Shares of Best Buy (NYSE: BBY) have corrected lower in the past few days after the buyers forced the stock to log record highs. The retailer previously surged higher after the company delivered a strong performance in the second quarter of the year.

Best Buy earned $1.71 per share, smashing expectations of $1.08 per share. Revenue came in at $9.91 billion, again topping expectations of $9.71 billion.

Strong results were mostly driven by the biggest-ever surge in online sales on a quarterly basis, up 242% compared to 2019. In-store sales also rose 5.8%, higher than market estimates of 2.3%.

CEO Matt Bilunas argues that the current growth pace is unsustainable in the long-term.

“Overall, as we plan for the back half of the year, we continue to weigh many factors including potential future government stimulus actions, the current shift in personal consumption expenditures from areas like travel and dining out, the possible depth and duration of the pandemic, the risk of higher unemployment over time, and the availability of inventory to match customer demand,” said Bilunas.

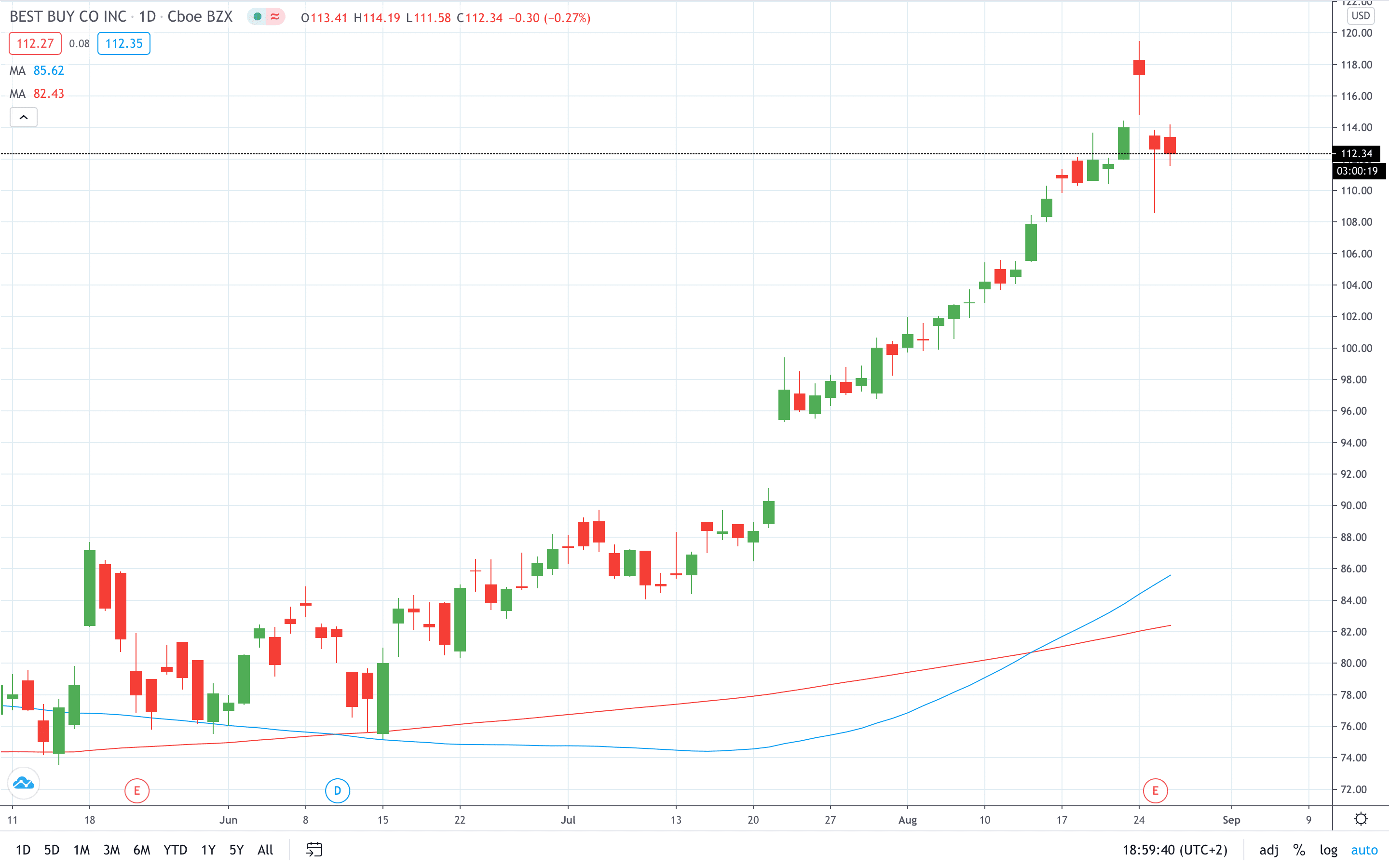

Best Buy share price now trades around the $112 handle, after logging an all-time high at $119.46.

- Learn more on how to open a demo account

- Learn more about Forex Pivot Points