Whether an individual’s decision to invest in a Fairtrade firm is based on ethical or financial priorities, the net result is the same. Ethical investing is gaining momentum and catching trends early is a great opportunity to make returns on capital. A decision to buy shares in a Fairtrade company can be good for the head as well as the heart.

The History of Fairtrade

Fairtrade is a certification system that aims to ensure that ethically oriented standards are met during the manufacture and supply of a product or ingredient. Farmers’ and workers’ rights, pay, and working conditions are among the factors considered. This means that consumers of Fairtrade-registered products can take comfort from them being high quality and ethically produced.

The move towards Fairtrade practices grew up in different areas of the world. The World Fair Trade Organization (WFTO) has been operating for more than 60 years and monitors in excess of 1 million small-scale producers and workers. The organisation’s network includes “3,000 grassroots organisations and their umbrella structures in over 70 countries” (source: WFTO). The Fairtrade Foundation (Fairtrade.org.uk) was established in 1992 and has supported more than 1.9 million farmers and workers who are members of their Fairtrade-certified producer organisations.

One of the central principles of Fairtrade’s model is the so-called ‘premium’ above the minimum price that companies must pay farmers for their produce. The additional funds that cooperatives receive must be used to build schools, or run clinics, or improve their communities in other ways.

The Growth of Fairtrade

With ethical concerns increasingly important, some of the facts about Fairtrade might at first glance be surprising. The Fairtrade branding systems have in recent years lost some of their cornerstone participants. In 2016, the UK’s biggest chocolate brand, Cadbury’s (NASDAQ: MDLZ), announced that it was moving away from using Fairtrade accreditation on its products, instead opting for an in-house Cocoa Life rubberstamp. UK grocer Sainsbury’s (Ticker: SBRY) holds the position of the world’s largest retailer of Fairtrade goods, but it has also moved some products such as own-brand tea away from being Fairtrade accredited.

This shouldn’t be seen as an abandonment of the principles of Fairtrade, but more of a reorganisation of the processes as the movement evolves. When scaling back its commitment to Fairtrade, Sainsbury’s explained that it wanted a firmer commitment to the ‘premium’ paid to cooperatives being used effectively and as intended. One of the Fairtrade facts that the company can still point to is that it has been selling Fairtrade-licensed products since 1994, and in 2014/15, SBRY Fairtrade sales increased to £293m.

How Can You Invest In Fairtrade Firms?

It isn’t possible to invest in Fairtrade organisations themselves – as a registered charity, the Fairtrade Foundation, for example, relies on donations and income from corporate partners. Around 2,400 companies, including multinational giants such as Tesco (LSE: TSCO) and Marks & Spencer (LSE: MKS), pay licence fees to their national Fairtrade organisation to use the mark on their products. However, while 93% of UK shoppers recognise the Fairtrade mark, those branded products make up a small percentage of each firm’s total sales. For ethical consumers, and investors looking to target ethical stocks, a commitment by a company to Fairtrade business practices is seen as an indication that a firm is heading in the right direction.

One of the criticisms of Fairtrade is that the administrative costs associated with operating the scheme eat into the income of the farmers it is intended to help. Those costs also eat into the margins of the firms that sell the products, so by stocking Fairtrade products, the likes of Tesco, Marks & Spencer and Sainsbury’s are taking a financial hit in exchange for an ethical gain.

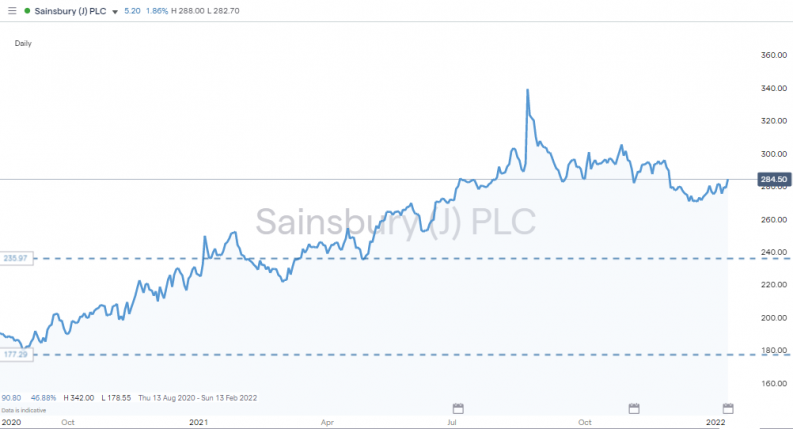

The below share price chart of Sainsbury’s shows that the extra cost associated with Fairtrade products doesn’t necessarily mean that investors or consumers lose out.

Sainsbury’s Share Price Chart – August 2020-January 2021

Source: IG

This report provides further analysis of the prospects of the UK’s second-largest grocer and information on how to buy Sainsbury’s shares.

Why Is Fairtrade Important?

From an investor standpoint, the Fairtrade movement is best used as an indicator of which way the ethical investment movement is heading. The 25 years plus track record of the organisations means that they are well-positioned to give investors a steer on what issues are being prioritised at a grassroots level. Fairtrade’s role in the move to better business practices has been complemented and to some extent superseded by a range of other ethical initiatives.

Fairtrade & CSR Policies

Large firms have got on board with low-carbon, happy workforce and eco-friendly initiatives, and operate corporate social responsibility (CSR) departments that monitor their day-to-day practices. CSR policies have ballooned in size and now encompass a range of different issues, ranging from carbon footprints to community outreach programmes. These reports are not standardised, and each firm applies its own criteria to what metrics are used. This means that firms can choose to show their operations in the best light possible, but they can be hundreds of pages long and offer a granular breakdown of operations.

Fairtrade & Ethical (ESG) Investing

Environmental, social and governance (ESG) criteria are another set of standards applied to a company’s operations. Socially conscious investors use ESG standards to screen potential investments, and as a result, a market has grown up offering ESG products.

It’s not just retail investors who are applying the approach when deciding whether to buy a particular stock. Institutional investment firms have created sizeable funds with mandates to invest in ESG firms only. They carry out extensive due diligence on potential targets, so do a lot of the legwork for retail investors who want to invest ethically but don’t have the time to work through the piles of paperwork that each firm generates on the topic.

This list of the best ethical investment funds considers some of the best bets for combining the joint aims of making a difference and making a return. Over the 10-year period between 2008 and 2018, many ethical investment funds outperformed the FTSE All-Share index. The Eden Tree UK Equity Growth Fund generated a return of 205% for its investors.

Summary

The shift towards ethical investment continues to gain momentum, and if that continues, more investor cash will move into the sector and market forces dictate that buying activity drives up prices. Fairtrade is an important part of the jigsaw. It was operating long before big corporations started producing CSR reports, and new ESG products can trace their history back to Fairtrade organisations influencing consumers and manufacturers. The sector has matured, and Fairtrade considerations might not be the most important element of an ethical investment decision, but as a non-profit organisation, it still maintains a place as an independent guardian of consumer opinion. As a result, Fairtrade practices still play a role as a leading indicator of future trends.