Every investor approaches their task in a very personal way, hopefully following the advice and guidance of experts as they go. It is not supposed to be purely an analytical and boring experience. You are also supposed to have fun with it. In this context, it has long been the counsel of professionals that a portion of one’s portfolio – somewhere in the neighbourhood of 5% to 10% – should be devoted to having fun.

YOUR CAPITAL IS AT RISK

Years ago, this allocation was referred to as a ‘Special Situations’ pool, but the idea was to choose a group of minor entities that might have the rare chance of dramatic growth with a big payoff down the road. These stocks would not appear on any published lists of the best stocks to buy over the next year, and for this reason, they soon earned the name of ‘under-the-radar stocks’. If your prospecting efforts were prudently spent, then the expectation was that anywhere from one to three items out of 10 might make it big time with price appreciation to match.

In modern times, this approach has given rise to what is called thematic investing, where you attempt to predict which companies might benefit from predictable long-term and global mega-trends. These trends might include the Internet of Things (IoT) or artificial intelligence and robotics, but the best under-the-radar stocks need not always fall within these thematic categories.

Table of contents

WHAT ARE THE ISSUES WITH THESE STOCKS?

As these entities are typically small enterprises, it does not take a lot of recognition by the global investing community to make prices skyrocket. You also want to choose a security for a firm that is on the cusp of a great discovery or has an innovation driven by bringing convenience to our lives. However, the goal is to find these gems before everyone else and before the big press releases alert the world to its achievements.

There is also an issue of liquidity. Small entities may have their price behaviour jump erratically before being found, which can make it difficult to cash in on your winnings. You want other investors to finally find this jewel before you part with it. Unless the venture appears to be a fly-by-night flash in the pan, which will fizzle out in the near term, you will want to hold onto these selections for a few years.

A perfect example is Bitcoin. Wise observers counselled that it was high risk and anything could happen, but early on, the advice was to buy a good stake, and then not look at it for at least five years. If you had bought just $1,000 five years ago, it would be worth a cool $60,000 today. Do the same math from eight years back, and you would be sitting on $500,000.

Bitcoin and stocks such as Apple, Google and Amazon do not come around every day – investors do not easily find these powerhouses in their nascent stage. Invest a tidy sum and believe in the long-term prospects, even against all odds. Choose your best shots, invest an appropriate amount, and wait.

YOUR CAPITAL IS AT RISK

HOW DO YOU FIND THESE STOCKS?

Is it possible to find one of these offerings as an individual investor when there are legions of experts on Wall Street covering every stock known to man? Indeed, there are also many experts in the investment community who enjoy searching for these diamonds in the rough.

On a personal level, your search engine will uncover a number of these specialised lists of the best under-the-radar stocks, or you may see a newsletter or two touting the latest and greatest find. If the distribution reaches a wide enough audience, there may be a price pump – a swing trader’s dream. However, caution is advised.

Most importantly, beware of ‘pump-and-dump’ fraudsters trying to unload a bad portfolio. Not every recommendation is worth your consideration. You must still do due diligence before rushing in to buy. You want substance, not an empty bag of air surrounded by a multitude of press releases that make the company sound like it is unstoppable. If the hype is worthy, then investors would have already taken note and produced a gradual uptick, not a spike.

When researching, however, there may be limited information regarding your candidates, as they more than likely have been relatively unknown. Their unique talent or special service may still be in its early proving stage, well before there has been adoption by the masses. At this stage, these small-cap companies also have limited access to financing sources, whether through a bank, investment funds, or the sale of their stock. Without this financial backstop, economic downturns can be brutal for these concerns.

Despite the risks involved, there are still advantages to finding a gem or two in this market. While in their development stage, it is also much easier to grow the business. An occasional press release touting astronomical growth may appear, but steady growth at well above average is the alert that something might be up. These smaller companies will also be quicker when adapting to changes in the market, but the downside is that share prices tend to react with higher and deeper swings when the general market abruptly changes its tone.

Lastly, the draw will always be the potential for high multiple gains. Conservative investors may shy away from this process, but it is part of what makes investing a fun pastime for many people. You never know what the future might bring, but if any one of your choices makes it big enough to suddenly rise to the Russell 2000 or the Wilshire 5000, then price appreciation may be guaranteed. A liquidity event may be assured at a good price, and you will remember your prowess as a wise stock picker forever.

IS NOW THE TIME TO BUY THESE STOCKS?

Stock advisors will counsel you that now is always a good time to invest in small-cap stocks, as long as you pick the right ones – the hidden gems that are truly under the radar. Over the long haul, these stocks do tend to outperform their large-cap brethren, but the risks are also higher in order to offset the potential for great returns.

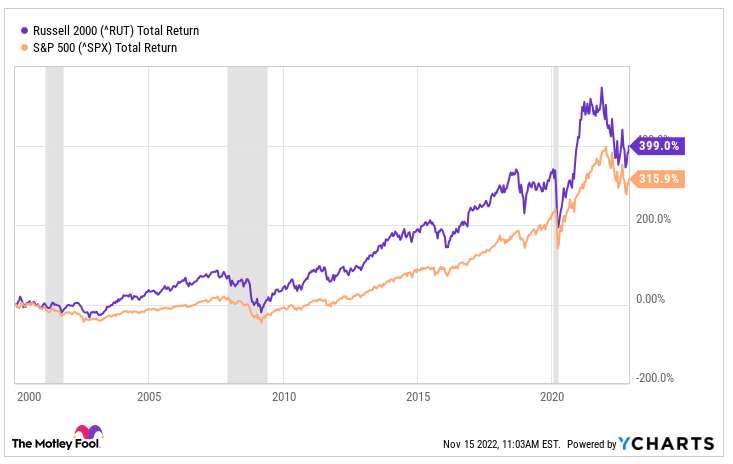

One interesting analysis produced by The Motley Fool was to look at how these stocks compared to large caps since the millennium crossover. The comparison used the Russell 2000 index, a grouping of small-cap ventures, versus the S&P 500, widely regarded as our best measure of the health of the global economy. Recessionary periods have been shaded for reference in the graphic below, but the long-term result is indisputable – small caps did better over the long term, even though small-cap stocks did decline more over the past year or so:

YOUR CAPITAL IS AT RISK

BEST UNDER-THE-RADAR STOCKS TO BUY

There is a variety of methods for prospecting for gold in the under-the-radar market sector. These firms will typically have market caps well below $10bn and look interesting. If you are a do-it-yourself type of investor, you will need a good stock-screening tool. Set your criteria for smaller-cap stocks with proven revenue growth records. Once you have located a few interesting prospects, start your due diligence review. Information may be limited, so you may have to make allowances and take chances – all part of the fun.

There are also a multitude of independent prospectors who will publish their recommendations on the internet. You may also find a gem or two there, but beware of obvious pump-and-dump scenarios, and also realise that once an idea is on social media and the internet, the herd may already be ahead of you and have driven the price beyond acceptable levels.

For now, here is a list of five hopefuls – our best under-the-radar stocks:

- Alpha Metallurgical Resources (AMR)

- Aspen Technology (AZPN)

- e.l.f. Beauty (ELF)

- Global-E Online (GLBE)

- World Wrestling Entertainment, Inc. (WWE)

There is no shortage of small and undiscovered ‘wannabe rock stars’ in this investment arena. American exchanges are filled with public stock companies that aspire to be the latest darling of Wall Street. Below is our overview of the five speculative ventures listed above.

Alpha Metallurgical Resources (AMR)

This company is a mining entity that focuses specifically on what is known as metallurgical coal. This specially mined material finds its way into many of the world’s best steel fabricators. It is also in the unique position of having paid down its complete long-term debt portfolio and is now positioned to allocate capital to newer projects and repurchase its stock. During the first half of 2022, the company bought back $195m of its stock, a positive signal for future return prospects.

The firm presently operates 21 mines across the globe, and roughly 25% of its exports fuel the India steel trade, which is growing at a 5% compounded annual clip. US customers also have commitments from the company for 4.5 million tons of its specialised coal product, thereby ensuring a positive road ahead in 2023. Revenues in 2021 topped $2.25bn, as the miner produced 16.2 million tons of coal.

AMR share prices tripled during the first six months of 2022, but have been ranging within tight boundaries from that quarter end. Be careful with entry points as expectations are high.

Aspen Technology (AZPN)

Aspen is in the technology business, or, more specifically, specialises in industrial infrastructure software for monitoring and maintaining a company’s line of internal assets. Its stock has had a good year in 2022, gaining more than 40% to date for 2022.

YOUR CAPITAL IS AT RISK

Investors have begun to take notice of this under-the-radar firm, which expects over $1.1bn in revenue in 2023. Even eToro added it to its portfolio in May of this year. One analyst is very optimistic about this unknown company and believes that its share price could double in 2023.

e.l.f. Beauty (ELF)

e.l.f. Beauty is a fairly unknown company in the cosmetics business, but it has been slowly establishing a wonderful financial track record over the past four years. According to its CEO, Tarang Amin, the firm has recorded 14 straight quarters of sales volume growth as of its first quarter. Revenue also jumped in the following quarters, beating expectations. Its chart reflects the market reaction to this news below:

Is it too late to jump on board this company’s train? The firm just raised its guidance for 2023, projecting $448m in sales revenue, more than $16m from previous guidance. Are you ready to jump?

Global-E Online (GLBE)

Global-E Online may be another company you have never heard of, but it may be a good infrastructure bet in the e-commerce world. It develops and operates a suite of services that simplify the cross-border buying experience, from handling payment methods, shipping and returns to solving complex language communication issues.

YOUR CAPITAL IS AT RISK

It is a relatively young and small company as far as public stock trading goes, but it has garnered quite a few prominent clients in a short time, such as Netflix and Adidas. When it recently added Disney, investors took notice. Revenue is up to $87m, a jump of 52% for the year. Its stock has dipped from its hype stage, but will it take off again?

World Wrestling Entertainment, Inc. (WWE)

Lastly, we have a firm invested in fun and entertainment, World Wrestling Entertainment, Inc. Analysts have shied away from this stock in recent years, but its recent announcement that it will expand into gaming has drawn attention from investors. The firm claims that 60% of its viewers play video games.

After the retirement of former CEO Vince McMahon, who owns 37% of the company, investors expect more innovation to come and a rebound in share pricing. Stock prices were stuck in a rut, but they have jumped 50% in 2022 to the surprise of many. The upward trend is impressive, but the question is whether it has much further to go. Are you ready to rumble?

CONCLUDING REMARKS

Investing can be a tough process at times, but one enjoyable pursuit is to search and take a chance on those shares nicknamed ‘under-the-radar stocks’. The list presented here is just one take, and it should not be considered investment advice. Each of these companies could take off like a rocket or fall like a rock.

Searching for these little gems, the ones that appear to have great potential, is half the fun of this exercise. Always remember, however, that these companies do pose high risk. Do your own due diligence, only devote a small portion of your portfolio to this activity, monitor your positions as you see fit, and, of course, enjoy the journey.