Lithium’s vital role in the global shift to renewable energy means that projected growth figures for the industry are eye-watering. In 2020, the global lithium market was valued at $2.7bn. Just one year later, it had grown to $6.83bn, and further growth between 2022 and 2028 is expected to have a CAGR (compound annual growth rate) of 12.0%.

YOUR CAPITAL IS AT RISK

The boom reflects a global consensus that a move to carbon-free energy production is not only required but also, thanks to delays, now needs to be fast-tracked. This shift in momentum has led to investors rushing to buy lithium assets.

Table of contents

Why Invest in Lithium Stocks Now?

One interesting feature of the industry is that lithium isn’t traded in the same way as other commodities such as gold, silver and copper. There isn’t a recognised lithium futures market, and because of its hazardous nature, holding it in physical form is also off limits.

Instead, investors looking to gain exposure to the lithium sector are limited to taking positions in mining stocks. Equities, in many respects, represent a more convenient way to invest in any metal than holding it in physical form. Equities on listed exchanges operate in markets that are overseen by regulators, and because of the volume of trades being booked, stock trading is more cost-effective.

The three best lithium stocks to buy now are detailed below and offer a user-friendly way to catch the upside of the coming green energy revolution.

Albemarle Corporation (NYSE: ALB)

US-based Albemarle Corporation is the world’s largest producer of lithium. Other business lines include the refining of speciality chemicals such as bromine, but approximately half of the firm’s total revenue comes from its lithium operations. This makes it an ideal stock pick for anyone looking to tap into the potential of the lithium sector.

Its customer base includes EV manufacturers such as Tesla, and rocketing demand for the electric battery materials that Albemarle produces has been matched by an increase in the market price of lithium.

During the 2022 stock market sell-off, the niche position that Albemarle holds resulted it in bucking the trend of falling share prices. While major stock indices were reporting negative year-to-date returns, ALB stock was in November 2022 showing a +30% price gain.

YOUR CAPITAL IS AT RISK

Strong 2022 Q3 earnings results point to the lithium assets that Albemarle owns continuing to generate returns for investors. The report beat analyst expectations and revealed that lithium sales more than quadrupled to $1.5bn.

This spike in revenue is partly down to increased demand driving up prices of the metal, but the firm is also restructuring to make the most of the opportunities it faces. It has opened new processing plants and expanded its operations in China, Chile, Australia and the US. It also expects to shortly complete the realignment of the core Lithium and Bromine businesses into Energy Storage and Specialties segments.

The US government’s interpretation of lithium being a strategic asset is another notable long-term driver of share price support. Albemarle recently received a $149.7m grant from US authorities to build a homeland processing facility in North Carolina, and while geopolitical concerns are increasingly given greater weight, the firm’s position as a US-based provider points to it cementing its position in the market.

Sociedad Química y Minera de Chile SA (SQM)

Based in Santiago, Chile, Sociedad Química y Minera de Chile (SQM) has convenient access to some of the best lithium deposits in South America. The proximity of the firm to the lithium-rich salt flats of the Atacama Desert, for example, helps SQM to keep costs low and record impressive operating margins.

The share price chart of SQM mirrors that of Albemarle, the price of both firms’ stock being closely correlated to the price of lithium on the open market. They both operate other business lines but are as close to an out-and-out lithium miner as it is possible to get.

The slightly higher volatility of SQM’s share price reflects some additional political risks that the South American firm faces. The decision by Chilean voters to elect Gabriel Boric, a left-wing activist, as president in 2021 resulted in a short-term dip in the share price based on concerns that the new regime would implement policies that involved greater environmental oversight.

YOUR CAPITAL IS AT RISK

The added geopolitical risk associated with SQM shouldn’t necessarily put off long-term investors, the assumption being that the peaks and troughs will ultimately be ridden out. Those running short-term and speculative strategies may even be drawn to SQM’s higher beta rating, which can suit investors with a stronger appetite for risk-reward.

The consensus rating of seven analysts who follow the stock is that SQM is a ‘Hold’. This partly reflects the impressive price rise that has already taken place and that a lot of the good news is already priced in.

One potential catalyst for further price rises is that the political mood in Chile could be changing. A shift in government policy saw SQM granted a lithium development contract in January 2022. This reflects political policies not only ceasing to be an obstacle but also swinging around 180 degrees to be a price support.

Lithium Americas Corporation (TSX: LAC, NYSE: LAC)

Lithium Americas Corporation (LAC) is another of the big players in the lithium sector. It has now been operating in the lithium sector for decades and has grown to have a market capitalisation of $3.6bn.

The reserves that LAC owns in Thacker Pass, Nevada are the largest-known lithium resources in the US. With the project facing several legal challenges, delays in bringing this mine into production have resulted in the LAC share price lagging some of its rivals.

While progress on the Thacker Pass project is slower than expected, the path of least resistance still appears to point to it coming in line in the near future, and that would provide an opportunity for investors to buy into a currently undervalued stock.

Adam Davidson, chief executive of one of the project’s big backers, Trident Royalties, said in a statement. “Thacker Pass remains one of the largest and most advanced lithium projects in the US and a key component in the US government’s ambitions to secure access to key critical minerals.”

YOUR CAPITAL IS AT RISK

With US authorities hoping to secure a reliable domestic supply of lithium and lithium products, political support at the highest levels suggests that Phase 1 production will begin soon. The company currently predicts that construction of the mine will commence in 2023.

When the site finally comes online, it will in Phase 1 production be a source of 40,000 tonnes of battery-quality lithium carbonate (Li2CO3) a year. Phase 2 production levels are forecast to be 80,000 tonnes per annum, and the mine has a viable lifespan currently predicted to be 40+ years.

How to Buy Lithium and Lithium Mining Stocks

It might not be possible to trade lithium itself, but the good news is that there are plenty of trusted brokers offering markets in the best lithium stocks. They’re all competing for new clients, which makes investing as straightforward and cost-effective as possible. Here are the five simple steps to follow to set up a trading account and start buying lithium stocks.

1. CHOOSE A BROKER

Differentiating between the firms on this list of trusted brokers can come down to the finer details. Some specialise in offering 24/7 customer support; others prioritise research services; and some emphasise the number of markets offered, which could be important if you’re looking to invest in a more offbeat lithium mining company. Those on the list are all worth considering, but the most crucial consideration is whether your funds will be safe.

Financial regulators in the below list oversee the financial markets and stock exchanges to ensure that they operate effectively. One of their tasks is monitoring and licensing brokers. To gain a licence, a broker needs to demonstrate that it is viable, that it is aware of client care protocols, and that client funds will be segregated – if it goes bust, you don’t lose your money.

The exact terms and conditions of regulatory protection depend on where you live. More information on the regulatory pros and cons of different brokers can be found here.

Picking a regulated broker is a good step towards safer trading, but if you’re still getting to grips with the prospect of trading, then practicing using a Demo account can be an excellent first step. These use virtual funds to trade the markets, so they offer a risk-free way of testing out strategies.

YOUR CAPITAL IS AT RISK

2. OPEN AND FUND AN ACCOUNT

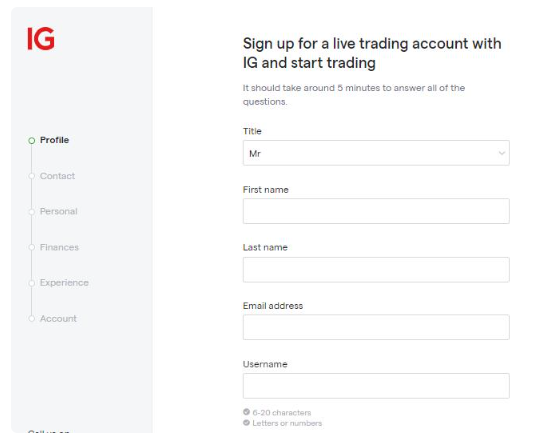

Opening a Demo account requires providing little more than an email address, but setting up an account for live trading involves sharing a more significant amount of personal information. This is so that you, and only you, can be identified as the account holder. It also allows the broker to comply with KYC (Know Your Client) regulations.

The next stage in the account opening process is wiring funds to your account. The user-friendly nature of the broker platforms extends to this area, with most brokers offering upwards of 10 different payment options. The simplest and fastest methods have traditionally been debit or credit card payments, but bank transfers and e-payment agents are also options.

3. OPEN AN ORDER TICKET AND SET YOUR POSITION SIZE

Once you’re set up on the platform, it’s a case of locating the lithium stocks that your research identified as worthy of investment. Navigating to that market can be done using the search function or filtering by sector.

Each stock will have a dashboard displaying price charts, market news and company details. Enter the quality of shares you want to buy into the appropriate data field, click ‘Buy’ and then ‘Open Trade’, and you’ll be the owner of a lithium stock position.

If you want to achieve an elegant entrance into the trade, then using limit orders allows you to set the price at which you’re willing to trade. If the market price reaches that level, you’ll execute your trade at your optimal price level. Getting ‘filled’ on a limit order is a great way to introduce discipline into your trading, but it does require market price reaching the level you stipulate, so it can lead to severe cases of FOMO.

4. SET YOUR STOPS AND LIMITS

Stop-loss instructions and take-profit orders are risk management tools built into the trading system. They instruct stock positions to be partially or fully closed out if price reaches a certain level. They allow investors to get on with their day job while still being able to respond to market moves.

Stop losses come into play if price moves against you. They cut loss-making positions. Take profits, work in the other direction, and crystallise gains should price move in your favour.

Some buy-and-hold investors don’t use stop losses and take-profit orders, as stop losses can lock in losses on positions that might eventually come back into profit and take-profit orders put a cap on potential gains.

Other risk management techniques include diversifying your capital across numerous positions and trading in small sizes to take the emotion out of the situation and reduce the likelihood of panic setting in.

5. MAKE YOUR PURCHASE

Once everything has been checked, it’s simply a case of clicking or tapping ‘Buy’. The platforms are set up to operate on mobile phones and desktop devices, so monitoring the performance of your lithium stocks can be done from nearly anywhere.

The Portfolio section of your site will display the value of your portfolio, with P&L (profit and loss) being determined by price feeds coming in from the stock market. This is also the area of the site to visit when you decide to sell out of some or all of your position. The process for selling is the reverse of the one used to buy, and once executed, the sell trade will convert the stock into cash, which will be credited to your online account.

Whether you are looking to trade short- or long-term strategies, it’s essential to check your trading activity soon after the trade has been booked. The online systems are reliable and robust, but human error can occur. Even experienced traders make ‘fat finger’ mistakes, so checking the portfolio section immediately after trading minimises any potential damage.

Final Thoughts

A lot of the work associated with building a successful lithium stock portfolio is front-loaded, but putting research into the firms and the broker you choose to use can pay off in terms of increased profits. Whether you’re committed to trading or just curious about how things work, one recommendation from experienced traders is to start by using a Demo account.

Demo accounts give you access to the broker platforms, which means that you can tap into free research and analysis reports. The aim is to incorporate the principles of technical analysis and fundamental analysis into your strategies to help you spot which lithium stock to buy and when to do so.

Some attention might need to be paid to the risk management side of investing. Lithium stocks are currently one of the hottest markets out there, and they attract traders running short-term speculative strategies. Longer-term investors have to consider how to ride out any market ‘noise’ caused by speculators and bank on the move to renewable energy continuing at the current pace. The secret to successful investing is spotting and joining trends, and the lithium market has all the hallmarks of one that could run for some time.