Ted Baker PLC (LON: TED) share price is trading around 25% lower in July after closing June 32.47% in the red. Still, the worst may yet come for Ted Baker stock price as the firm faces a backlash from its investors.

Despite the fact the fashion retailer is fighting for survival, the management team decided to increase the executive pay and bonuses. As a consequence, the advisory firm said the decision is not justified given the difficult financial situation in the company.

Last month, Ted Baker raised £105 million to increase liquidity and fight the economic consequences of the coronavirus pandemic. The retailer was forced to increase its liquidity after reporting an annual loss of almost £80 million.

“Today we are excited to launch Ted’s Formula For Growth, a comprehensive strategy for the Ted Baker brand which is supported by a significant recapitalisation of the business, that strengthens our position and enables us to both execute that transformation, and navigate through the disruption caused by Covid-19,” Ted Baker chief executive Rachel Osborne said last month.

Moreover, Institutional Shareholder Services (ISS) has called for Ted Baker investors to vote against the firm’s remuneration policy at the meeting next week.

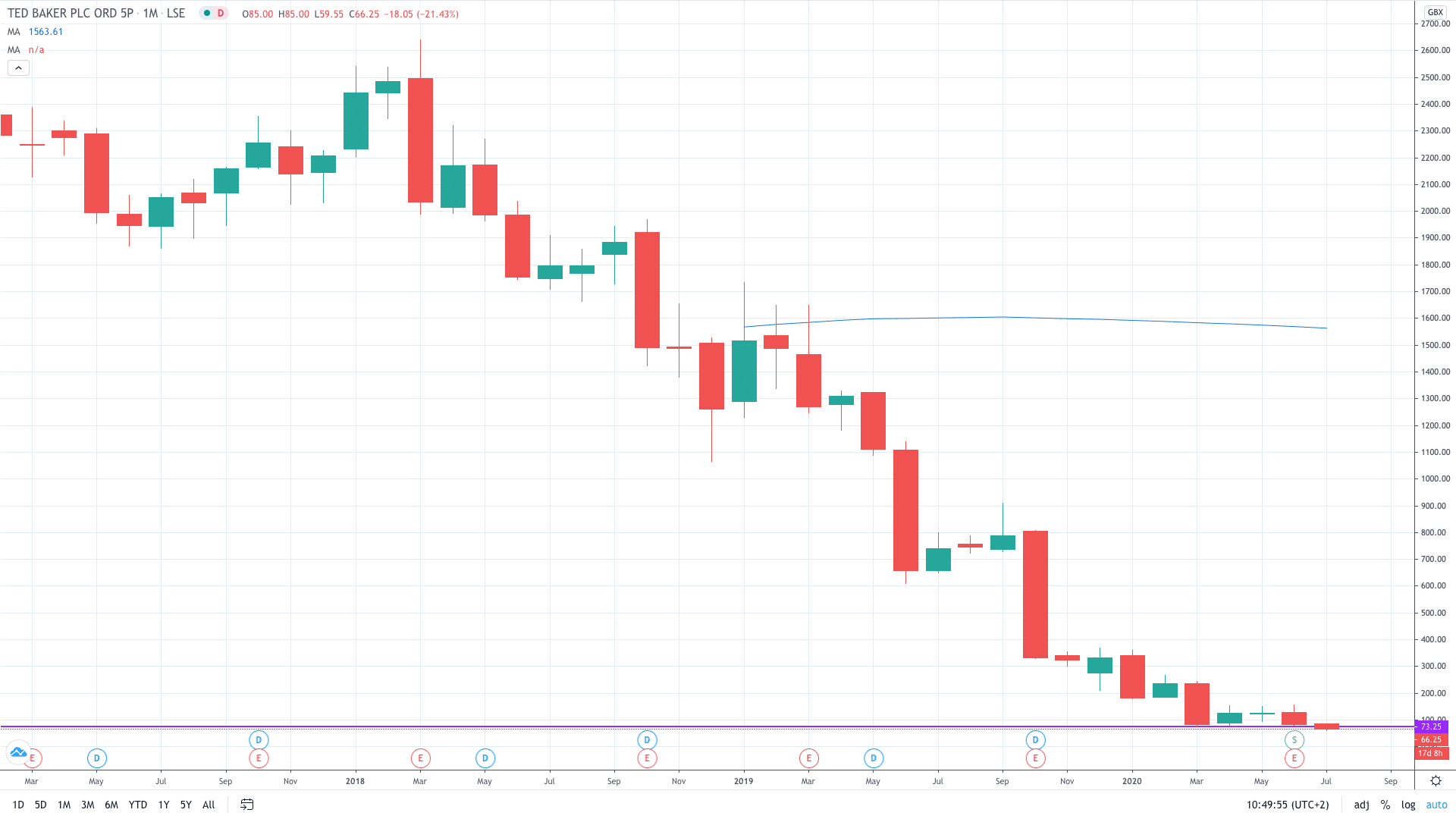

Ted Baker share price crashed nearly 95% in the last two years. This week, the fresh all-time low of 59.55p is hit.

-

Start trading Ted Baker stock with the best stock brokers

-

Learn how to buy shares