Maybe you’ve got positions that are underwater and are looking for a route to the other side? Or you have cash on the side-lines and are looking for the right time to buy the dip and put on the trade of a lifetime? Either way, factoring in the thoughts of investors who have seen it all before can help you time your trades. The market going down could have a big impact on stocks, so your trading strategy is paramount. The market will inevitably rebound, but according to these investors that bounce might still be some way off.

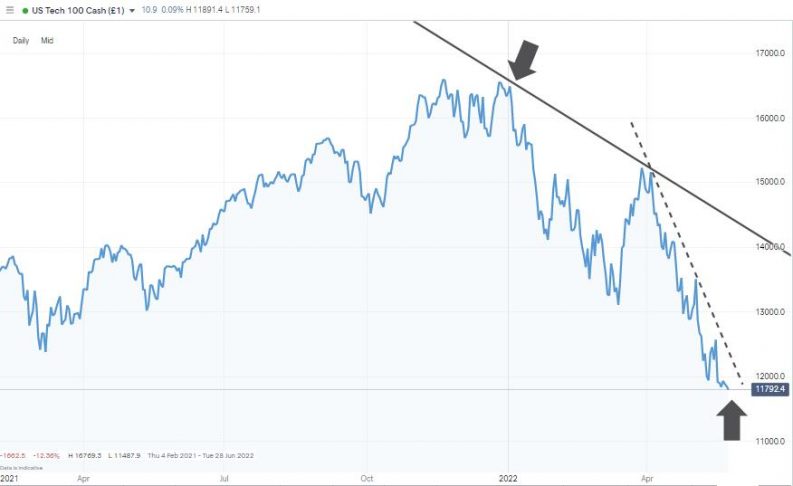

Nasdaq 100 Index – Daily Price Chart – 2021 – May 2022 – Bear Market

Source: IG

Michael Burry

Michael Burry’s impressive track record of picking the top of the market has been turned into the Hollywood movie, The Big Short. It details the white-knuckle ride his hedge fund Scion Asset Management took when it shorted the housing bubble of 2008. Shorting stocks is a dangerous pastime because losses are technically infinite. Equity markets also tend to rise gradually over extended periods and the occasional crashes are sudden and short-term, so it’s hard to time trading them right.

Burry’s approach is based on fundamental analysis which involves looking into the granular detail of corporate and economic data reports. His prognosis for 2022 is bad news for long investors and on 24th May he pointed to more pain for buy-and-hold investors.

“As I said about 2008, it is like watching a plane crash,” Burry posted on Twitter. “It hurts, it is not fun, and I'm not smiling.”

Source: TheStreet

How low could the market go? Burry thinks the global benchmark for stocks, the S&P 500 index could trade as low as 1,862. It opened the year at 4,782 so that represents a +61% fall and would take it below the lows seen in 2020 during the COVID pandemic. It is also +50% lower than where the index opened in May 2022.

S&P 500 Index – Daily Price Chart – March 2019 – May 2022 – Burry’s Worst Case Scenario

Source: IG

Burry’s insight on the markets extends to the nature of the potential sell-off. During previous crashes, stock markets traded lower several years later. It takes time for the problem of overvalued stocks to work through the system. The S&P 500 Index, for example, bottomed out in 2009 at a level 13% lower than it did in 2002. The low of 2002 which followed the Long-Term Capital Management fiasco of 1998 was 17% lower than the low of ’98.

If the stock markets do follow that historical pattern then now is not the time to step in and buy, but even to consider strategies that involve going short.

Lisa Shalett

Morgan Stanley Wealth Management CIO Lisa Shalett has adopted a cautious approach through 2022 but even with major stock indices already in bear market territory, she expects further price falls ahead.

Speaking in February of the Ukraine-Russia conflict she picked out the start of the move away from growth sectors.

“I think it's a big deal. And I think it's a risk off factor in the next few weeks… When there are exogenous crises around the world, whether it's a war, whether it's 911, whether it's a trade war, or whether it's a political scandal, whatever it is, these things tend to make people want to reduce their exposure to the most-risky assets.”

Source: Markets Insider

According to Shalett, the situation has, if anything, worsened due to Q1 corporate earnings figures missing expectations. On 23rd May she updated her research findings to say, “Negative earnings revisions and negative economic surprises could produce another 5% to 10% decline in the S&P 500” (Source: MarketWatch)

Shalett’s forecast might not be as apocalyptic as Burry’s, reflecting the differing nature of their investment vehicles. The hedge fund Burry operates can make bolder calls on market direction and sell short. In contrast, wealth managers are limited by their investment mandates which may stipulate they can only take long positions. For Shalett it’s a case of finding the best stock to buy into even if she has concerns about the sector as a whole.

One sector she is avoiding is growth tech stocks because it contains high beta shares which fare particularly poorly during sell-offs. Instead, she leans towards defensive assets, such as gold and bonds. This move away from tech started at the end of last year when she pointed to the sector being ‘crowded’ and coming to the end of its good run.

“Big techs like Apple and Netflix are great companies, but can you think of better circumstances for their businesses than having a pandemic when people are working from home and need better tech and holed up in their houses with nothing to do?”

Source: CNN Business

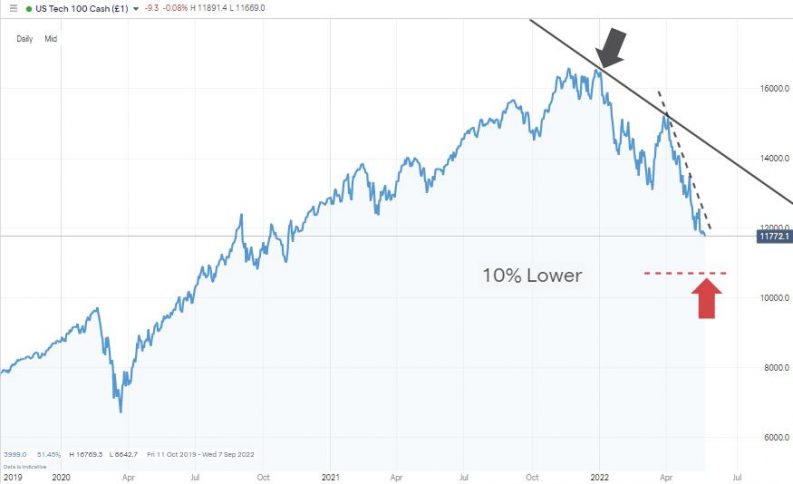

Nasdaq 100 Index – Daily Price Chart – 2021 – May 2022 – 10% Lower…

Source: IG

Bill Ackman

Billionaire hedge fund manager Bill Ackman made an estimated $2bn selling short into the COVID-19 market crash of 2020. Ackman has seen it all before and in May 2022 came out to say the current sell-off could have some way to go.

“Inflation is out of control,” Ackman Tweeted on 24th May. “Inflation expectations are getting out of control. Markets are imploding because investors are not confident that the @FederalReserve will stop inflation.”

Source: Yahoo! Finance

The worst-case scenario in Ackman’s view would be a timid response by the US Federal Reserve to runaway inflation. The FOMC committee is due to meet on 9th June and Ackman thinks they might have already lost the room. He shared the view that only a dramatic rise in interest rates can stop the stock markets from tanking.

“If the Fed doesn’t do its job, the market will do the Fed’s job, and that is what is happening now… The only way to stop today’s raging inflation is with aggressive monetary tightening or with a collapse in the economy.”

Source: CNBC

Ackman doesn’t put an exact figure on how much further markets could fall. For him, there is a sense of ‘all or nothing’ about the situation. The stakes are high and the outcomes binary. One glimmer of hope for perma-bulls looking to buy the dip is that Ackman says if the Fed “puts a line in the sand” and avoids “demand destruction” then “markets will soar.”

(Source: CNBC)

Jeremy Grantham

Speaking in mid-May, with some of the world’s major stock indices already down more than 20%, Jeremy Grantham sounded out a warning that the correction could only be halfway done. Grantham is co-founder and chief investment strategist of Grantham, Mayo, & van Otterloo, a Boston-based asset management firm. He’s been making the right calls on the markets for decades and when assessing the current situation draws parallels to his experience of navigating the dot-com bubble of 2000.

The first similarity between 2000 and 2022 is that most of the pain has been felt by holders of US stocks, specifically tech stocks. As in 2000, he predicts there will be a sudden recession which will have a knock-on effect on corporate revenues. That would then bring the second wave of stock selling due to bottom fishers who bought stocks after the first wave of selling realise those undervalued stocks, they bought weren’t so cheap after all.

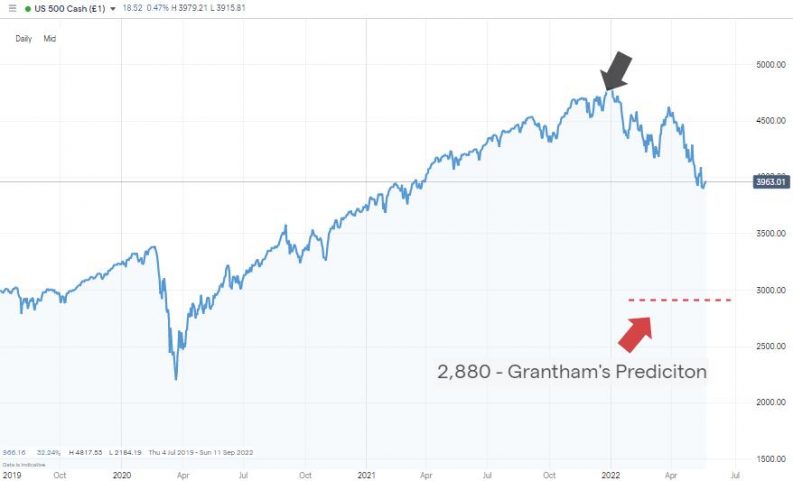

S&P 500 Index – Daily Price Chart – March 2019 – May 2022 – Burry’s Worst Case Scenario

Source: IG

Grantham expects the S&P 500 index to fall at least 40% from its peak. That would take it to the region of 2,880, a price level lower than the low point of March 2020. The decline he forecasts won’t be in the form of a rapid drop and bounce but will be a multi-year decline brought on by persistent bad news filtering into the markets.

The 40% prediction made by Grantham is alarming enough for those who are still overweight stocks but there are other factors to consider which could make things even worse. He cites the risk of a housing market crash as being something that could turn the 2022 sell-off into a financial disaster.

He states that in 2000 “housing was cheap” but it is currently overpriced. “What you never want to do in a bubble is mess with housing, and we're selling at a higher multiple of family income than we did at the top of the so-called housing bubble in 2006.” (Source: Yahoo!)

Ray Dalio

Ray Dalio is the founder of the world’s largest hedge fund, Bridgewater Associates so his nerve-jangling statement on 24th May can’t be dismissed too easily. Speaking with CNBC he said, “Cash is trash … but equities are trashier.” (Source: MarketWatch)

This view is taken even after millions of investors have suffered excruciating losses throughout the course of 2022.

The first part of Dalio’s statement refers to previous statements he has made regarding those sitting on the side lines and not putting their capital into assets with higher returns. His outspoken criticism of those who were “keeping their powder dry” has morphed into a warning about the stock markets as well.

The first part of his warning remains, “Do you know how fast you’re losing buying power in cash?” (Source: MarketWatch) but stocks are now seen as being a much less attractive option.

Dalio explained, “Here’s the dynamic that I think is a problem: everybody is long equities, and everybody wants everything to go up. The more they hype it the more it becomes somebody else’s financial asset they’re holding. You can’t have that, so you’re going to have an environment of negative real returns. Everything can’t go up all the time, that system won’t work that way”.

Source: MarketWatch

For Dalio, the situation has gone past the point of no return and further share price falls can be expected. He did offer ideas of where any spare cash should be placed, at least until inflation is controlled and the dust settles on the stock market sell-off. He’s currently a fan of ‘real’ assets such as property.

Final Thoughts

Seasoned pros might not necessarily take comfort from being right about calling the top of the market and investors suffering jaw-dropping losses. They may have themselves been obliged to hold onto some of their positions because going completely to cash can be impossible for big institutional managers. They share your pain and will also be looking for the time to step back in. But for these five that time has not yet come.

Whether you’re looking to find a route to the safety of the next bull run, looking to buy at record low levels, or setting up short-selling strategies, the good news is that it takes minutes to set up an account with an online broker. Head to this shortlist of good brokers which include firms that are well regulated and have been reviewed by the Ask Traders team. The review process takes a rounded approach and considers, pricing, platform functionality, customer service, and the quality of research materials.

Finding the best broker for you can also be done using demo accounts which allow you to test strategies using virtual funds. That might not be a bad approach to take if the predictions of the above investors become a reality.