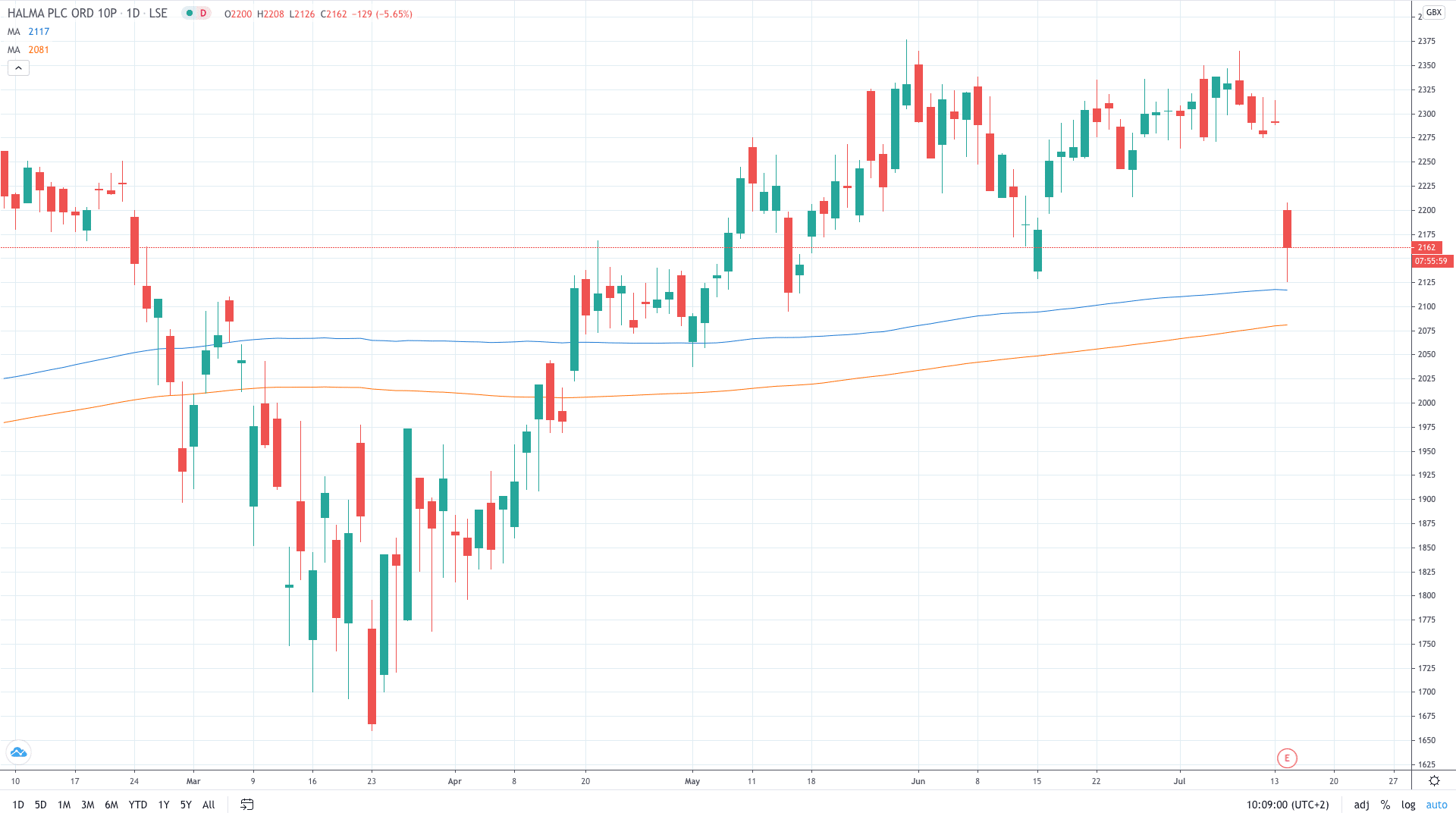

Shares of Halma PLC (LON: HLMA) have fallen around 7% today after the firm reported its revenue dropped 4% in the first quarter of the new year.

On an annual basis ending March 31, revenue jumped 11% £1.3 billion. Halma reported that its profit before tax surged 8% to £224.1 million for the same period.

“Halma delivered a record financial performance in the past year, and trading in the first quarter has been resilient despite the effects of the COVID-19 pandemic. This reflects our clear purpose and focused strategy, our flexible and agile organisation, and the resilient, long-term growth drivers in our chosen markets,” said Andrew Williams, Group Chief Executive of Halma.

Halma, which produces hazard detection and life protection products, decided to raise the final dividend by 3.8% to 9.96p per share. This means that Halma shareholders will receive 16.5p per share, a jump of 5% on a year-to-year basis.

In addition to the falling revenue, investors were not happy to hear that the debt surged to £375.3 million.

Halma share price has fallen nearly 7% today to mark the new 2-month low at 2126p. The stock has been performing excellently lately, hitting the all-time high at 2377p in the last week of May.

- Start trading Halma stock with the best stock brokers

- Learn more on how to start trading stocks