Platinum is a commodity that is actively traded around the globe. The metal is categorised as a precious metal rather than a base metal but is used in industrial manufacturing and is held as a store of value. Naturally, the choice to invest in platinum has become increasingly popular. In this guide, we're going to take a look at:

- What is platinum

- Who buys platinum?

- How to invest in platinum

- How you can get started trading platinum

- Distinctive features of the commodities markets

- Metal trading strategies and tips

What Is Platinum?

Platinum is one of the four major precious metals. It's a relatively rare, naturally occurring metal, officially ‘discovered' in the 18th century. As a result, the amount of platinum that has been mined is 15 times less than gold and 150 times less than silver. Like the other precious metals, it is highly unreactive, and because it is denser and more durable than gold, it is used more widely in industrial processes.

Global production of platinum amounted to nearly 161 metric tons in 2020, which compares to approximately 3,200 metric tons of gold during the same period. About 80% of the world's platinum deposits are mined in South Africa, with other notable deposits located in Russia and North and South America. The four main precious metals are:

Platinum is actively traded on futures exchanges via contracts for difference (CFD), exchange-traded funds, and over-the-counter (OTC) products. It can also be purchased in physical form. The platinum market attracts those who require the product to use in some way and others who speculate on price moves.

Platinum is used in jewellery making, but most global demand comes from industry. The automotive industry uses the metal as a catalyst that reduces exhaust emissions. It is also used in chemical and petroleum refining and computer hard drives.

Platinum Daily Hour Price Chart – December 2018 to March 2022

Source: IG

Who Buys Platinum?

A variety of institutions buy and trade platinum, including:

- Commercial and investment banks

- Investment funds

- Retail traders

- Corporate producers

- Corporate consumers

- Retail operations

Commercial and investment banks generally enter the market on behalf of corporate clients.

Investment funds and retail traders are speculating on the future direction of platinum prices.

Corporate producers, corporate consumers and retail operations might buy and sell metals to create merchandise. Furthermore, South African policymakers are encouraging central banks to adopt the metal as a reserve asset, a trend that is yet to take off.

How to Invest in Platinum

There are several ways to trade metals:

- Physical bars, bullion, jewellery, and coins

- Futures contracts using online brokers

- Exchange-traded funds (ETFs) using online brokers

- Contracts for differences (CFDs) using online brokers

- Over-the-counter instruments (OTC)

OTC trading in platinum

Most platinum trading is carried out in the over-the-counter market. This type of trading activity generally occurs between two banks and their clients or banks and central banks. The trades are usually customised so that the metal is delivered at a specific date in the future.

Contracts for Differences (CFDs)

A CFD contract is an agreement between a broker and a client where one pays the other according to how the price of platinum moves. The contract is for the difference between the opening and closing price of the trade.

CFDs allow retail investors to gain exposure to the platinum market without having to worry about the costs and security issues surrounding physical storage of the metal or the rolling over of expiring futures contracts. They also allow for leverage and short-selling. That is because the agreement is between two parties, and as long as the broker is satisfied with your ability to meet any payment demands should the price go against you, they are happy to put on trades.

Futures Contracts

Platinum futures traded on a specialist exchange such as the Chicago Mercantile Exchange (CME) are associated with physical delivery. Markets on the CME metal exchange were developed with industrial user metals in mind, not speculators. The intention being that anyone holding platinum futures on the date they expire would be guaranteed to receive a quantity of the metal in physical form. This is ideal if you're using the metal to make catalytic converters at your auto-manufacturing plant; however, retail investors who bought the contract merely to speculate on price are left with a major headache if they forget about the T&Cs.

The CME also offers a financial version of platinum futures contracts that don't involve physical delivery. However, these have set expiry dates, so positions need to be ‘rolled' where a future with an imminent expiry date is sold, and a new position is taken in a more distant future. This can be associated with extra costs, and specific aspects of futures contracts pricing models can be pretty technical.

Anyone using leverage on their CME futures trades should note the exchange can, at its discretion, ask investors for additional deposits, known as initial margin. Changes typically come into place during periods of higher price volatility, and if investors can't meet the margin call, they are forced to liquidate some, or all, of their position.

How You Can Get Started Trading Platinum

Given CFDs' convenience and enhanced functionality, they offer a straightforward route into the metals markets. Most brokers provide a range of different commodities markets, so it's possible to trade platinum, other precious metals, base metals, energy markets and soft commodities such as wheat from the same account.

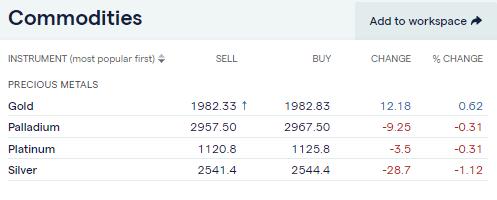

Source: IG

It's also possible to use CFD brokers regulated by tier-1 financial authorities. That means opening an account with a firm from this list of trusted brokers offers additional features relating to client security.

Tier-1 US Regulators

- The U.S. Securities and Exchange Commission (SEC)

- Commodities Futures Trading Commission (CFTC)

- National Futures Association (NFA)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

Online CFD broker platforms are designed to be user-friendly, and the process of opening an account takes a matter of minutes to complete. Account administration, trade execution and portfolio management can be carried out using desktop or mobile devices. So, entering in and out of positions takes little more than a click of a mouse or a tap on a screen.

Distinctive Features of the Commodities Markets

There are certain aspects of the market that anyone looking to get into platinum trading would do well to consider.

Different demands

The underlying factors driving the price of platinum are quite different. The primary determinant is the metal's use in industrial production, but its use as a store of value also needs to be considered. The move away from carbon-based vehicles and towards EVs will impact demand for the metal, as will investor sentiment regarding levels of global geopolitical risk. The two price drivers aren't correlated, so they could sometimes force price moves in the same direction and sometimes act against each other.

The events of March 2020 illustrate how industrial demand for platinum is the key price driver. During the COVID crisis, demand for new vehicles plummeted as the world went into lockdown. The stalling of vehicle production lines far outweighed buyers who moved into positions in the metal as a defensive move. As a result, between the middle of February and the end of March 2020, the price of platinum crashed by more than 40%.

Price volatility

Gold and silver are also seen as safe-haven assets, but those markets are relatively small in size compared to the global equity, forex or bond markets. If there is a dash for the relative security of precious metals, the price can move dramatically in a short time. This, in turn, attracts day traders, investors running short-term strategies and speculative traders.

The below price chart shows the price of platinum falling by 6.67% in the space of nine hours and then one week later rallying by 6.82% in less than three trading sessions.

Platinum 1 Hour Price Chart – 22nd February to 7th March 2022

Source: IG

Inelastic Supply

It's anticipated to take at least ten years for a mining company to identify platinum deposits and bring them into production. That means any short-term spikes in demand can't realistically be met by increasing supply levels.

Base Currency

Traders and investors who live in countries where the US dollar is not the base currency also need to factor in currency exposure. Like most other commodities, platinum is priced in US dollars, so if the dollar-price increases by 10% but the forex conversion rate falls by 10%, the net gain on a trade will be zero.

Platinum Trading Strategies

Several different techniques can be used to forecast the future direction of platinum prices. Some traders lean heavily on one approach, while others use a combination of indicators to establish which way prices will head and when they might start doing so.

Fundamental Analysis

Fundamental analysis considers the demand from both industrial customers and geopolitical risk concerning the potential supply of platinum. One major factor overhanging the demand for platinum is the potential for its use in carbon-based vehicle engines to become obsolete as the world moves towards EV-based travel.

Battery powered cars don't require catalytic convertors; that is a ‘curve ball' which needs to be considered and is bad news for the prospects for the metal. At the same time, one of the world's largest providers of platinum, Anglo American Platinum, regards platinum-containing hydrogen powered fuel cell electric vehicles (FCEVs) as a way in which platinum demand levels might hold up. AAP describes FCEVs as “an important innovation” (source: AngloAmerican). The company goes on to say that “studies show the use of zero-emission hydrogen FCEVs will increase as more stringent emissions targets drive technological change in the automotive industry. The use of platinum in FCEVs, as well as the predicted increase in vehicles using fuel cell technology, translates into increased demand for platinum by the automotive industry. This innovative technology uses a platinum catalyst and runs solely on hydrogen, emitting only water from the tailpipe” (source: AngloAmerican).

Given growing concerns about the sustainability of critical commodities used in battery production, there is clearly room for an upgrade in which technology is used to manage the switch away from carbon-based travel.

Technical Analysis

Technical analysis takes price chart data to identify key price points and uses them to extrapolate which direction price might next head. Used in conjunction with fundamental analysis, technical analysis can offer a steer on when price might turn and how far that move might go.

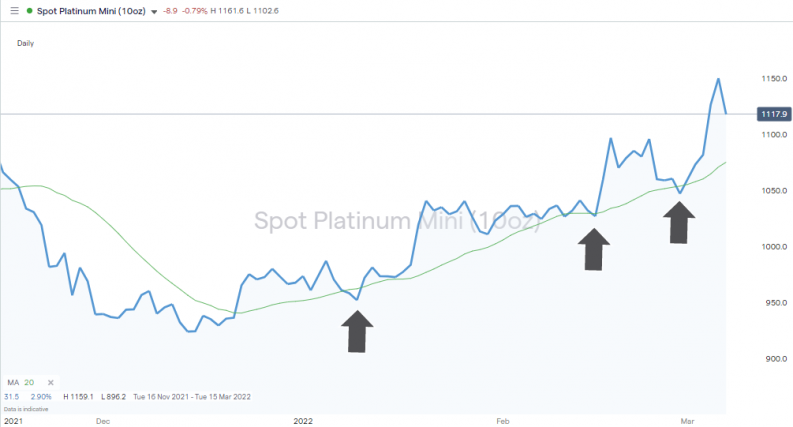

Platinum Daily Price Chart – November 2021 – March 2022

Source: IG

Between November 2021 and February 2022, the platinum price chart established a bullish price pattern of higher highs and higher lows. The dips in price which touched the 20 Day simple moving average (SMA) were associated with increased buying pressure. Using technical analysis to ‘buy the dips' can enhance returns by identifying the optimal moment to step into the market

Momentum trading

Rule 101 of successful trading is to trade with the trend. There are various ways to establish which direction markets are heading and when they might be about to turn. Strategies that aim to establish market sentiment include trendline strategies, volume trading strategies, and VWAP trading strategies.

Overextension

Momentum oscillators such as the stochastic oscillator and relative strength index (RSI) can tell you when prices are overextended. It can mean they are overbought or oversold over a particular timeframe. When the stochastic oscillator prints a reading above 80 on a platinum price chart, price is considered overbought and points to a potential downward correction and price weakness. When the fast-stochastic prints a level below 20, the price of platinum is deemed to be oversold and is due to rebound.