Palladium is a rare precious metal that is traded on global commodity markets . The metal is categorised as a precious metal rather than a base metal, but it is used in industrial manufacturing processes as well as being held as a store of value or as jewellery, and many make the choice to invest in palladium. In this guide, we’re going to take a look at the following:

- What is palladium?

- Who buys palladium?

- How to invest in palladium

- How you can get started trading palladium

- Distinctive features of the commodities markets

- Metal trading strategies and tips

What is Palladium?

Palladium is one of the four major precious metals. It is rarer than platinum, gold and silver. Global deposits are centred in South Africa and Russia, with both countries being notorious for keeping the exact size of their reserves secret as this helps them influence the market price. South Africa currently accounts for 40% of global mining activity in the metal and Russia 25% to 30%.

Discovered in 1803, the metal began to be used more widely in jewellery in the 1920s. Palladium is categorised as a member of the platinum group metals (PGMs), and as it is highly unreactive, it is a useful material to use in certain industrial processes. More than half of global production is used in catalytic converters of automobiles, where its relatively low boiling point and density make it an ideal material for reducing emissions made by carbon-fuelled vehicles.

Europe (including Russia) was the world’s largest producer of palladium in 2020, with a total production of 88.3 metric tons. Africa, the world’s largest palladium-producing region in 2019, came in second place in 2020 with 79.2 metric tons produced. This compares to approximately 3,200 metric tons of gold being produced during the same period. The four main precious metals are:

Palladium is actively traded on futures exchanges, via contracts for differences (CFDs), exchange-traded funds (ETFs), and over-the-counter (OTC) products. It can also be purchased in physical form. Demand for palladium comes from two main sources: those who require the metal as part of their manufacturing process and others who speculate on price moves or consider it a safe-haven asset.

Palladium Daily Price Chart – May 2019 to March 2022

Source: IG

Who Buys Palladium?

A variety of institutions buy and trade palladium, including:

- Commercial and investment banks

- Investment funds

- Retail traders

- Corporate producers

- Corporate consumers

- Retail operations

The palladium trading activity carried out by commercial and investment banks is generally on behalf of corporate clients.

Palladium trades made by investment funds and retail traders are generally speculative and purely looking to benefit from moves in palladium prices.

Palladium’s use in sectors ranging from auto manufacturers to dentistry means that a range of corporate producers, corporate consumers and retail operations buy the metal.

Although palladium is a rare and precious metal, it is not held by central banks as a store of value. The metal is not recognised by the international banking system and central banking community as a monetary reserve asset. Any inventories held by governments are due to the metal’s position as a strategic asset and not accounted for as official reserves.

How to Invest in Palladium

There are several ways to trade metals:

- Physical bars, bullion, jewellery and coins

- Futures contracts using online brokers

- ETFs using online brokers

- Metals market CFDs using online brokers

- Buying shares in palladium mining companies

- OTC

OTC Trading in Palladium

The OTC market in palladium occurs when two banks, or banks and their clients, trade the metal directly between themselves. The trading activity is generally customised so that the metal is delivered at a specific date in the future. This forms a large percentage of total trade volumes and largely relates to the metal being mined and distributed to buyers who will use it as part of their day-to-day business operations.

CFDs

A CFD contract is an agreement between a broker and a client. Each party agrees to pay the other according to how the price of palladium moves between the opening and closing price of a trade. The ‘contract’ is for the ‘difference’ between those two prices.

As CFDs are essentially an agreement between two parties, the T&Cs can be relatively flexible, and this results in CFD brokers being able to offer leverage and the ability to sell short. This added functionality and the user-friendly way that online broker platforms are set up make CFDs an ideal way for retail investors to gain exposure to the palladium market.

Once your account is set up, it can be used to buy or sell palladium. It is important to check that your broker is one of the firms on this list of trusted brokers as profitable trades only get paid out if the broker is in a position to be able to do so.

Futures Contracts

Palladium futures traded on a specialist exchange such as the Chicago Mercantile Exchange (CME) were designed for the industrial users of palladium to be able to take physical delivery of the metal. They buy a futures contract, which guarantees that an amount of the metal will be delivered on a predetermined date. Having a truck turn up at your door with an amount of palladium is ideal if you’re an auto manufacturer, but not if you’re a retail investor who just thought that the price would go up.

The CME does, therefore, also offer a financial version of palladium futures contracts that don’t involve physical delivery. It’s important to check the T&Cs on any futures trades, and even the financial version needs to be ‘rolled’ if you’re holding the position for more than a couple of months. Rolling futures involves trading out of near-dated futures, which are expiring, and into longer-dated futures. It requires a greater degree of trade management, incurs additional costs, and there are certain aspects of futures contracts pricing models that are quite technical.

Anyone using leverage on their CME futures trades should note that the exchange can, at its discretion, ask investors for additional deposits, known as initial margin. If market volatility picks up and you don’t have the extra funds needed to meet the margin call, then you’ll be forced to liquidate some, or all, of your palladium futures position.

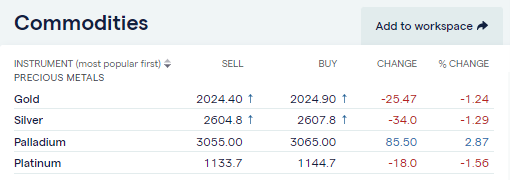

How You Can Invest in Palladium

Given the convenience and enhanced functionality of CFDs, they are a popular choice for beginners. Most brokers offer a range of different commodity markets, so it’s possible to trade palladium, other precious metals, base metals, energy markets and soft commodities such as wheat all from the same account.

Source: IG

Another benefit of using CFDs is that it’s possible to find a regulated broker that offers them. Good online brokers that are regulated by Tier-1 financial authorities offer additional features relating to client security.

Tier-1 US Regulators

- US Securities and Exchange Commission (SEC)

- Commodity Futures Trading Commission (CFTC)

- National Futures Association (NFA)

- Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

Online CFD broker platforms take great pride in offering a user-friendly way to trade the markets. Opening an account takes a matter of minutes, and account administration, trade execution and portfolio management can all be carried out using a desktop or mobile device. Trading and managing your trades can be done from a desktop or mobile device, meaning that you can trade from nearly anywhere using little more than a click of a mouse or a tap of a screen.

Distinctive Features of the Commodities Markets

If you’re looking to make money from palladium trading, there are certain aspects of the market that are worth factoring in.

Different Demands

The underlying factors driving the price of palladium are quite different in nature. The main determinant is the metal’s use in industrial production. However, its use as a store of value also influences price. These two price drivers aren’t correlated, so they could sometimes be operating in the same direction or at other times against each other. Speculators also play a role, and if they identify that a price change is likely, then the additional trading activity from this group of short-term traders can add to the momentum of the move.

Palladium Daily Price Chart – July 2021 to March 2022

Source: IG

Consideration also needs to be given to the different time-frames of the key price movers. The move away from carbon-fuelled vehicles and towards EVs is likely to provide long-term downward pressure on the price of palladium, but global geopolitical risk events such as the Russia-Ukraine conflict can trigger immediate price shocks. In March 2022, due to concerns about Russian palladium supplies, the price of palladium sky-rocketed from $2,360 to $3,149 in the space of nine days, a +30% price increase.

Price Volatility

Precious metals are seen as safe-haven assets, and if market sentiment takes a downturn, then gold, silver, platinum and palladium are often targeted by investors who want to move out of riskier assets. The palladium market is, though, relatively small in size compared to the global equity, forex or bond markets. An institutional investor that liquidates $100m of equity positions and buys $100m of palladium would see the second trade move market price to a greater extent than the first one did. The small-scale setup of the market attracts day traders and speculative traders, and the additional trading activity of those groups can take price volatility to higher levels.

The below price chart shows the price of palladium falling by 48% in the space of 21 trading sessions in March 2020, and then rallying by +70% between 16th January and 11th March 2022.

Palladium One-Hour Price Chart – 22nd February to 7th March 2022

Source: IG

Supply Issues

The time taken to identify palladium deposits and bring them into production is estimated to be at least 10 years. This means that any short-term increases in demand can’t realistically be met by an increase in supply. Instead, such events are reflected in the market price, which surges as buyers rush to buy whatever palladium is available.

Another distinctive characteristic of the palladium market is the approach of certain countries towards declaring their known reserves. Downplaying the size of its stocks helps support market price and so encourages a lack of transparency, and this can lead to price instability.

Base Currency

Traders and investors who live in countries where the US dollar is not their base currency also need to factor in currency exposure. Like most other commodities, palladium is priced in USD, which means that if the dollar price of the metal increases by 5% but the forex conversion rate falls by 5%, then the net gain on a trade will be zero.

Palladium Trading Strategies

Different trading techniques can be used in the palladium market. Some traders specialise in one approach, while others use a combination of indicators. It is important to establish the market conditions before opting for a particular strategy. For example, times, when palladium adopts a sideways trading pattern, would favour scalping-style strategies rather than trend-following ones.

Fundamental Analysis

Fundamental analysis considers the core economic determinants of demand for palladium. The global move away from automakers producing petrol and diesel vehicles, for example, has the potential to severely impact demand from that sector because EVs don’t require catalytic converters.

Shock news events also come into play. When the COVID-19 pandemic caused global economic activity to grind to a halt in 2020, demand for palladium dropped off the edge of a cliff, and price soon followed. Between 26th February and 18th March 2022, the price of palladium crashed by more than 45%.

Technical Analysis

Technical analysis uses price data to identify trade entry and exit points. Used in conjunction with fundamental analysis, technical analysis can offer clues not only on which direction price is heading, but also when to pull the trigger on a trade.

Palladium Daily Price Chart – October 2020 to March 2022

Source: IG

Between October 2020 and March 2022, the 20-day simple moving average (SMA) proved a reliable guide to price moves in both bearish and bullish markets. During the times of falling prices, it offered resistance to further upward movement. During the upward trend, it offered support and marked places where bullish investors could ‘buy the dip’.

Momentum Trading

Prices in metals markets are known for forming long-term trends. A commodity super-cycle can be a multi-year event, and identifying the underlying direction of the market can result in substantial returns to investors. Strategies that aim to establish market sentiment and identify trading opportunities include trendline strategies, volume trading strategies and VWAP trading strategies.

Overextension

Momentum oscillators such as the relative strength index (RSI) and stochastic oscillator can offer insights on when prices are overextended. This can mean that they are ‘overbought’ or ‘oversold’ over a particular time-frame. The metrics used in the calculations can be adjusted to suit personal preference, but generally speaking, when the RSI prints a reading above 70 on a palladium price chart, price is considered to be overbought, which points to a potential downward correction and price weakness. When the RSI prints below 30, the opposite is the case and price could be due to a rebound.