International Consolidated Airlines Group's (LON: IAG) share price has been somewhat of a rollercoaster over the last few years…

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

It hit a high of almost 240p in June 2020, then moved to a low of below 90p before rising, then falling once more, dropping below the 100p mark again in October/September 2022.

But, IAG shares are ascending once more, and the recent rise has fuelled hope that they could hit 200p per share this year.

Top Broker Recommendation

- eToro Top stock trading platform with 0% commission – Read our Review

- Admiral Markets More than 4500 stocks & ETFs available – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

- IG Top-tier regulation – Read our Review

- XTB UK regulated by the FCA – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY

The company's results last week were positive, returning to annual profit for the first time since the pandemic. Even though IAG's shares fell following the earnings release, here's why we think it will continue to climb this year…

Strong Travel Demand

Despite soaring inflation over the past year and other macroeconomic headwinds, travel demand, as was the case last year, remains strong…

Airlines on both sides of the Atlantic are upbeat on demand, providing positive outlooks for the year in the face of an uncertain economic environment as travellers revert to pre-pandemic booking habits.

In addition, with travel to Asian countries now fully open, pent-up demand for these destinations should also boost IAG this year.

Finally, web traffic for IAG's British Airways and Iberia (according to Semrush) are once again back at highs and on course to potentially surpass last year's levels, suggesting an even more robust peak travel period this year.

Inflation Easing

As mentioned, alongside staff shortages and other macro challenges during last year's peak travel period, airlines had to deal with surging costs, but these pressures are now easing.

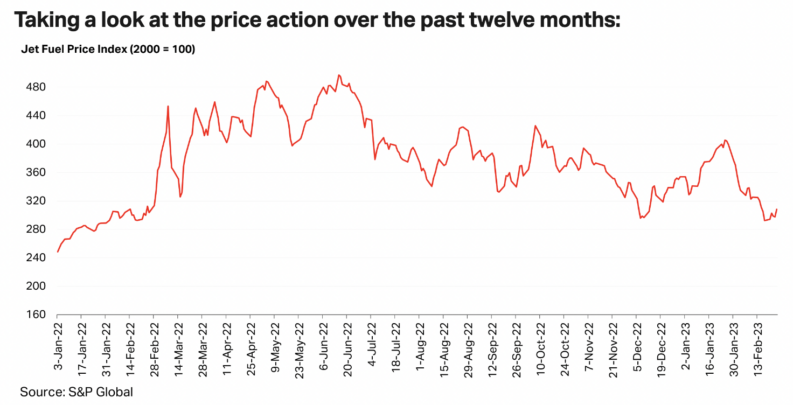

The cost of jet fuel has decreased in the last month or so, and it is expected to continue to slide, potentially boosting IAG's profit potential.

Air Fares

According to an article by CNN citing an economist at travel site Hopper, US domestic fares are now around 20% higher than they were in February last year.

In addition, economy fares originating in the UK have risen 36% from the same period last year, according to the same article citing Flight Centre UK data.

Increased fares and lower business costs should translate to increased profit for IAG.

Bottom Line: Of course, there are still risks for the airline industry, IAG (LON: IAG), and the global economy in general. IAG's significant debt is one headwind and was said to have made a significant impact on its share price following the results last week.

However, the company is finding its feet once again, and we see it continuing to perform well over the coming year.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.