listed on the NASDAQ exchange offers international investors a chance to gain exposure to a high-growth tech sub-sector and the China economy.

iClick’s current share price of $5.00 puts it in the group of tech stocks under $10, but it has a track record of trading well above that level. As recently as February 2021, ICLK was trading at $18.6 per share, meaning that it has already indicated what could be possible.

A global recession would put pressure on marketing budgets, but iClick’s business model opens the door to it actually picking up market share from competitors. It has a diversified client base, which is always useful in a downturn. Its core products provide firms with innovative ways of achieving their online marketing goals and in a cost-effective way.

The recent spike in the ICLK stock price points to the stock having bottomed out. As with other tech stocks, the sell-off in 2022 appears to have been overdone. Before the recent price crash, the previous all-time-low of $2.90 per share had acted as support, and now price is trading back above that level, it can be expected to do so again

YOUR CAPITAL IS AT RISK

Wipro Limited ADR (NYSE: WIT)

Wipro Limited is an Indian multinational technology company providing information technology and business consulting services to a global client base. It is listed on the New York Stock Exchange as an ADR, and as of January 2023, it has a market capitalisation equivalent to just over $26bn.

The size of Wipro confirms its position as an established player in a growth sector and a firm with the critical mass to weather an economic downturn. It also has enough spare capital to take advantage of new opportunities, with its financial reports as of 2022 stating that it has $4.269bn cash on hand.

Wipro is often compared to tech services giant Infosys Ltd. The larger of the two Bangalore-based firms has a market cap as of 12th January 2023 of $77.08n and a P/E ratio of 25.92. Wipro stock in comparison looks cheap as it has a P/E ratio of 19.24, meaning that there is potential for share price growth before it comes in line with its larger rival.

The Daily Price Chart shows that Wipro hasn’t broken its 2022 downward trendline yet. There is a suggestion that while price action has been sluggish, that represents consolidation, a double-bottom, or a higher swing low forming – all of which are bullish. The price support in the region of $4.43 marks the price low of 22nd October 2022, and while this holds, Wipro looks primed for a rally.

BlackBerry Limited (TSX: BB, NYSE:BB)

BlackBerry’s fall from grace as the go-to handset for corporate users saw the BB stock price crash from $138 to below $10. Shareholders who suffered on the downside may be looking for opportunities to bail out of positions.

However, those approaching the situation with a fresh pair of eyes will find that BlackBerry has moved on to become a global leader in the provision of cyber-security software that uses artificial intelligence and machine learning. It is also investing in another massive growth market, the Internet of Things (IoT).

One of the biggest obstacles facing BlackBerry is its reputation. Its fall from grace was made even harder due to it once being a much-favoured stock of investors. The reorganisation of the firm’s business model will take time to work through the system and be reflected in the share price, but buying cheap tech stocks is all about identifying undervalued and out-of-favour stocks.

BlackBerry investors could be in for the long haul, but the firm expects its cyber-security business revenue to increase at a CAGR of 10% through to 2027. Increased geopolitical risk also needs to be factored in, and the rise in cyber-security threats will support BlackBerry’s financials.

YOUR CAPITAL IS AT RISK

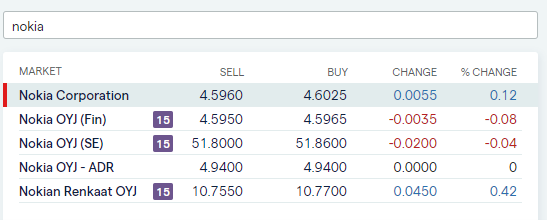

Nokia Corporation ADR (HSE: NOKIA, NYSE: NOK)

Like BlackBerry, Nokia moved out of the phone handset game in the last decade, but its shift into the 5G network business has been much more successful. The New York Stock Exchange ADR listing of the stock has been trading under $10 since 2016, but Nokia takes the position as the best cheap tech stock to buy, thanks to a series of factors aligning at the same time.

Cash from long-term 5G contracts is beginning to flow into Nokia’s accounts to the extent that the firm is looking to increase the dividend payment to investors. Income streams could rise even further.

Not only is 5G one of the most exciting growth sectors in the economy, but also political tension between the West and China is blocking Nokia’s competitor Huawei from taking up market share.

The price low of $4.11 recorded during the peak of the COVID-19 crisis in March 2020 forms a significant price support for the NOK share price. While the stock trades above it, there is potential for future gains, especially as 5G revenues begin to come through the pipeline.

Why Buy Cheap Tech Stocks Now?

The alarming sell-off in tech stocks in 2022 saw the flagship index the NASDAQ 100 lose 33.1% of its value. This is a significant correction that is triggered by very real headwinds in the global economy, but economic cycles continuously evolve and make the current pullback a golden buying opportunity.

Over a longer-term timescale, the NASDAQ 100 between 2010 and 2021 gained in value by 841%.

Cheap tech stocks tend to be smaller companies that have ‘potential’, which means that when investor mood sours, they can be impacted to a greater extent than firms with better-established income streams. This makes the sector an ideal one for those looking to bottom-fish the markets during periods of investor pessimism.

What to Know Before Investing in Cheap Tech Stocks

There are very good reasons to approach the cheap tech stock sector with caution. Amazon, Facebook and Zoom all started life as cheap tech stocks and have since posted staggering gains, but not all currently undervalued tech stocks will be winners.

Picking winners is made harder by small firms tending to be less well covered by researchers and analysts. Finding crucial information might require investors to dig down into company accounts to a granular level.

Big tech firms also have another advantage associated with their scale. Amazon’s dominant position in the home shopping market, for example, means that any disruptor firms face countless barriers to entry should they want to compete. First-mover advantage can play a crucial role.

With new tech start-ups focusing on innovation and more obscure corners of the economy, there is a chance that they don’t get things right, or that the societal shift they are banking on doesn’t materialise.

The final potential pitfall of investing in cheap tech stocks is that they can take time to come good. This potentially involves periods when a position is showing a loss.

The opportunity cost of tying up capital in a buy-and-hold-style position also needs consideration. Could those funds generate a better or at least earlier return invested in other assets?

How to Buy Cheap Tech Stocks

Not all brokers offer a wide range of markets in cheap tech stocks. Some prefer to concentrate on the large-cap household names such as Microsoft and Apple. This list of good stockbrokers includes firms that are more client-focused and offer access to a wider number of stocks.

1. CHOOSE A BROKER

Any broker shortlist should include firms that are well-respected in the trading community and also regulated by Tier-1 authorities such as the SEC and FCA.

2. OPEN AND FUND AN ACCOUNT

The process of opening an account is relatively straightforward. It takes minutes to sign up and can be done using a handheld or desktop device.

Wiring funds to a new account can be done in various ways, with the simplest and fastest approach being debit and credit cards.

Alternative payment methods are available, but check the T&Cs to ensure that there aren’t any charges on deposits and withdrawals.

YOUR CAPITAL IS AT RISK

3. OPEN AN ORDER TICKET AND SET YOUR POSITION SIZE

Once funds are in your account, the next step is to buy the target stocks. The trading dashboard for each stock can be located using the ‘search’ function.

Enter the number of shares you want to buy into the appropriate data field and click or tap ‘Buy’.

4. SET YOUR STOPS AND LIMITS

Stop-loss instructions and take-profit orders are risk management tools instructing a broker to automatically close out some or all of a position if the price reaches a certain level.

Buy-and-hold investors operating a long-term strategy often decide to not use stop-loss and take-profit orders. This enables them to avoid being kicked out of a position that might ultimately experience a price rise.

Trading in small size is recommended as an alternative way to approach risk management. Diversifying your investment across several cheap tech stocks will help avoid single-stock risk.

5. MAKE YOUR PURCHASE

After you click ‘Buy’, the Portfolio section of the platform will report the live P&L of the position.

Final Thoughts

Whether you’re an experienced investor or new to trading, the cheap tech stock sector is worth considering.

Modern trading platforms are perfect for gaining exposure to firms that have the potential to skyrocket in value. Brokers that are fully regulated also offer a safe and secure trading environment as well as additional services designed to help you succeed.

Choose the right broker, and you’ll receive everything you might need to get started and book your first trade.