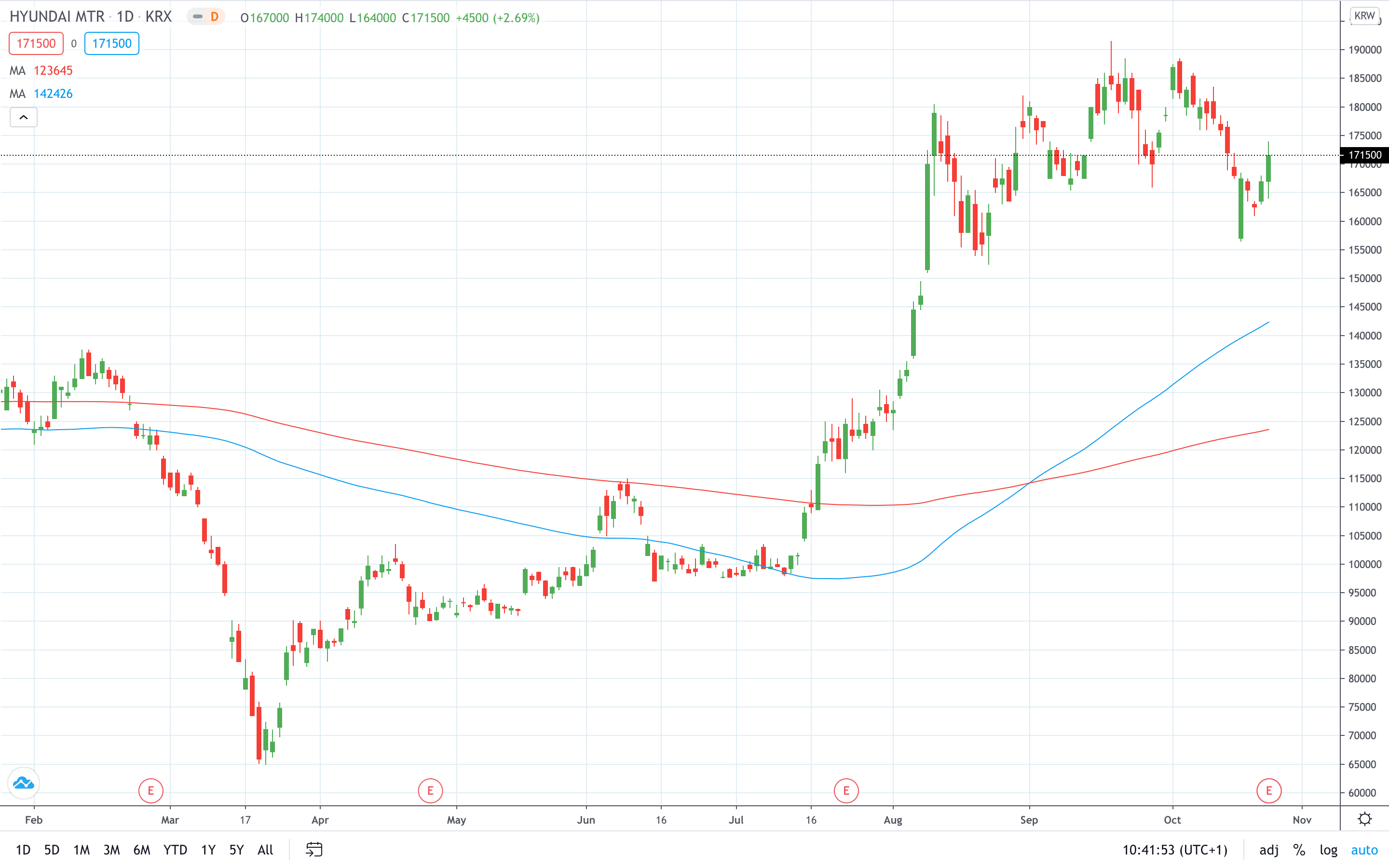

Shares of Hyundai Motor (KRX: 005380) closed the day 2.69% higher after the car producer saw its revenue rise by 2.3% on year to 27.6 trillion won in the third quarter. The company said it witnessed a great demand for its vehicles in the United States and India.

However, Hyundai reported a net loss of 336 billion won ($297.72 million), significantly lower than 1.2 trillion profit expected by the market’s analysts.

A huge loss is a direct result of higher costs as the South Korea-based car producer had to set aside 2.1. trillion won to cover charges related to engine defects.

“Third-quarter results reflect engine-related provision expenses as the company took preemptive measures to ensure customer safety and cover any possible future increase in quality-related expenses,” Hyundai said in a statement.

“We sincerely apologise to our shareholders and investors for having repeated quality cost issues over three quarters since 2018.”

Hyundai share price closed at 171500 won or 2.69% higher on the day to nearly erasing all of last week’s losses.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan