Key points:

- Hope Bancorp is listed as being down 90% overnight

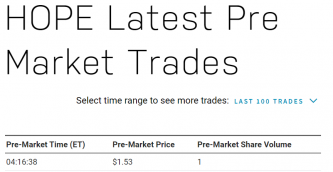

- This appears to be off a trade of one and only one piece of stock

- This isn't a real price therefore and will revert

Hope Bancorp (NASDAQ: HOPE) stock is down 89.59% on the ticker of premarket trades. If a seemingly sensible mid-tier US bank can do this then we're all in serious trouble. Except there's an explanation for this at HOPE. OR a couple of possible explanations perhaps, neither of which include the implosion of Hope Bancorp.

Hoe itself is an LA based bank largely engaged in commercial real estate lending. This is both with and to the Korean community. With, in the sense of drawing their deposit base from it, to in the sense of lending to those setting up in business. It is possible for such a bank to have such an implosion, that has to be said. There have been past examples of it. But this near 90% decline today looks like something much different. The one grand and important fact to have is this:

This compares with from last night, post market:

Also Read: These 5 Investors Say The Market Will Go Down From Here

Given the automated nature of many tickers and stock price displays this then turns up at that 90% (well, OK, 89.59%) decline in the value of Hope Bancorp stock.

But the thing we've got to note here is that this is based upon the one trade only. Not just that, it's the one trade involving the one piece of stock, just the one share. This is not in fact indicative of anything useful about the HOPE stock price.

If there actually was a disaster at Hope then of course the sales of stock at that price would be rather larger in volume as people fled for the doors. So, it's a one off, but why?

One answer is simply that it's a mistake. What's known as a “fat finger” one (although that often refers to when someone sells a million instead of a thousand, that sort of thing, fat finger really means any trade in error). So, something lost $12 on selling one piece of stock and the world will recover no doubt.

The other possibility is some manipulation. Volume in HOPE is some half a million shares a day. So it's not something (and with a $1,7 billion equity valuation) something that can be easily manipulated. But still a smaller stock. And no trades from just after close, at 4 pm, through the night into the next day's markets. Except this one, single, trade at 4 am. Taking advantage, perhaps, of a dead time to get that one single share traded to be setting the automated price for Hope Bancorp for whatever period of time until more, corrective, trades appear.

Why would someone do this? Possibly if they had some derivative connected to HOPE that they could close out at the manipulated price. Whether they did or not is another matter. This is not to claim that there is some nefarity here. It is just to point out that there are those two obvious possible explanations.

Hope Bancorp really hasn't dropped 90% overnight. We'd expect any trades in any volume to be at around last night's close, not this erroneous price.

The one certainty we've got is that whoever it was who sold that 1 share at 04:16 this morning is going to have some interesting conversations as to why they did so.