What is a Limit Order?

A limit order is a type of a pending order which doesn’t get executed (which is triggered or completed) until certain pre-specified conditions are met. The most usual condition that a limit order needs to meet is the price. In this case, a limit order remains a pending order until the price hits the pre-specified level, after which the limit order becomes a market order and either buys or sells the underlying asset that is being traded or invested in.

Limit orders are used by traders and investors to both imporve trading performance and to manage their time efficiently. While traders could also wait for the price to reach a certain level before executing a market order, this wait-and-see approach is significantly more time-consuming compared to simply placing a limit order at the desired price-level. This way, traders can catch breakouts from chart patterns and trend lines or bounces off major support and resistance levels without the need to be in front of their trading platform for the price to reach the entry point. This helps not only to be more productive in trading, but can also help to improve profitability, as the limit order is able to catch the initial momentum – which is the usually large price-move – immediately after the break of a major price-level.

Here we will it look at how to sell and buy on limit to improve your trading performance.

Types of Limit Orders

1. Buy Limit

A buy limit order is a pending order that buys at the current market rate once the price reaches or goes through the pre-specified price. Buy limit orders are therefore usually used to enter trades around significant support zones. If a trader expects a certain support zone will hold, the trader would place a limit buy order at the support price. This will then automatically execute a buy market order when the price reaches the limit buy order level. This strategy can also be used in combination with other technical indicators, such as trendlines, channels, round-number supports etc.

The buy limit order is a great way to trade support zones, as the trader does not have to wait for the price to actually reach the support in order to execute a long position. By placing a buy limit order, traders save time which can be used to review other trading opportunities.

2. Sell Limit

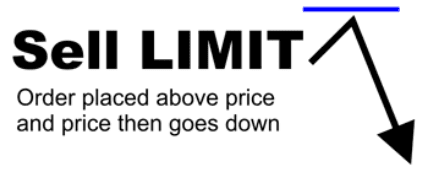

Sell limit orders are similar to buy limit orders, only that they’re used to sell at the pre-specified price. Selling at limit is therefore usually used to trade major resistance zones. If a trader or investor believes that a certain resistance zone will hold, they could place a sell limit order at the resistance price. This will then automatically execute a sell market order when the price reaches the sell limit level (at resistance).

As with buy limit orders, sell limit orders can be used in combination with technical tools to identify where major resistance levels are. By selling at limit on those levels, the trading platform will automatically execute a sell market order at the stated sell limit price.

In the case of selling at limit, the specified execution price has to be above the current market rate. This is represented here.

Both buy limits and sell limits are used when we expect the price to reverse after a certain price level is achieved. If, however, the trader believes that the price should continue in the same direction after a price level breaks, they would need to use buy stops and sell stops.

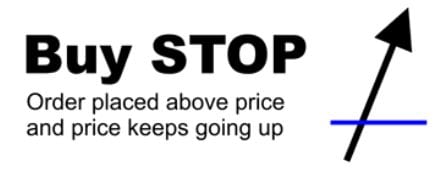

3. Buy Stop Entry

A buy stop order is a pending order that becomes a buy market order after the price reaches the pre-specified level. Unlike buy limits and sell limits which are used to catch a price-reversal, stop entry orders are used to trade in the direction of the previous price move. This means that in case of buy stops, the execution price has to be above the current market rate.

Buy stops are widely used to trade on breakouts of major chart patterns or resistance levels. Some examples of technical patterns which can be used in combination with buy stop orders are double bottoms, triangles, flags, inverse head and shoulders and rectangles.

If the investor or trader believes that the price will continue to move in the direction of the breakout, they could place a buy stop order at the desired price. This way, they don’t have to wait for the breakout to actually occur, as the buy stop order will automatically buy after the price hits its target. This concept is described by the following image.

However, traders need to be aware that stop orders, unlike limit orders, carry certain risks which will be discussed in more detail below.

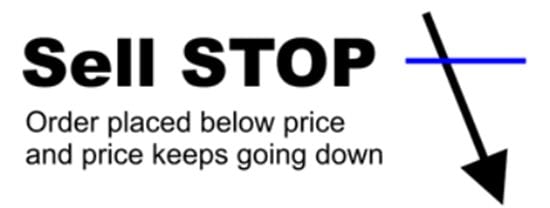

4. Sell Stop Entry

Sell stop entry orders are similar to buy stop entry orders, only they become sell market orders after the price reaches the pre-specified level. Sell stop orders can be used when a trader believes that the price will continue to fall after a certain price-level is reached and broken.

Therefore, sell stop orders return the best results when combined with breaks of major support zones and bearish continuation chart patterns, such as descending triangles, head and shoulders, bearish wedges and bearish rectangles. They can also be used in combination with candlestick patterns, which can be used to confirm whether a support level is going to hold or break.

Sell stops and buy stops are also often used to trade on major news reports which are expected to break certain support and resistance levels. Traders would look to try to catch the initial breakout momentum which can be very volatile and therefore profitable, if stop entry orders are placed at the correct levels to avoid fake breakouts from occurring.

In case of sell stop orders, the execution price has to be set below the current market price, as shown on the following image.

How to Set a Pending Order on MT4

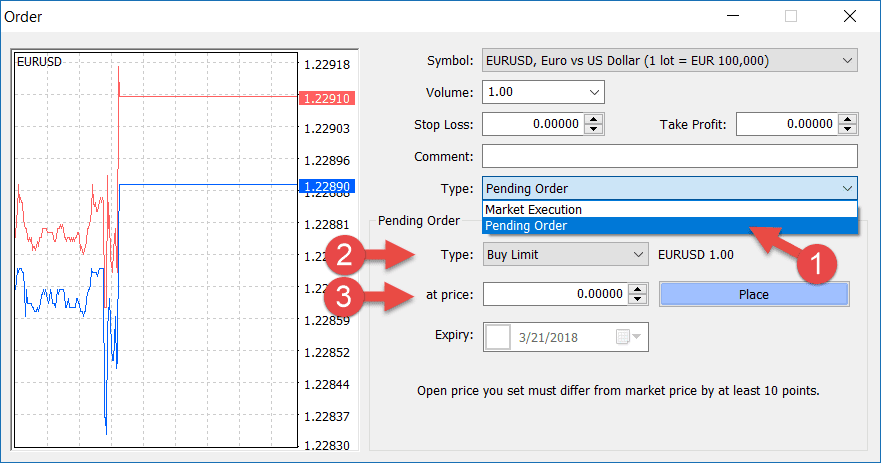

By now, we’ve answered the question of “What is a limit order”, and now it’s time to see how to place limit orders on your MetaTrader platform.

The MetaTrader 4 platform allows you to set limit orders in the “New Order” window. After selecting “Pending Order” (1), there are four types of pending orders you can select: Buy Limits, Sell Limits, Buy Stops and Sell Stops. As said earlier, the MetaTrader 5 platform expands this list and also includes Buy Limit Stops and Sell Limit Stops, which combine limit and stop orders in one order.

After you select the desired order type (2), all you have to do is to set the price at which the pending order will be executed into a market order (3). Additionally, you can also set the stop-loss and take-profit levels in advance. While this is not a prerequisite to place a limit order, you should always use stop-loss levels on all of your trades.

Finally, simply press “Place” and your limit order will remain pending until the market hits the pre-specified price.

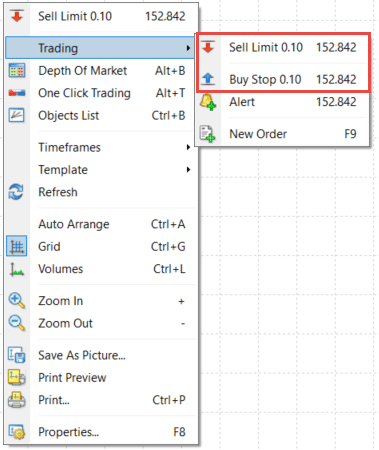

Another way to place a pending order on MT4 is to right-click directly on the price-chart and select “Trading” from the drop-down menu. It will automatically reveal the types of pending orders which can be placed on the selected price-level (“Sell Limits” and “Buy Stops” if you click above the price, and “Buy Limits” and “Sell Stops” if you click below the price).

Risks Associated with Limit and Stop Orders

There are certain risks associated with pending orders of which traders and investors need to be aware of before using them. Risks include the widening of spreads, slippage and price volatility.

a) Widening of spreads – If a pending order is placed directly on a support or resistance level, the underlying imbalance of buying and selling power which occurs at breakouts can lead to a significant widening of spreads. Wider spreads increase the trader’s transaction costs, and so these need to be factored into a trading strategy when using pending orders.

b) Slippage – This is related to the widening of spreads, as a pending order may get executed at a relatively unfavourable price. For example, if you place a buy stop at the break of a major resistance zone, there might be not enough sellers to meet the increased demand and the pending order may therefore get executed at a relatively higher price, higher than the level that was set.

c) Volatility – Volatility is another important consideration when using pending orders. Price volatility around major support/resistance zones may trigger a pending order, only to form what is known as a “fake breakout”. To prevent this from happening, don’t place a pending order directly on major price-levels.

Limit Orders and Support/Resistance Trading

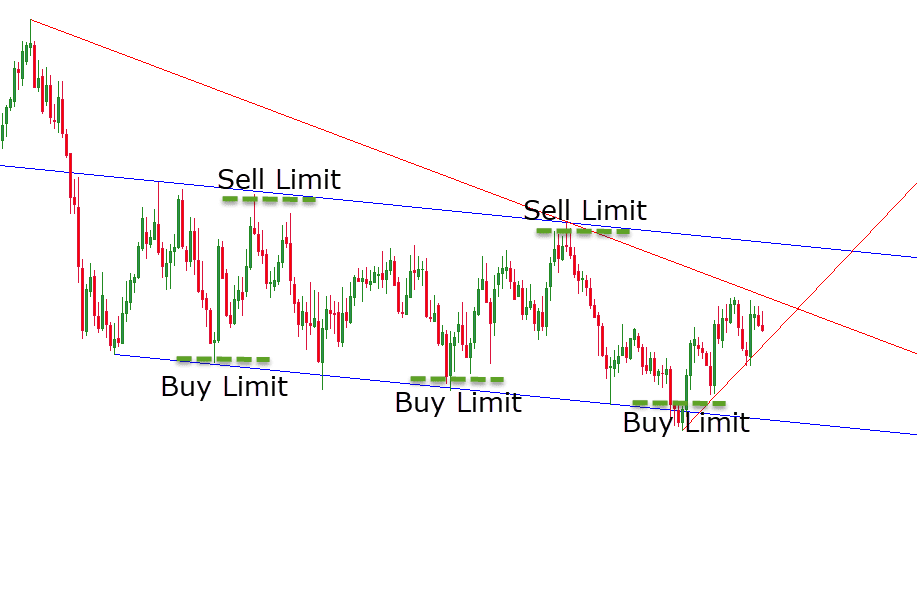

Limit orders are often used to trade the expected bounce off major support and resistance levels. By placing one on or near to price-levels where the trader or investor expects the price to reverse, it is possible to increase the chances of catching the following price-move without the need to spend hours in front of a screen. The following chart shows a possible setup of buy limit and sell limit orders placed on support and resistance zones inside a channel. However, other technical tool can be used with this strategy, such as trendlines or horizontal support/ resistance lines.

Each buy limit order becomes a buy market order after the price reaches the buy limit from above. Similarly, each sell limit order becomes a sell market order after the price reaches the sell limit from below. These pending orders allow you to catch the bounces off the channel-lines which could be otherwise missed.

Additionally, you could place stop-loss orders just below the buy limit orders and just above the sell limit orders, in order to protect your capital in case the trade goes against you. Also, by placing take-profit orders at the upper and lower channel lines, you could lock in your previous profits before the next limit order gets executed.

Summary of Limit Orders

Limit orders are types of pending orders which become regular market orders once certain conditions are met. If you believe that the price will reverse after a price-level is hit, you should use buy limit and sell limit orders. On the other hand, if you believe the price will continue in its previous direction, you should use buy stop and sell stop orders.

If used correctly, pending orders can enhance your trading performance to a large extent. However, you should be aware of the risks when using pending orders and manage them accordingly. To avoid slippage and higher transaction costs because of wider spreads, don’t place your pending orders directly on major price-levels.

Limit orders are perfect to combat the negative effects of human emotion. All traders are susceptible to emotions like fear, greed, panic and excitement. Limit orders can keep these emotions in check by providing a support and structure to our trades. By limiting the losses, they can also limit the fears.

PEOPLE WHO READ THIS ALSO VIEWED: