The price of gold has been on an upward curve for a while, but gold trading reached somewhat of a fever pitch over the last 18 months. Looking at the 5 year chart below, it is clear as day that gold has been setting new high after high, but the sheer pace of acceleration through 2024 has taken many market participants by surprise.

If you are wondering how to start trading gold yourself, then you are in the right place. We will walk you through all the basics, but before we do, let’s just take a quick moment to catch up on gold itself and why it has a place in the market.

Gold is the most liquid of all precious metals, trading around the clock across the globe. Some view gold as an investment, while others see it as jewellery. Gold has been traded for centuries, serving as both a benchmark for currency and a hard asset that is used to hedge future inflation.

Physical gold is mined throughout the world and then refined into products that can be used by consumers. The supply and demand for gold are measured monthly by the World Gold Council, which is a market development organization for the gold industry. This information, along with other fundamental and technical factors are used by traders to determine the future direction of the world’s most liquid precious metal, creating a place in the market for gold trading.

How to Trade Gold – Multiple Ways To Access The Metal

Gold is traded in number of ways, including:

- Physical trading (gold bar, coin, or bullion)

- ETFs

- CFDs

- Futures Contracts

- Gold stocks – direct or Options

Most of the gold that is transacted globally trades in the over the counter market. This type of trade generally occurs between two banks, banks and their clients or banks and central banks. The trades are generally customized for delivery at a specific date in the future.

The most common transactions are spot trades which means that delivery is two days after the transaction. Gold can also be transacted in the forward market which is delivery beyond 2 days. In this case, a gold interest rate is used to determine the future price of gold. The gold forward rate is added to the spot rate to attain a gold forward price.

ETFs, CFDs and Futures Contracts – These products emulate the price of over the counter gold prices and the liquidity is excellent. For investors that are active in the futures markets, gold can be traded through exchanges such as the Chicago Mercantile Exchange. These exchanges require a futures account at a broker that is an active clearing member.

For anyone looking to trade gold more actively, rather than taking the physical form, you can find an appropriate broker as a starting point that offers access to all other gold trading types. The good news is that it takes only a matter of minutes to open an account with a regulated online broker, the bad news is it can take some time to find the right one. We have various pages that can help you with that selection if you need it.

Setting up an account with an online broker requires some form-filling and the wiring of funds using a bank card, wire transfer, or ePayment system. Once done, buying and selling gold or gold related assets is as easy as clicking a button or tapping a screen. The platforms support traders who want to trade from their desktop or on the move using a mobile phone app. If you choose a broker that is well-regulated, you’ll be taking a step towards buying gold safely.

Physical Trading

Many traders like to trade physical gold. This involves the exchange of cash for physical bullion, bars, or coins. If you plan to engage in this activity, you need to know exactly what you are buying. Most of the physical gold that is traded is 99.99% pure.

This process works for investors who are looking to hold a tangible item at home or in a vault. Physical gold is relatively easy to buy through coin shops, but the liquidity is only fair, and it is difficult for an investor to receive transparent pricing.

For those taking a longer term view, taking the extreme scenario of the global economy going into meltdown, ease of access would be paramount. Some investors even avoid holding bullion at banks or specialist exchanges – the reasoning being that they’d still be relying on a third party to gain access to their asset.

Keeping gold at home is an improvement in terms of guaranteeing access, but that approach comes with its own obvious security issues. Choosing to buy gold jewellery can also have its downsides – gold in this form can be subject to wide bid-offer spreads due to jewellery, to some extent, involving personal taste.

Contracts for Differences

Contracts for Difference (CFDs) are a more user-friendly way for beginners to trade the price of gold. They are an agreement between a broker and their client where one of the parties pays the other according to how the price of gold moves. A contract for difference is a security that tracks the movements of another asset.

For example, a contract for difference on gold bullion tracks gold prices. If gold increases by 2%, a gold CFD will also increase by 2%. The benefits of trading a gold CFD is that you are only responsible for the difference in the price of the CFD, from the time you purchase it to the time you sell it or vice versa. You never have to own physical gold or take delivery.

Prices on CFD platforms will most likely be based on data feeds from the specialist exchanges where futures are being traded. This way, clients still get full exposure to the heart of the gold market, it’s just that the broker acts as a convenient interface.

Another feature of CFD trading is that the broker may offer leverage, which allows clients to scale up on their risk return. One potential downside of CFD trading is that there is a possibility that daily financing fees may be incurred. These can eat into profits if positions are held for a considerable period of time. Our article on the pros and cons of CFDs looks into this in more detail.

CFDs provide leverage that can enhance your returns and allow you to trade instruments for pennies on the dollar. For example, with gold trading near $2,200 per ounce, a CFD broker might allow you to purchase 1-ounce of gold for as little at $22 using 100-1 leverage.

If you buy a gold CFD at $22,000 and the price in the market goes to $22,150 then your profit will be $150. CFDs also allow you to sell short. That $22,000 trade could have been a ‘sell’ where the broker would pay the client if price fell.

Gold Futures Contracts

Futures markets allow the holder of a gold future to take delivery of the metal at a specified future date. In the build up to that expiry date, the value of the future will fluctuate as buyers and sellers take a view on what direction price.

An alternative to CFDs is gold futures contracts. The gold futures contract listed on the Chicago Mercantile Exchange is physically delivered. This means if you hold the contract beyond the delivery date you are required to take delivery of gold in a CME regulated warehouse.

Most of the gold that is traded on the CME is not taken to delivery. Most traders, exit or roll their position and never take physical delivery. The CME also offers a gold e-mini contract that is financially settled.

One of the benefits of trading futures contracts is that the futures exchanges provide margin to customers. This means that you can borrow money to leverage your position and enjoy enhanced returns.

Taking a fixed price in April 2020, the leverage on gold is approximately 18:1. This means for every $1 you post you can borrow $18 to trade. This number will fluctuate based on the volatility in the gold market. Presently the CME requires that you post $9,150 for each futures contract you trade. This compares to the $170,000 value you would hold from owning a futures contract (100 ounces * $1,700 per contract-current price as of April 2020).

Gold futures on specialist metal exchanges have traditionally been something for more experienced investors to consider, which can be considered somewhat of a disadvantage for investors new to the sector. There are certain protocols such as providing ‘initial margin’, meeting ‘margin calls’ and ‘rollovers’ to consider. However, the volume of gold traded does ensure pricing is efficient and bid-offer spreads are tight.

Leveraged Futures Contracts Returns are Robust

The CME has the right to change the leverage it will offer at any time. Changes are generally based on gold volatility. The higher the volatility the higher the initial margin which equates to lower levels of leverage.

Futures contracts are also very liquid, allowing you to enter and exit positions seamlessly. The downside of trading futures is elevated costs. You will need at least $9,150 to post the initial margin needed to buy one contract.

Trading Gold Stocks

If you’re new to investing and find stepping into the commodity markets and trading metals directly is a step too far, then it is possible to gain exposure to the gold market by buying shares of firms in the sector.

This is a tried and tested approach used by large-scale investment funds who might think the price of gold is going to rise but who have an investment mandate that forbids trading in metals. They indirectly gain exposure to the gold market by buying gold mining stocks instead.

Mining stock prices tend to be highly correlated to the price of the underlying metal that they source, extract, and process. There is potential for firms that are capable of working around the obstacles posed by inelasticity of supply. It can be possible for them to squeeze extra production out of their existing operations to do particularly well in bull markets.

Rio Tinto PLC is one such global mining giant that mines and refines gold and other metals. Rio is listed on the London Stock Exchange, which means it has to comply with rules and regulations of the exchange – designed to ensure investor interests are protected. It’s also often identified as being one of the best starter stocks for beginners.

Trading volumes in equities are huge, so the bid-offer spread on trades are tight enough to allow for cost-effective trading. If you buy stocks outright using a share dealing service, it’s also possible to avoid the financing costs associated with CFDs.

Returns from gold mining stocks can take two forms. The first relates to the fact that mining firms are also known for income stocks. Rio Tinto’s annual dividend yield is currently calculated to be 10.56%, which means investors can receive an annual return on their investment that is in excess of bank cash savings rates. At the same time, it’s possible to hope for capital gains generated by the share price going up.

A Brief History of Gold Trading

During the mid-1970s, the Bretton Woods agreement established the financial and commercial relations between major industrial countries. The countries that participated agreed they would allow their currencies to float in a marketplace.

The agreement removed gold as the standard as to which countries would benchmark their currencies. The float of currencies somewhat reduced the need for countries to hold large gold reserves and brought on the importance of new reserve currency – the US dollar.

Characteristics of the Gold Market

There are certain features of the gold market that mark it out compared to other financial instruments.

Gold Supply Is Inelastic

It’s estimated that it takes more than 10 years to get a new gold mine up and running. As a result, short-term changes in demand for gold are not easily met by efforts to increase supply. This explains why price moves can be sudden and dramatic.

Gold Price Drivers Compared to Other Precious Metals

Gold is differentiated from platinum, palladium, and silver by the extent to which demand for the gold is largely based on investors looking for a store of wealth. This is in contrast to other precious metals, which due to their unique characteristics, are used extensively in manufacturing processes. Close to half of the global platinum produced in 2020 was, for example, bought by auto manufacturers who use the metal to reduce emission levels from their vehicles.

Whereas silver, platinum and palladium are categorised as precious metals, it is gold that dominates the sector in terms of being seen as a financial instrument.

Who Produces Gold?

Gold production is diversified to a greater level than some other precious metals. In 2020, China took the top spot and was responsible for 11% of global production. The amount of gold that comes onto the market after being recycled rather than mined currently equates to 25% of total annual production. As a result, no single country dominates the production of the metal.

Who Buys Gold?

There’s an old adage in the financial markets that every investor should hold a percentage of their portfolio in gold. The thinking behind this is that gold can go up in value when certain if infrequent market conditions prevail. One twist to this strategy is that if that happens, it’s likely that all other higher risk assets will fall in value. Few would suggest going all-in on gold, but many experienced investors use it to diversify their portfolio.

Gold Price Chart – 2002 – 2022

Source: IG

Gold is seen as a form of insurance against the most dramatic of market meltdowns – those when the financial system comes under so much stress that even the viability of fiat currencies begins to be questioned. The financial crisis of 2008 was one such instance, and concern about bank defaults and the financial system resulted in gold increasing in value by 158% between March 2008 and September 2011.

Even subtle shifts in the perception of risk will trigger moves in the price of gold. As a result, certain groups of investors are known to be active in the market.

Investment Funds & Retail Investors

With billions, if not trillions of capital invested in equities, bonds, currencies and forex, large institutional investors also take positions in gold as a means of protecting themselves from any downturns in more risk-on assets.

While retail investors might not necessarily have portfolios that are the same size as the big funds, some still use gold to diversify their portfolio and hedge against risk. In 2020, 46.64% of global demand for gold was credited to being associated with investing. Other retail investors trade the commodity on a short-term basis to take advantage of the sharp price moves that can be associated with the market.

Jewellery

Demand for gold from the jewellery sector amounted to 36.83% in 2020. While there is some value added during the production process, gold as jewellery is often considered to represent demand from people investing in it as an asset.

Central Banks

Gold is recognised by the international banking system and central banking community as a monetary reserve asset. This dates back to times of the Gold Standard when fiat currency was based on a central bank’s holdings of gold. Even though the direct link between paper notes and the metal has been broken, it’s estimated that the US central bank still holds 8,133 tonnes of gold, and the International Monetary Fund (IMF) 2,814 tonnes.

Central banks have huge stores of existing gold, but ongoing demand from this group in 2020 amounted to only 8.58% of global production.

Industry

Gold is virtually indestructible and highly unreactive. As a result, it is used in industrial manufacturing processes – especially the electronics sector. In 2020 this sector made up 7.95% of the global demand for gold.

Why Trade It At All?

Gold is a commodity that has been a hard asset benchmark throughout human history. The yellow metal is sought after for jewelry, as well, as a way to build wealth. Gold is often viewed as a currency and when you trade it for future delivery the price incorporates a gold interest rate called the gold forward rate (GOFO).

Gold is held in reserve by most countries throughout the globe. Until the mid-1970’s gold was used as the benchmark for a fixed rate exchange mechanism on currencies including the US dollar. This was the case until a global agreement changed currency trading to a floating rate mechanism. Gold used to be difficult to transact, but recent developments within the capital markets have made gold trading easy and liquid.

Gold is viewed as a hard asset that can be used as a hedge against future inflation expectations. This compares to assets like bonds and stocks which provide payments from a loan or a share of future profits. Gold prices generally rise along with inflation. As a hard asset, the demand for gold increases to protect investors against the decline in the value of their currency.

Risks Associated with Gold Trading

Gold, like any asset, has risks. Whether you buy or sell gold, you are risking capital and could experience an adverse market change. Gold can fluctuate if there are geopolitical events that drive investors to the safety of gold. If a mining company cannot produce the volume of gold expected, demand might exceed supply driving the price of gold higher. Additionally, financial stress can generate strong demand for gold. During the financial crisis that commenced in early 2008 and until late 2012, the price of gold increased by more than 230%.

Gold Trading Strategies

There are several trading strategies that you can use to trade gold:

- Evaluating sentiment

- Technical indicators

- Trend following

- Momentum

- Overextended

- Fundamental analysis

You can use an active trading strategy or a passive buy and hold strategy. Many financial analysts will recommend that you passively own gold as a certain percentage of your portfolio. You can use several different types of technical strategies, along with evaluating exchange information to determine sentiment.

Evaluating Sentiment

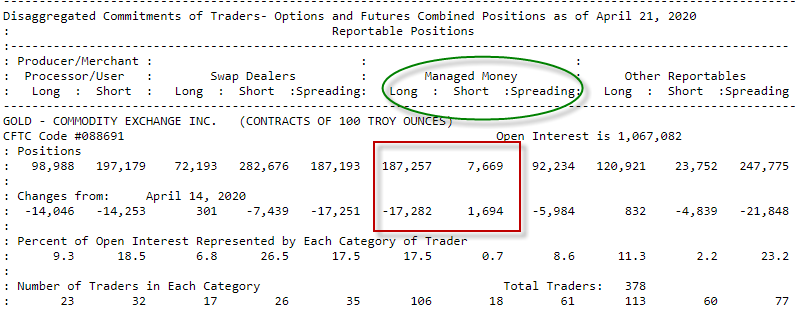

One of the best ways to determine if other trades are betting on gold is to evaluate the commitment of traders’ report, released every Friday by the Commodity Futures Trading Commission. This report will provide you with information about investor sentiment. The report shows any increases or decreases in gold futures and options contracts held by swap dealers, hedge funds, or retail traders.

Swap dealers represent producer positions, as banks generally offset their OTC swap positions with futures contracts. Managed money represents hedge funds traders. Since hedge funds are speculating, the information provided can be especially useful.

For example, the commitment of traders report shows that hedge funds reduced long positions in gold futures and options as of the date ending April 21, 2020 (red circle). The decline in long positions shows that some hedge funds are taking profits on gold.

The open interest of 187K contracts relative to the short opening interest of 7.6K contracts tells you that hedge funds are well overweight gold and if there was an adverse move lower, there would likely be a rush toward the door. The decline of 17K contracts on the latest week means that more than 204K contracts were open the previous week as hedge funds bet that gold prices go higher.

The increase in short positions (the red circle which shows an increase of 1.6K contracts) tells you that some hedge funds are betting that gold prices will decline. This report can be used as a contrarian sentiment indicator.

In addition to using sentiment analysis, you might also consider using technical analysis to trade gold actively. You can also use a gold trading chart to check the current prices and see where prices were in the past. This might help you determine the future direction of gold prices. A chart will help you determine both support and resistance levels, trends, as well as momentum. You can even determine if the recent move in the price is overextended.

Technical Indicators

Technical indicators can help you determine where prices might find support, which is levels where prices cannot penetrate lower, or resistance, where prices cannot pierce higher. For example, the 10-day moving average on the chart is likely a support level.

Trend Following

You can also use moving averages to determine a trend. A moving average is the average of a specific period. You can use any period, to create an average. When a 10-day moving average, crosses a longer-term moving average, like the 50-day moving average (depicted on the chart), a short-term uptrend is considered in place. You can use the same moving averages to find a short-term downtrend.

Momentum

An indicator like the moving average convergence divergence index describes momentum. This indicator subtracts a short-term momentum average from a longer-term moving average and compares that change in the moving average to a moving average of that change. When a MACD crossover occurs (as it does in the chart of gold prices) momentum is turning positive.

Overextended

Momentum oscillators such as the fast stochastic can tell you when prices are overextended. When the fast-stochastic prints a reading above 80, the price of gold is considered overbought and points to a potential correction. When the fast-stochastic prints a level below 20, the price of gold is considered oversold and could rebound.

Fundamental Analysis

The most common form of fundamental analysis related to gold is evaluating the value of the US dollar. Since gold is priced in US dollars it generally increases when the dollar declines and falls when the dollar is rising. This is because gold prices become more expensive in currencies other than the US dollar when the value of the US dollar climbs. To compensate for this change in value, the price of gold needs to decline.

Summary

Gold is the most liquid precious metal and is traded throughout the globe. There are several ways to buy and sell gold including using physical coins and bars, as well as purchasing and selling contracts for differences (CFDs). Additionally, you can buy and sell exchange-traded funds (ETFs) and futures contracts.

You can also use many different gold trading strategies including using sentiment and technical analysis along with a buy and hold strategy. Since gold is viewed as a hard asset, higher levels of inflation will generally increase its value. Gold is also viewed as a safe-haven asset. During periods of financial stress or geopolitical unrest, investors tend to purchase gold to protect themselves from adverse market conditions.

PEOPLE WHO READ THIS ALSO VIEWED: