Deciding which asset groups to invest in during inflation can help with the process of preparing a portfolio for what could be a bumpy ride. Some sectors offer protection from inflation, and some offer what could turn out to be trading opportunities of a lifetime. Using fundamental and technical analysis, we’ve created a list of the different ways to trade inflation depending on your own risk appetite.

Assets That Offer a Hedge Against Inflation

Investors are piling into assets that might hold their value in money terms for the foreseeable future. This tackles the second part of the standard definition of inflation – a general increase in the prices of goods and services in an economy and a fall in the purchasing value of money. Nothing is ever guaranteed, but the renewed interest in the below sectors is based on them keeping up with rising prices during previous periods of inflation.

Value Stocks

The report ‘How Does Inflation Affect The Stock Market’ details how inflationary pressures have caused a sell-off in stock markets. Digging into the granular details of the price slide establishes that not all sectors suffer to the same extent and that value stocks can actually be a good hedge of inflation.

Firms that have solid business models and perform consistently regardless of whether an economy is booming or in recession can offer a way to navigate an inflationary environment. Big blue-chip stocks that have a track record of returning cash to investors in the form of dividends tend to stay with that approach regardless of external shocks to the financial system. Profits may be squeezed to some extent, but during inflation, it’s better to make money at that stage rather than in the future.

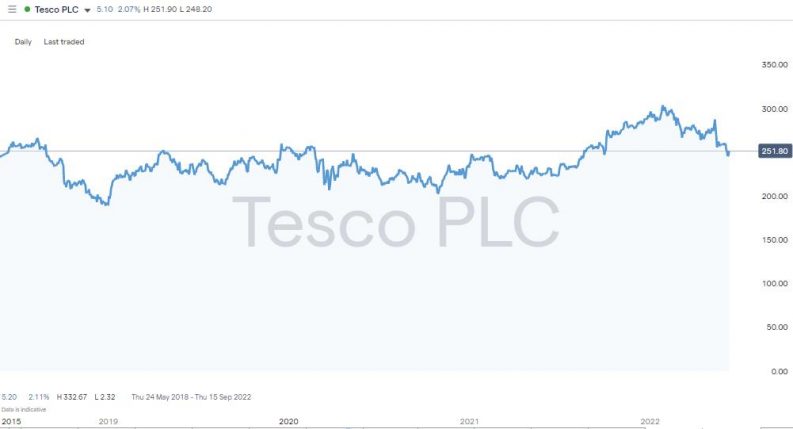

Tesco PLC – Daily Price Chart – 2018 – 2022

Source: IG

UK Retailer Tesco is one example of a value stock that could provide a hedge against inflation. Like other value stocks, it has a stable if unspectacular share price, which reflects the limited growth prospects of the firm. On the other hand, it is the UK’s largest supermarket and has the critical mass to ensure its shop-floor prices remain competitive. It currently offers a dividend yield of 3.27% and has a P/E ratio of 10.19. Any stock that has metrics in that region and a share price that has weathered the initial storm can be expected to hold its ground despite what might be coming around the corner.

Support for these stocks is based on their strong fundamentals, but there is another quirky feature of the markets that suggests support for value stocks will be maintained. The huge funds managed by institutional investors have mandates that require them to keep a minimum amount of their capital in stocks – they can’t just retreat to holding cash. With so much of the equity sector known for underperforming during inflation, the rotation into value stocks can provide a secondary and sustained burst of momentum.

Commodities

Tangible assets tend to maintain their spending power regardless of changes to the value of fiat currencies. If prices in the broader economy rise, then the price of copper, iron ore, wheat and cotton can be expected to follow. The assets involved don’t change in any way, regardless of how many zeroes need to be added to a banknote.

If demand and supply of commodities remains unchanged, they will remain one of the best asset groups to invest in during inflation. The trick is finding the best way to gain exposure to the sector, as storing bales of cotton or tonnes of lithium is beyond the capability of most investors. One user-friendly way to trade commodities is by buying shares in commodity firms. Trading commissions are low, and ongoing fees are also capped if you opt for a share dealing rather than a CFD account.

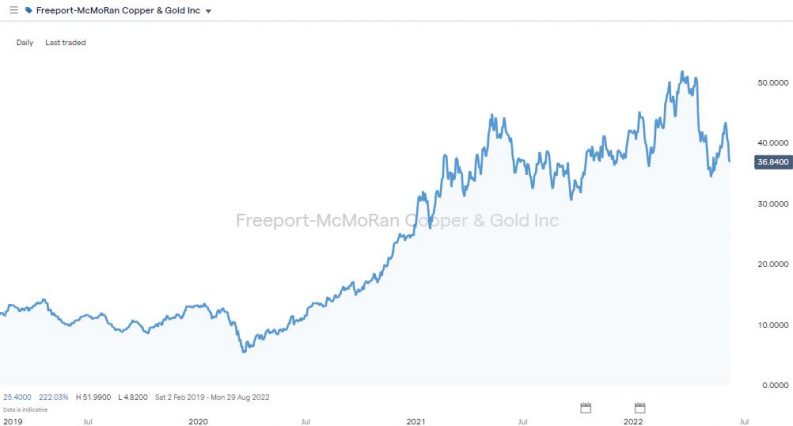

Freeport McMoRan – Daily Price Chart – 2019 – 2022 – +700% returns

Source: IG

The dividend yields on some of the world’s largest mining companies are currently inflation-beating. BHP Group PLC (BHP) currently has a yield of 9.12% and Rio Tinto PLC offers a yield of 10.56%. Other commodity stocks pay lower dividends and instead offer returns in terms of capital gains. Freeport-McMoRan (FCX), for example, currently has a dividend yield of 0.858%, but its share price rallied by an eye-watering 730% between March 2020 and March 2022.

Not only is the commodity sector a good one to invest in during inflation, but there is room to build a portfolio of different stocks offering different kinds of returns. That kind of diversification in terms of risk-return profiles can help optimise returns and manage risk.

Real Estate

Like commodities, the real estate sector involves tangible assets. The illiquid nature of the property market and inertia from commercial tenants also allows landlords to raise rents in line with inflation.

Gaining exposure to the different areas of the real estate sector is increasingly easy. REITs (Real Estate Investment Trusts) can be bought and sold using an online brokerage account. These fund-style products allow investors to gain exposure to different sub-sectors such as commercial property or overseas real estate developments. Once your account is set up, buying them is as easy as clicking a button or tapping a screen.

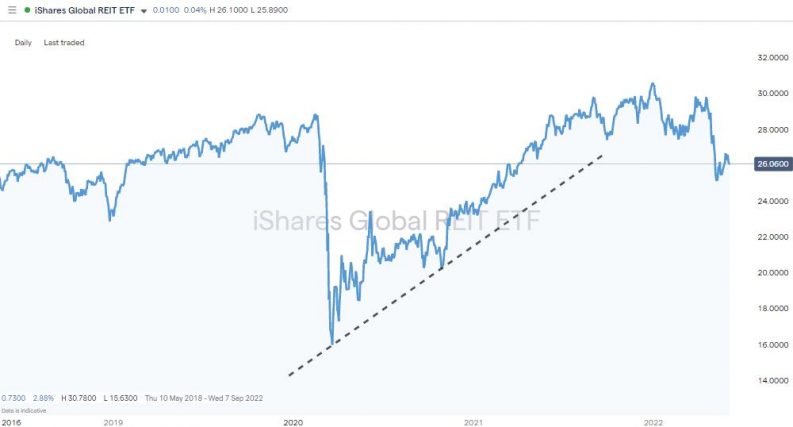

iShares Global REIT ETF – Daily Price Chart – 2018 – 2022

Source: IG

Land Securities Group PLC (LAND) is an easily tradeable REIT and the largest commercial property development and investment company in the UK. The size of the firm offers some added protection to investors looking to use real estate to protect against inflation.

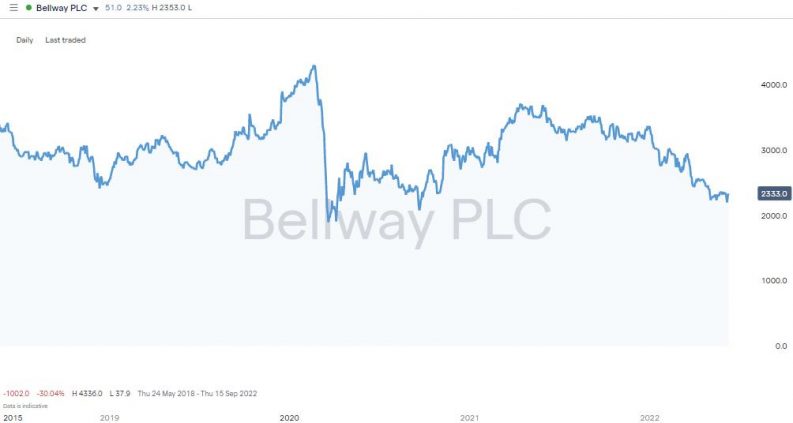

Another way to gain access to this asset group is to buy shares in housebuilders. The protection offered is not as extensive as that found with REITs, but the land banks of firms such as Bellway PLC (BWY) offer some security against rising prices. Shares in house builders offer more upside if, and when, market mood changes and inflation is considered to have been brought under control.

Bellway PLC – Daily Price Chart – 2018 – 2022

Source: IG

Gold

Gold has traditionally been seen as a hedge against inflation because its price has at times tracked those of other assets. More recent research suggests that the link might be weakening, but it’s a relatively easy market to trade and still manages to find a place in a lot of investors’ portfolios.

Gold’s role as an inflationary hedge is based on the same arguments that make commodities a good sector to buy now. Not only does gold tend to track the price of other assets such as oil, but it has a special role as a precious metal and substitute for devaluing fiat currencies.

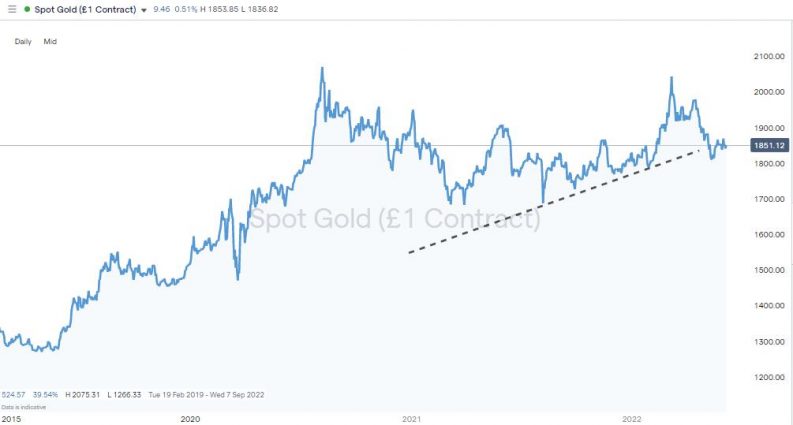

Gold – Daily Price Chart – 2019 – 2022

Source: IG

Gold can be bought in physical form, but those wanting to avoid the security risks associated with that approach can buy into gold stocks. Big gold miners such as Newmont Corp (NEM) tend to have share prices that track the price of the metal – their balance sheet valuations being driven by the value of the deposits of raw materials they hold.

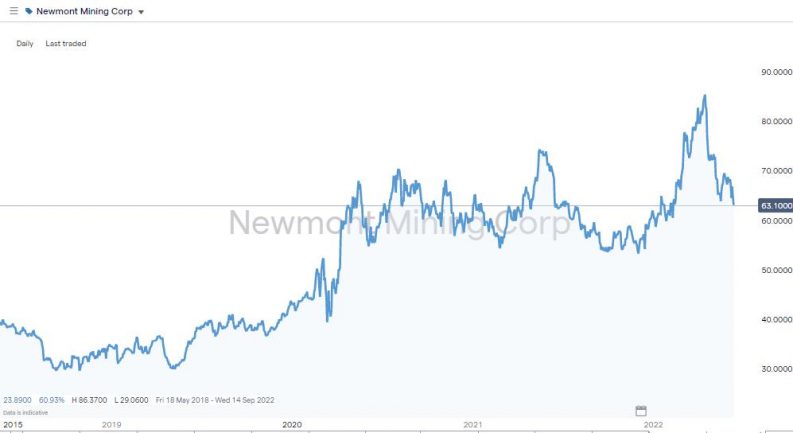

Newmont Mining Corporation (NEM) – Daily Price Chart – 2019 – 2022

Source: IG

Bonds

The huge levels of borrowing that governments and corporations engage in are supported by issuing bonds. While efforts are at times made to reduce the size of the credit line involved, the standard practice is for more bonds to be issued when existing ones mature. The buyers of those bonds appreciate the guaranteed returns, but to ensure they don’t lose out, they also price in current inflation rates, which means bonds are a great way to hedge against inflation.

Not only do governments and corporations offer higher interest rate returns to bond buyers, but the income stream from bonds is also regular – in some cases, payments are made monthly. This makes them attractive when inflation is high, as payments received now are preferable to payments received in the future.

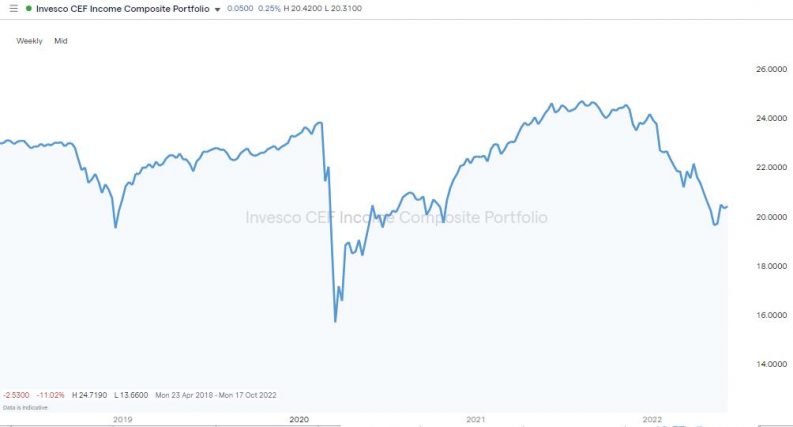

Bond investors do have to cope with the upside being capped, but sometimes, a consistent income stream is a higher priority. The Invesco CEF Income Composite Portfolio applies a variety of strategies specifically designed to make inflation-beating returns. It invests in a wide range of bonds, including investment-grade bonds and high-yield bonds. As of 6th June 2022, its 30-day SEC yield was 8.24% and 12 month distribution rate to investors was 7.80%. Both numbers are in line with the headline US rate of inflation, which for May 2022 was 8.6%.

Invesco CEF Income Composite Portfolio – Daily Price Chart – 2018 – 2022

Source: IG

Assets That Suffer During Periods of Inflation But Rebound Dramatically

The early part of 2022 saw huge sell-offs in the below sectors, which are considered underperformers during times of inflation. It is worth remembering the nature of markets and their habit of overshooting. While they might not be immediate targets, they are worth having on a watchlist for when the trend reverses.

Growth Stocks

Stocks can rebound in dramatic style and getting in early to a new bull run can result in substantial long-term gains. It’s also worth noting that stock prices tend to adjust before the fundamental economic situation changes. It’s all about expectation and potential future earnings – a stock market rally can be expected to form prior to inflation being beaten.

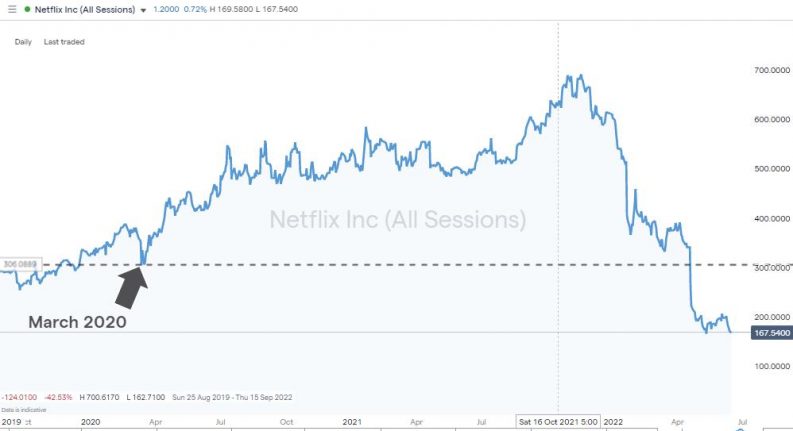

Growth stocks are high beta, which means they are prone to falling or rising in price to a greater extent than the general market. Between November 2021 and June 2022, Netflix Inc shares fell in value by more than 75%. Increased competition in the streaming market from the likes of Disney does damage the firm’s prospects, but there is an argument that the sell-off could be overdone. The stock is currently trading below where it was prior to the COVID pandemic.

Netflix Inc – Daily Price Chart – 2019 – 2022 – COVID Premium Eroded

Source: IG

A relatively safer bet is Apple Inc, which although being a long-term market darling, was, in June 2022, trading at price levels 27% below where it started the year. Given that the firm makes its big announcements of the year in Autumn, there is a potential catalyst in the pipeline, which could inspire a rebound. The Apple share price is currently sitting below the 38.2% Fibonacci Retracement level ($134.38) and a climb back above that support level or a drop to the 50% Fib ($119.67) would act as a trigger for those looking to buy the dip.

Apple Inc – Daily Price Chart – 2019 – 2022 – Fib Retracement Levels

Source: IG

Buying into either of these growth stocks is a risky proposition while the fear of inflation is spreading through the markets. But any signs of the way in which price rises might pan out would boost market sentiment. It would be worth waiting for an upwards trend to be confirmed, but there will come a time when buying the dips in growth stocks comes back with a bang.

Final Thoughts

When considering the best asset groups to invest in during inflation, it’s also worth noting that price volatility tends to pick up for all asset groups when prices are rising. This is because inflation unnerves analysts who struggle to have much confidence in their own forecasts. Inflation rates are hard to make a reliable call on, and an investor who thinks it will be 5% in 12 months’ time will have a very different view on prices than one who thinks the rate will be 15%.

That means that even relatively low-risk assets such as real estate and bonds can offer enough ‘juice’ and other assets might have whipsawing prices, making them hard to trade effectively. So, the above sectors are not only a good hedge against inflation but have a degree of risk management built-in.

Whether you are new to trading or an experienced investor, it’s important to choose a broker that offers a wide range of asset groups to trade. This shortlist of well-regulated, safe brokers has been compiled by the AskTraders team, which has reviewed the different platforms. They all offer a way to buy instruments that perform well during inflation and have competitive T&Cs and impressive research support tools as well. Inflationary markets can be challenging, but those brokers have experience in supporting their clients and helping them make a success of trading.