Chinese Electric Vehicle (EV) manufacturer Nio Inc (NYSE: NIO) is listed on the New York Stock Exchange and, from a trading and investing perspective, has something for everybody. For a comprehensive Nio stock forecast, read on.

YOUR CAPITAL IS AT RISK

While short-term strategies can benefit from its volatility, longer-term strategies can also buy into the Nio play, with the stock considered a growth stock and a target for many looking to invest in a seismic change in how the world operates. A look under the hood confirms nothing is guaranteed with Nio.

Table of contents

Who is Nio?

Nio shares are listed on the New York Stock Exchange under the ticker NIO. The firm’s IPO on the NYSE was in September 2018 at a launch price of $6.00. However, its market cap has swung around dramatically in the last few years. Both optimism and pessimism may or may not be unfounded, but the stock has struggled recently.

Nio was founded in 2014, and the design of its vehicle models is very consumer-focused, with the company’s stated aim being “to give you a new definition of car ownership experience” (source: Nio). To meet that target, it has set up offices around the world, but production is based in China.

The firm also boasts some neat and unique EV features, such as the ability to switch depleted batteries at a service station rather than wait for them to charge. Demand for Nio EVs is strong, and the business is consistently satisfying the needs of buyers as it manages to scale up production.

Nio also boasts a product range that includes sports cars and SUVs. A Nio stock forecast for the next five years is incredibly hard to put together, and in fact, one for the next year would be difficult because Nio’s share price has something of a ‘meme stock’ feel about it. It’s a go-to market for millions of investors with a speculatory approach. To some extent, the share price and fundamentals are disconnected, with the subsequent question being, ‘To what extent?’

Current NIO Share Price

YOUR CAPITAL IS AT RISK

Where Will Nio’s Stock Price Be at The End of 2023?

Nio shares have been impacted by rising interest rates and a slowing economy, as well as supply chain challenges. Nio, like many other automotive manufacturers, fell victim to the short supply of semiconductors, weighing on its share price. However, a recent move by the company to cut prices has provided it with some relief in the near term.

Nio’s share price may be subject to speculative positions from traders looking to trade a volatile market, but company valuations, and with that, Nio’s stock forecast, are largely based on projected future earnings. With the price cuts set to come into play, we could see NIO’s shares ease some pressure on investors in anticipation of a sales boost.

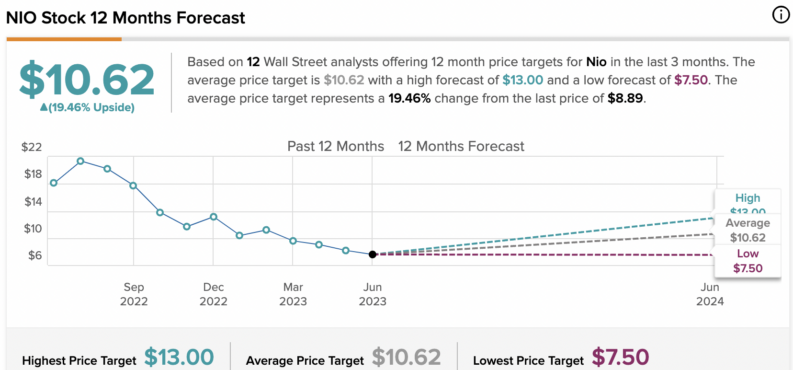

According to TipRanks, at the time of writing, the average 12-month price target based on 12 Wall Street analysts' expectations is $10.62.

YOUR CAPITAL IS AT RISK

Nio Long-Term Stock Forecast

From a long-term perspective, Nio has enough about it to help it stand out from the crowd. The battery-switching functionality is an attractive feature, even though it will no longer be free. When the global economy begins to improve, Nio should be in a good position to develop market share.

Of course, there is the added benefit that the rising tide will lift all EV manufacturers.

Nio Share Price

However, there are risks. With electric vehicles moving towards becoming the norm by 2030, pioneers like Nio will face and are facing significant competition from traditional manufacturers.

The Nio stock price is a bet on the possibility that the firm will become one of the major winners of the new way of doing things.

YOUR CAPITAL IS AT RISK

While Nio currently has a strong foothold in the market, making it a solid investment for anyone looking to add an EV stock to their portfolio, there is the risk that competitors mimic Nio’s battery swap or even introduce new innovative ideas that leap-frog it.

Over a period of five years, it should become clear which school of thought comes out on top. Will it be the bean counters who are giving weight to sales numbers and earnings data or those backing a dynamic firm in a sector that has potential for growth not found elsewhere?

Is Nio a Good Buy?

There are a lot of good reasons for the interest in Nio stock, but is Nio a buy or sell?

As we know, in the last 12 months, it has been a firm sell, but many see it offering a lot of upside potential and view the company as a key player in an exciting new sector.

There are external and internal threats to the firm, and given its current valuation, some may consider it oversold, although there are still analysts and investors that see it moving lower.

Timing is everything, and long-term investors might want to make the most of the actions of the speculators influencing the stock price in the short term. The price swings generated by that group provide long-term investors with opportunities, and given the slide, many view the stock as attractive at current levels.

The Best Brokers to Trade Nio Stocks:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to add some Nio stocks to your portfolio you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.