Fidelity Investments is a name that is synonymous with the investing space having offered financial services since it was founded back in 1946; the firm later expanded globally in 1969. It now offers a massive variety of investment products including retirement plans, brokerage and trading services, and wealth management to name but a few. The firm has over 27 million clients in the United States and millions of clients in other countries given its global presence.

The company’s main focus is on providing traders with access to the stocks, bonds, ETFs and options markets. This review analyses how the brokerage operates in each respective compartment. You will see the things they do well and the areas where they need to make improvements.

Fidelity Review Navigation

What can you trade?

Stocks

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £1000 | Good | 1:1 | Low |

With this brokerage, you get to choose which stocks to trade from a massive selection of shares picked from different countries globally. The firm provides a lot of market analysis and research tools to help you with your decision-making when trading. You can choose to trade UK stocks or stocks listed in 24 other countries and you can use 16 different currencies when trading depending on your specific needs.

You can also participate in Initial Public Offerings (IPOs) where you can invest in real estate investment trusts (REITs), closed-end funds, preferred securities, common stock, unit trust funds, variable interest entities and depository receipts. The fees you pay will vary depending on the country in which the stock you are trading is listed.

ETFs

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £1000 | 1900 | 1:1 | Low |

The firm offers traders access to over 2,000 different ETFs from all the major issuers. This is a mesmerising number of ETFs and you will be hard-pressed trying to find a more extensive offering from another broker. About 5% of these ETFs are commission-free, which is an added bonus.

You can choose from a host of active and passive ETFs which allow you to develop a comprehensive investment strategy. You can easily filter out the specific types and themes of ETFs you are looking for using the tools provided by the firm.

The firm also provides a selection of curated ETF ideas that can help make your decision-making process much easier. The company has a collaboration with the leading provider of ETFs globally, iShares, which is ideal for those looking for commission-free trades.

What did our traders think after reviewing the key criteria?

Fees

The company has a reputation as one of the most affordable online brokerages, especially when it comes to ETF trading. As mentioned earlier, about 5% of all ETFs are available for commission-free trading. For UK clients, the lower cost ETF trades are not as lucrative as those offered to those available for the US market.

UK clients are likely to pay £10 for online trades with the figure rising to £30 for each trade you make over the phone. The maximum fee you are ever going to pay when trading an ETF with the firm is capped at £45. There are no fees charged for holding ETFs in your account.

There is a stamp duty of 0.5% when purchasing UK shares with the duty rising to 1% when you buy Irish shares. There are also foreign exchange fees that you should consider if you are using a currency other than pounds sterling. If you what to participate in regular savings or reinvestment plan, then this will cost you £1.50 each time a transaction is made on such plans.

Account Types

When it comes to trading financial products, there is only really one account that caters to traders at the firm, which is the Investment account. Other account options on offer such as personal pension accounts, stock and shares ISA accounts and junior versions of these accounts generally cater to non-traders (long-term investors).

There is no limit on how much you can spend when trading through your Investment account. You also get access to a nice range of financial instruments. When getting started, you will need to make an initial deposit of at least £1,000 or else get a regular savings account that starts at £50.

Platforms

There are a couple of different trading platforms available to you when you sign up for an Investment account with Fidelity. There is a proprietary trading platform called the Active Trader Pro, which is an advanced trading platform that is ideal for more experienced traders. The software features countless exclusive trading tools that are not available elsewhere.

The interactive charts allow you to quickly see the instruments price history, your open positions, and real-time integrated balances. There are a couple of dozen drawing tools and hundreds of different analysis and research tools built into this platform. Despite having a lot of functionality, the Active Trader Pro is surprisingly straightforward to use once you learn the ropes. The process of trading options only takes a few clicks with everything being broken down into three separate stages.

You use the ‘Trade Armor’ function when trading ETFs and you can access the software through your web browser or download the desktop client. Not all traders are given access to the Active Trader Pro service from the start. You need to have made at least 36 trades over the course of a calendar year in order to gain access. Sometimes if you contact the customer support team, you can access the platform without having to hit this trade requirement. The fact that most brokers will give you access to their trading platforms right off the bat puts the firm at a slight disadvantage. There is a mobile app that is part of this offering and it is available on both iOS and Android devices.

For the traders who do not have access to the Active Trader Pro platform, you can use the industry-standard MetaTrader 4 option, which is open to all clients. Traders with some experience will be familiar with the MT4 platform given its extreme popularity across the industry. The software has a nice array of tools and options but misses some of the custom features present in the Active Trader Pro offering.

Usability

The website is very clear and easy to navigate. While the US site is somewhat cluttered, the UK version only has a few items on the menu, allowing you to quickly find what it is that you are looking for. All of the key information such as the fee structures are neatly laid out in tables, so you don’t have to plough through reams of text to find the answers you are looking for. In the footer, you will find a list of the pages on the website, all in one place. The website’s speed is pretty good and the important information is easily reachable.

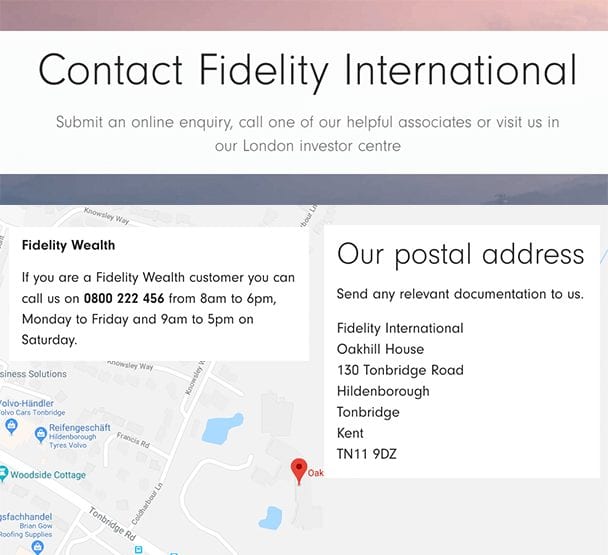

Customer Support

There is an FAQ section that you can use when you are trying to resolve any issues you may experience or to find answers to popular questions about the firm. If you want to get directly in contact with a member of the customer support team, there are a few ways to do so. You can use the email form on the website to communicate with them via email. If you prefer a more traditional approach, you can send the support team a letter via the postal service to their office in Kent.

There is also a phone number you can ring to speak directly with the customer service team. You can also contact the team via one of the major social media channels. The main downside is the lack of a live chat function on the UK-facing website. However, the response times are pretty good, with the email inbox and phone lines being manned around the clock.

Payment Methods

When adding funds to your Fidelity account, there are a number of options that you can use. You can use a debit or credit card from Visa or MasterCard to deposit funds. You may also be asked to complete a 3D security page from your card provider to confirm the transaction. You can also send a cheque through the post or use a wire transfer. There are usually fees associated with sending a wire transfer, which is levied by your bank, not by broker.

Currently, the only way that you can withdraw funds from your account is by using a bank wire transfer. Through this method, it can take up to five business days for the withdrawn funds to reach your bank account. Usually, the firm will process these requests quickly, often within 24 hours on a weekday.

Best Offers

The company does not offer demo accounts, which is a major disadvantage to new traders. Therefore, beginner traders do not have an avenue to learn the ropes and familiarise themselves with the nuances of a given platform. Experienced traders also do not have software to test and tweak their trading strategies before switching to live trading.

As for the education section, there is an introductory guide on how to use the platform and an insight into the fundamentals of trading. There are also guides and videos on more advanced topics as well as regular market analysis. You also have all sorts of tools for selecting and choosing different investments, with a range of different calculators on offer.

For analysis purposes, you get regular investment outlooks, daily market reviews and a raft of data points that you can analyze to help you come up with strong trading ideas.

Regulation & Deposit Protection

The firm is licensed to operate in the UK by the Financial Conduct Authority (FCA), which is a well-respected regulatory body. Naturally, it is also licensed in the United States by the Securities and Exchange Commission (SEC). It is also part of the New York Stock Exchange and the Securities Investor Protection Corporation (SIPC). This means that all the client funds held by the company are kept in separate bank accounts. Therefore, in case of any financial trouble for the company, the client funds cannot be accessed to pay creditors. In total, there is customer protection of up to £50,000 in place for client accounts.

The security of the website itself is quite strong as it utilises the latest encryption technology, which adds an extra layer of security to your account. This means that you will receive a text message or a call when logging in to confirm that you are the legitimate holder of the account. The platform also utilizes McAfee Antivirus protection to prevent hackers from accessing important data.

Awards

With Fidelity being such a mainstay in the brokerage industry over the past few decades, you should not be surprised to learn that it has received numerous awards over the years. The industry awards came from a variety of different countries for different reasons. Some of these awards won in recent times include:

- Best Online Broker 2018 – Investors Business Daily

- Best Online Broker 2017 – Barron’s

- Best Online Broker 2016 – Barron’s

It has also won awards for the speed of its platforms, its selection of assets and its mobile offering. If you want to list out all of the awards won, we would have to create a separate article for the same.