Key points:

- Cloudbreak Discovery has been disappointing recently

- It's the quality of the projects being organised

- Some of the romance has gone out of the base idea at play here

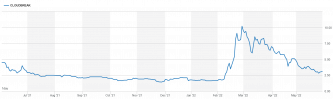

Cloudbreak Discovery (LON: CDL) shares have been both exciting since we first looked at them at the turn of the year and disappointing more recently. It's possible to say that some of the gloss has come off the idea, the romance is missing. From a price of 1.7 when we first looked at Cloudbreak up to a peak of 10p and change back down to the current 3.10. Of course, it's nice enough to be on the right side of price movements like this but what matters is what happens next:

A possible answer is that not much will happen. An example of why being this latest announcement. “Cloudbreak will provide a portion of the acquisition financing for the Masten Unit Energy Project (the “Project”), located in Cochran County Texas, to G2 in exchange for a 3.25% Overriding Royalty Interest (“ORI”) in the Project”. Well, yes, very exciting. This follows the interest in Namibian oil prospecting which also failed to set the markets alight. The staking of Foggy Mountain. As we've said before the Cloudbreak Discovery idea is interesting but it does depend upon which deals are brought to the table.

Also Read: The Best Lithium and Lithium Mining Stocks to Buy

The aim is to be a “natural resources project generator” and in a market as fragmented as that of junior miners and resource plays there's an interesting opportunity there. Being able to create the network necessary to pull together mining projects can add significant value – value that can be captured by taking a slice of each project organised.

This does though depend on the quality of the projects that are organised. One can imagine being at the nexus of such a process and seeing that – just as examples – lithium, or germanium, projects are what the market seems to desire. At which point fund a little lithium exploration, or organise a small germanium from coal fly ash plant. There would be an increase in value just from the existence of such projects being organised and a slice of that would revert to Cloudbreak.

But as we say this does depend upon that network – and its nexus – being proactive in designing projects to meet market demand. In the same way that the mining houses of old did, even investment banks before that all became about trading pieces of paper. Simply doing what seems to be being done isn't adding value in that sense. Stumping up the cash for a couple of Namibian oil licences, well, that's not the sort of value additive work that such a project generator might be thought to be valua additive at.

That is, there's a certain disappointment not at the Cloudbreak Discovery idea but at the actual actions. This isn't as transformative as it first looked it might be. Of course, that could change if the quality of projects does.

There's also a certain worry about dilution of the current shareholders. In order to gain access to capital Cloudbreak has issued what amounts to a put option to Crescita. That could indeed lead to significant new share issuance.

A reasonable option might be that Cloudbreak needs to up its game – start generating natural resource projects where it adds significant value. That is the basic concept after all.