The nickel market has become a target of short-term speculators and long-term investors. On the one hand, there are extreme short-term price moves, which provide opportunities for day traders. On the other hand is the fact that explosive growth in nickel prices is being driven by the metal’s role in the booming electric vehicle (EV) market. In an effort to move away from carbon-based energy sources, the world is going electric, and the EV market alone is forecast to achieve a remarkable compound annual growth rate of 29% over the next 10 years.

YOUR CAPITAL IS AT RISK

Nickel became a hot commodity in recent years, due primarily to geopolitical tensions related to the crisis in Ukraine. Prices went asymptotic in early 2022, reaching as high as $100,000, as detailed below, but soon fell back to a steady, predictable slope. There could be more to come, and if the global economy is entering a commodity super-cycle, then this could be the start of a multi-year trend. That would be an ideal opportunity for those trading momentum strategies, but short-term noise in prices would also open the door to short-term strategies.

One way to trade the nickel market is to buy the metal itself. Trading commodity futures, exchange-traded funds (ETFs) and contracts for difference (CFDs) can involve additional financing fees and charges that rack up over time. These all eat into profits, especially if positions are held for some time. An alternative approach is to identify and buy nickel mining stocks and other nickel stocks that give exposure to various parts of the metal’s sector. This means that investors can still benefit from the booming nickel market, but do so by holding a position in stocks that are an easier-to-manage and more cost-effective asset group.

Research into the best nickel mining stocks involves using technical and fundamental analysis. There are sector-specific and broader economic issues relating to the world economy to factor into your analysis, but one bit of positive or negative press can override these details. Investing in precious metals and minerals can be high risk. Major swings in price, together with the uncertainty of mining fields in early development, can increase the risk. Industry leaders may come and go, and rankings can shift in an instant, which means that vigilant monitoring is a must.

Below, you will learn about five mining companies that analysts favour over the coming year and how investors, including those in the US, can access such stocks using a trusted broker.

Table of contents

Best Nickel-Related Stocks for 2022/23

Conservative investors, who rely upon the favourable projections for nickel demand over the next five years, may choose to invest solely in a nickel ETF. For those investors who would prefer potentially higher returns, investing directly in individual nickel-related stocks may be the way to go. If the firms have a pipeline of proven reserves or a backlog in orders, then their share prices may be more stable than more developmental-oriented firms.

Investing in mining stocks can be exciting, but they pose a higher risk factor. A company’s fortunes can abruptly change with the wind, especially when testing reports prove to be negative. There is also a long timeframe between discovery, mining, and then selling on the open market. With long timeframes, performance risk becomes overriding, even when fundamentals and technical data would seem to suggest a stable course.

For the next 12 months, these five companies warrant your consideration, if you prefer not to invest in a nickel ETF:

Valeo SA (VALE)

Brazil-based Valeo SA has been operating since 1942 and has built up a portfolio of mining assets that stretch from New Caledonia to Canada. It produces and extracts iron ore and pellets, manganese, ferroalloys, metallurgical and thermal coal, and metals such as copper, gold, silver, cobalt, precious metals and platinum. It also mines and processes nickel and is one of the world’s largest producers of the metal.

According to Deloitte’s global EV forecast, total EV sales will have, in the five years between 2020 and 2025, grown from just 2.5 million to over 11.2 million. All of those vehicles will require nickel in their batteries, which means that the scale of the Valeo nickel operation has caught the eye of investors. VALE’s Canadian operation in Sudbury, Ontario produces almost 65,000 metric tonnes of this metal, which represents a healthy supply of a key resource in a politically stable country. The operations in Brazil, New Caledonia and Indonesia may be further away from Tesla’s EV gigafactories, but in 2019 produced a staggering 800,000 tonnes of the metal.

YOUR CAPITAL IS AT RISK

Valeo is a large conglomerate based in Brazil and is presently the largest producer of nickel across the globe. Russian firms are currently dealing with sanctions, which is holding back their production efforts and global distribution. The firm has focused on this particular metal and regards it as one of its specialties.

Valeo has established a good track record over the years for being a leader in this industry sector. Its share price has, however, been on a gradual downslope due to geopolitical factors affecting the industry, but analysts consider the stock as undervalued. The rollercoaster shape presented in the chart data reflects the cyclical nature of this business. Share prices are up 18.5% YTD, and analysts see an average appreciation of 6% in 2023 with a range of -25% up to 33% on the positive side.

Valeo is headquartered in Rio de Janeiro and listed on the B3 stock exchange in São Paulo, but the American depository receipts (ADRs), which are listed on the New York Stock Exchange (NYSE), offer international and US investors the chance to buy into the stock.

Rio Tinto Group (RIO)

Rio Tinto Group is a major mining consortium that was founded back in 1873 in Spain. Jointly headquartered today in London and Melbourne, Australia, it explores, mines and processes mineral ores across the globe. RIO is the second largest of its kind in the industry and has embarked upon a long-term program focused on conserving the environment. It processes many ores and minerals, including iron ore, aluminium, copper, various other minerals, and nickel. It is one of the larger producers of nickel, a market that has witnessed wild swings of late.

YOUR CAPITAL IS AT RISK

With Rio, an investor partakes in several mineral developments with a very large company that operates primarily in Australia and Canada. It has weathered the chaos in commodity prices due to COVID-19 restrictions and appears ready to expand going forward. Share prices on the LSE have climbed from 2020 levels and recently spiked when China announced a relaxation in COVID-19 lockdowns.

Analysts on Wall Street are currently favourable regarding forecasts over the next year. Analysts who follow this stock foresee a range from -7.6% up to a high of 28.9%, with an average increase in share price of 7.4%. Rio Tinto, however, is a conservative firm, and its internal forecasts can dampen investor enthusiasm in the marketplace.

Sibanye-Stillwater Ltd (NYSE: SBSW)

Sibanye-Stillwater Ltd is a precious metals mining company that mines and processes palladium, platinum, rhodium, iridium, ruthenium, copper, chrome and nickel. Based in South Africa, it also has operations in the US, Zimbabwe, Canada and Argentina.

YOUR CAPITAL IS AT RISK

Previously known as Sibanye Gold, the firm is listed on the NYSE and its North American interests include the East Boulder and Stillwater mines located in Montana and the Columbus Metallurgical Complex, which smelts the material mined to produce PGM-rich filter cake. It also has a foothold in the recycling area of the mining sector, which ticks a box in terms of the firm fitting in with ethical investing.

Sibanye-Stillwater is in a good position to move forward in the next few years. The firm takes the view that “Precious metal prices are stabilising – outlook positive” (source: Vault). It also states that operations are back at pre-COVID-19 levels and that staff in South African mines have been vaccinated. Stock prices have risen quickly after two announcements of 5% buyback programs, but, as depicted on its chart, prices have fallen back to a level of support established back in 2021.

Analysts are generally favourable with regard to SBSW going forward. Hedge funds tend to follow this stock due to its volatility. It also has a reputation for being a good dividend payer, and its share price has doubled since 2020. Projections are positive, with a mean target of 13% growth in share price. Analysts do not see much downside in this stock, specifying a negative floor of nearly 9% but an upside potential of more than 72% in appreciation.

BHP Group (BHP)

BHP Group, also known as BHP Billiton, is a global resources and mining company with interests in a wide range of commodities such as metallurgical coal, copper, uranium, iron ore and nickel. It is the world’s largest mining company and one of the world’s largest nickel producers. It is headquartered in Melbourne, Australia but has operations around the world, and its stock is listed on the Melbourne, Johannesburg, London and New York stock exchanges.

YOUR CAPITAL IS AT RISK

According to the firm’s 2022 earnings report, it had its best year ever. BHP has been highly profitable, and as a result, hefty dividends to shareholders followed, as the management team painted a picture of strong long-term demand for its products. Share prices did dip in 2020 due to the pandemic, but from that point forward, shares prices have soared 150% from that low point.

Investors may want to be careful with their entry points with this stock, as the general feeling is that prices may subside a bit after such a successful year in 2022. As profits come in at lower levels, prices may fall, but the long-term forecast is positive. Globalisation has increased the wealth across the globe and thereby also increased the demand for the commodities that this firm produces. Analysts are currently forecasting a 10% decline in prices, but there will be a reversal at some point.

Nickel may be playing a part in making the world a greener place, but the extraction process associated with mining has historically placed mining stocks on a blacklist, or at least a greylist, for ethical investors. Sentiment has shifted and the mining of the metals needed to help the world move away from carbon is increasingly seen as a necessary evil, but BHP has gone an extra mile to placate investors with ecological concerns and ethical standards.

Haynes International Inc (HAYN)

Haynes International Inc represents another way to play the metals sector. It is a metal fabricator. Mining and producing a raw resource is one thing, but most ingots find their way into useful materials that are used across all industries. The firm’s primary competencies relate to nickel and cobalt-based alloys, which it manufactures and sells worldwide. Its products find their way into such industries as aerospace, chemical processing and industrial gas turbines.

YOUR CAPITAL IS AT RISK

The company was founded in 1912 and maintains its headquarters in Kokomo, Indiana, in the US. Since 2020, its share price performance has been stellar, almost tripling in price from its low point of that year. Its chart is similar to our previous four candidates, but its growth has been more stable and predictable, not subject to the same market vicissitudes as with mining stocks.

Investors have enjoyed a 60% return over just the past year, and analysts remain positive about future outcomes. On the low side of forecasts is growth in share prices of nearly 7%. The high side estimates reach 21% appreciation, resulting in a median forecast of 14% growth. Haynes is often rated as the highest-performing company in the metal fabrication industry, and recent results are evidence of this claim.

The shares for HAYN, however, seemed to have hit a plateau in 2022, with renewed volatility over the period. The firm has had a series of positive earnings statements, beating street estimates, which has fuelled the rapid rises. As reality set in, prices fell, but management has noted that factory utilisation and a backlog in orders are both up – good signs for more good news to follow.

How to Buy Nickel and Nickel Mining Stocks

The price of nickel and nickel mining stocks can swing around quite dramatically. A lot of the interest in the sector comes from predictions of future demand, so there is a real risk that price can move against investors. While price risk can’t be avoided, the good news is that there are ways to ensure that the broker you use to manage your account is trusted.

Recent interest in the nickel market has seen more and more brokers offer stocks relating to the industry. Increased trade volumes also result in lower commissions, tighter trading spreads and increased coverage by analysts. Improved T&Cs are good news for investors who are looking to buy nickel miners and mean that there is a wider range of brokers to choose from. That being said, rule number one in investing is to make sure that your broker can be trusted.

Choose a Broker

Trading and investing have been revolutionised by brokers setting up state-of-the-art online trading platforms that can be accessed from desktop and mobile devices. They have also made the signing-up process easier, and setting up a new account can also be done entirely online. In addition, the efficiencies brought on by new technologies have to a large extent been passed on to traders, which has made trading more cost-effective.

Some brokers specialise in providing news features and research resources, while others might lean towards offering 24/7 customer support. These are more than just nice-to-have features and can make a difference to the trading bottom line. One crucial check to make is that the brokers on your broker shortlist are safe and trustworthy.

How to Choose a Safe Broker

If you erroneously sign up with a scam broker, then you’re on track to one of the most painful trading experiences out there, to lose not only your potential profits but also your initial deposit. In an effort to protect retail investors, financial authorities have set up teams to oversee the financial markets. They also issue licenses to firms that meet certain criteria, and those brokers with appropriate rubber stamps, from Tier-1 regulators, are the ones to consider using.

The US financial regulators are a prime example of authorities that are setting the gold standard in terms of regulatory compliance. By choosing a broker that is licensed by one of the below highly regarded agencies, you are taking the first step towards trading safely.

Tier-1 US Regulators

- US Securities and Exchange Commission (SEC)

- Commodities Futures Trading Commission (CFTC)

- National Futures Association (NFA)

The exact details of what regulatory protection applies is dependent on where account holders are domiciled, so it’s important to check the small print. That being said, a broker with a number of regulatory approvals from different Tier-1 regulators is demonstrating that it is doing what it can to be considered trustworthy.

Being regulated is a big commitment for brokers, and to comply with the license terms of regulators, brokers are required to pass a series of tests. These range from demonstrating that they hold enough cash to be viable business operations, to ensuring that they keep client funds in segregated accounts. Then, there is also a need for independent audits and client protection protocols. More information on the regulatory pros and cons of different brokers can be found here.

YOUR CAPITAL IS AT RISK

Is it Possible to Trade Nickel Stocks Using a Demo Account?

With lots of new brokers to choose from, differentiating between brokers can at first glance appear a bewildering proposition. The best way to find out if a broker is a good fit for your style of trading is to set up a free demo account. These take moments to set up and offer a test drive of trading and investing, but as they use virtual funds, they are completely risk-free.

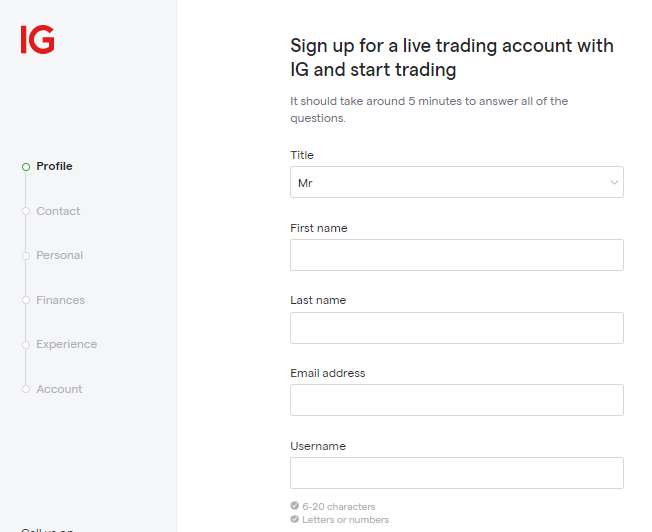

1. Open and Fund an Account

Whether you are upgrading from a demo account to a live one, or simply signing up for a live account from scratch, the process is relatively straightforward and should only take minutes to complete.

The first step involves sharing personal information so that the broker is able to identify you. This enables you to keep control of your funds and helps the broker build a profile so that it can apply client care protocols.

Once your account is set up, the next step is transferring funds to your new brokerage account. Wiring funds can be done in a variety of ways, with the simplest and fastest approach involving debit and credit cards. These are typically associated with immediate transfer of funds, whereas bank transfers can take days to process. E-payment agencies are another option, but it’s worth checking the T&Cs at different brokers to avoid paying unnecessary commissions or suffering time delays. Most brokers don’t charge any fees on cash deposits, but some do on withdrawals.

2. Open an Order Ticket and Set Your Position Size

Once your account is set up and funds have been transferred, it’s a case of locating the nickel mining stocks that your research has identified so that you can buy into them. You can do this by using the ‘search’ function or filtering by sector.

Each nickel stock will come with a dashboard, which includes price charts, latest news and company information. The process is as simple as entering the number of shares you want to buy into the appropriate data field, and clicking or tapping ‘Buy’ will convert some of your cash pile into a nickel stock position.

As stock exchanges have set trading hours, you will either need to trade while the exchange is open, or input a limit order into the system, which is a binding contract to buy a stock at a certain price, triggered when the market next opens. Getting ‘filled’ on a limit order isn’t guaranteed, but using limit orders can help to instil some discipline into a trading strategy and optimising trade entry points is a key part of maximising returns.

3. Set Your Stops and Limits

Stop-loss instructions and take-profit orders are risk-management tools built into the trading system. Investors can set levels at which they want to instruct their broker to automatically close out some, or all, of a position if price reaches a certain level.

Stop losses kick in if price moves against you and limit downside risk. Take profits work in the other direction and lock in gains should the price of your nickel stock suddenly soar.

Investing in nickel stocks can be a long-term proposition, and for that reason, some buy-and-hold investors don’t use stop-loss and take-profit orders. The argument goes that a short-term price crash move might trigger a stop loss when it would have been better to ride out the price dip.

Take-profit orders can also be viewed as putting an unnecessary cap on potential gains. The decision whether to use these instruction types comes down to strategy selection and calculations relating to risk-reward. Alternative approaches to risk management include trading in small size, diversifying your cash across a range of names, and only investing amounts of money that you can afford lose.

4. Make Your Purchase

The value of your new nickel stock position will be determined by live market prices. Progress can be monitored by accessing the Portfolio section of the platform where you can monitor the P&L (profit and loss) on trades.

The Portfolio section of your broker platform is also where you can adjust active stop-loss or take-profit orders at any time during the lifecycle of a trade. It is also the place to head when you want to sell up some or all of your position. The process for selling is a reversal of the buying process and will convert your stock back to cash with the amount determined by the closing price.

One final tip from experienced traders is to check any trades immediately after they have been executed. Human error can result in ‘buys’ being booked as ‘sells’ or incorrect amounts being entered. Remedying any such errors as soon as possible avoids the potential for massive losses being accrued.

Summary

Until the EV revolution, nickel was traditionally used in the manufacture of stainless steel, refrigerators, cookware, homeware and medical equipment, but the prospects for the metal have been completely changed by what BHP describes as ‘Electrification Mega Trends’. Wind turbines, EVs, solar panels, battery charging, EV batteries, and grid storage solutions will all require nickel, and trends in the economy are usually reflected in trends in share prices.

As recently as November 2021, Vandita Pant, BHP’s chief commercial officer, announced that the global markets will need four times the nickel and double the copper in the next 30 years to facilitate a decarbonised world. Mining bosses are expected to be bullish about their prospects, but that view is backed up by statements from the other side.

Around the time that Pant was speaking, the CEO of Trafigura, one of the world’s largest metals traders, warned of possible significant deficits for nickel as global demand rises. The main driver of increased demand is the use of nickel in EV batteries, and the boom in that market and transition away from fossil fuels appear to be trends that are locked in.

The technical and fundamental analysis tools used to spot good nickel stocks are free to use at good brokers, and most of the work associated with building a portfolio of nickel mining stocks is in the research stage. Forecasts for the long term are very positive for commodities, especially the ones produced in the mining sector, which includes nickel. The effects of globalisation will continue to drive long-term demand, as new pockets of wealth form across the globe and people demand a higher standard of living than in previous periods. Commodities are positioned especially well for this future demand.

Onboarding to a good broker is as important as making the right stock pick, but the step-by-step guide has been created by experienced traders and offers a range of guidelines designed to help the trading bottom line. For those running a buy-and-hold strategy, the post-trade experience is low-maintenance and largely involves watching, monitoring and managing positions, and potentially a degree of patience.