Switzerland, known for its world-renowned chocolates, is also home to some of the best-performing companies in the world. Some of these companies are publicly listed, whether in the US, their home country, or both. In addition, the best Swiss stocks listed below all pay dividends once per year, as is the general theme amongst Swiss dividend stocks.

YOUR CAPITAL IS AT RISK

In this article, we will explore five of the best Swiss stocks to watch, covering a variety of sectors and industries. The names here may not be the most glamorous performers from a growth perspective, but as dividend payers, there is a strong history of providing shareholder value, and of stable operational delivery.

Swiss Index SMI Chart

Best Swiss Stocks Overview

- UBS – a prominent investment bank and financial services company

- Novartis – a global pharmaceutical powerhouse

- Nestle – a consumer goods giant with many well-known brands

- Roche – one of the world's largest biotech companies

- Richemont – a luxury goods holding company

Best Swiss Stocks

UBS

UBS Group is a prominent investment bank and financial services company based in Switzerland. The company operates through four main business divisions: Global Wealth Management, Personal & Corporate Banking, Asset Management, and Investment Bank, offering a comprehensive range of financial services. UBS is well-known for its expertise in wealth management, investment banking, and asset management.

UBS typically pays a dividend once per year, making it slightly attractive for income-focused investors. While the bank faces challenges related to regulatory changes, market volatility, and technological disruption, it also stands to benefit from global economic growth and emerging market opportunities, making it an attractive consideration for investors seeking exposure to Swiss stocks.

UBS Group Stock Price Chart

Novartis

Novartis is a global pharmaceutical powerhouse specialising in the research, development, and manufacturing of innovative drugs. The company has a diverse portfolio of products, ranging from prescription medicines to generics and biosimilars. Novartis' strong research capabilities and strategic acquisitions make it a key player in the pharmaceutical industry.

Novartis is also another dividend player. The company pays shareholders once per year and recently increased its dividend for the 27th consecutive year. Trading under ticker symbol NOVN, Novartis share price has showed a period of slow but consistent appreciation over the past 5 years. Dividends would need to factored into the equation here on a value perspective.

Novartis Stock Price Chart

Nestle

Fast-moving consumer goods giant Nestlé is a food and beverage conglomerate and one of the most well-known Swiss companies. The company has a diverse portfolio of extremely well-recognised brands, including KitKat, Nescafé, Cheerios, Coffee Mate, Häagen-Dazs, Nespresso, and many, many more. The company has consistently delivered strong financial performance due to its focus on innovation, sustainability, and consumer trends, which positions it for long-term growth. Nestle also has a track record of once-per-year dividend payments, which have consistently grown over the years.

Nestle shares trade under the ticker symbol NESN and have struggled to break into positive territory when looking out at the stock over the past few years.

Nestle Stock Price Chart

Roche

Roche is one of the world's largest biotech companies. The Basel-headquartered company operates under its pharmaceuticals and diagnostics divisions. Roche is a powerhouse in the healthcare industry, known for its advancements in healthcare, particularly in the fields of oncology and immunology. Roche's strong pipeline of innovative drugs and diagnostic tests makes it an attractive investment for those looking to capitalise on the growing healthcare market.

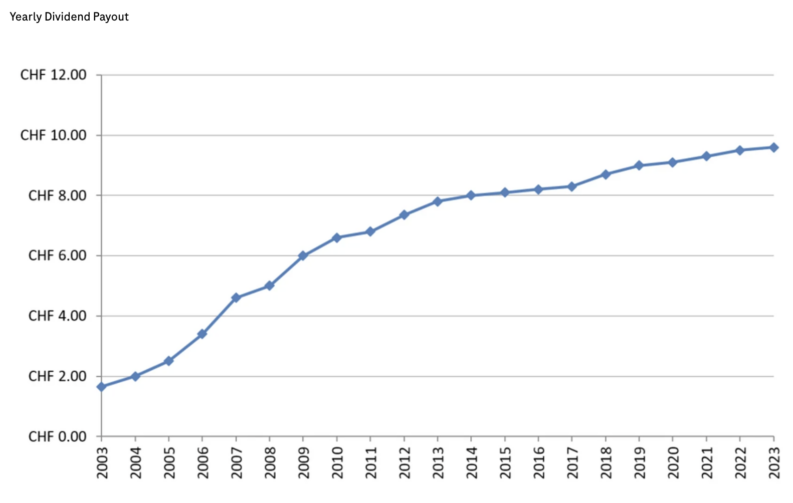

Roche's yearly dividend payouts have continued to grow over the years, although the rise has begun to slow recently.

Roche Stock Price Chart

Richemont

Compagnie Financière Richemont S.A., otherwise known as Richemont, is a Swiss luxury goods holding company focused on jewelry, watches, fashion, and accessories. Its portfolio includes prestigious brands such as Cartier, Van Cleef & Arpels, IWC Schaffhausen, Purdey, Chloe, Piaget and Montblanc. Over the years, Richemont has strategically expanded through notable acquisitions.

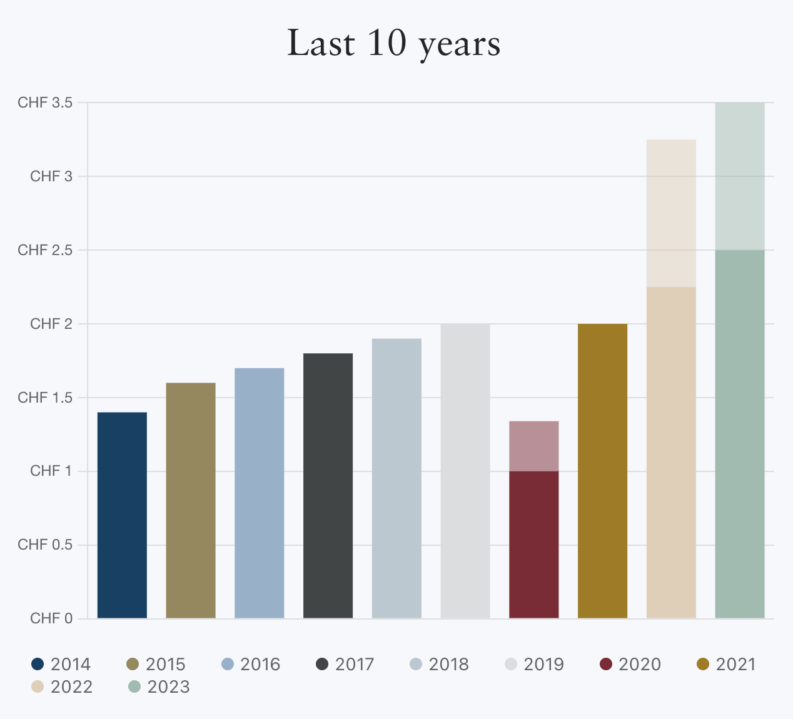

Richemont, like the other names on this list, has a history of providing annual dividends, which have consistently grown over the last four years.

Richemont Stock Price Chart

Largest Swiss Stocks By Market-Cap

Why Buy Swiss Stocks?

Over the years, the Swiss stock market has demonstrated solid performance. The Swiss Market Index (SMI) has shown resilience even during periods of economic uncertainty, reflecting the stability of the Swiss economy and the quality of Swiss companies. Swiss stocks are often perceived as safe havens due to the country's history of being economically stable.

As a result, investing in Swiss stocks can be a rewarding endeavour for investors seeking stability, innovation, and diversification. Switzerland's strong economy, coupled with the expertise of Swiss companies, presents attractive opportunities for long-term growth.

What to Know Before Investing in Swiss Stocks

The Swiss stock market is primarily represented by the Swiss Market Index (SMI), a blue-chip index that includes the 20 largest and most liquid stocks listed on the SIX Swiss Exchange. This index serves as a benchmark for the overall performance of the Swiss stock market.

The Swiss stock market is characterised by a mix of multinational corporations and local Swiss companies. It is known for its strong focus on quality and long-term value creation. Swiss companies are often recognised for their adherence to high governance standards and sustainable business practices.

Furthermore, several factors must be taken into account when considering Swiss stocks. For example, the company's financial performance and growth prospects must be considered. It's essential to assess the company's revenue, profitability, and cash flow to evaluate its ability to generate consistent returns over a long period of time.

Another factor to contemplate is the competitive landscape and whether the Swiss stock is able to compete not just in its own market but eventually abroad, where there may be expansion opportunities.

The Swiss stock market is relatively small compared to other global markets. This limited market size can result in lower liquidity and higher volatility, making it important for investors to exercise caution and have a long-term investment horizon.

One risk to assess is currency fluctuations. Switzerland is not part of the European Union, and its currency, the Swiss Franc (CHF), can be influenced by factors both in the EU and in its own country, such as economic conditions and geopolitical events. Currency fluctuations can impact the returns on investments for foreign investors. However, this can also work positively, as Swiss stocks have a low correlation to global equities, with the safe haven of the Swiss franc supporting valuations.