- Aberdeen Standard Investments has offered a forecast for 2020. Despite the calendar moving from one month, year, decade to another, there is a feeling of ‘business-as-usual’ in the markets.

- A lot of the risk factors are ‘known’ even if not mitigated and have generally been controlled though 2019.

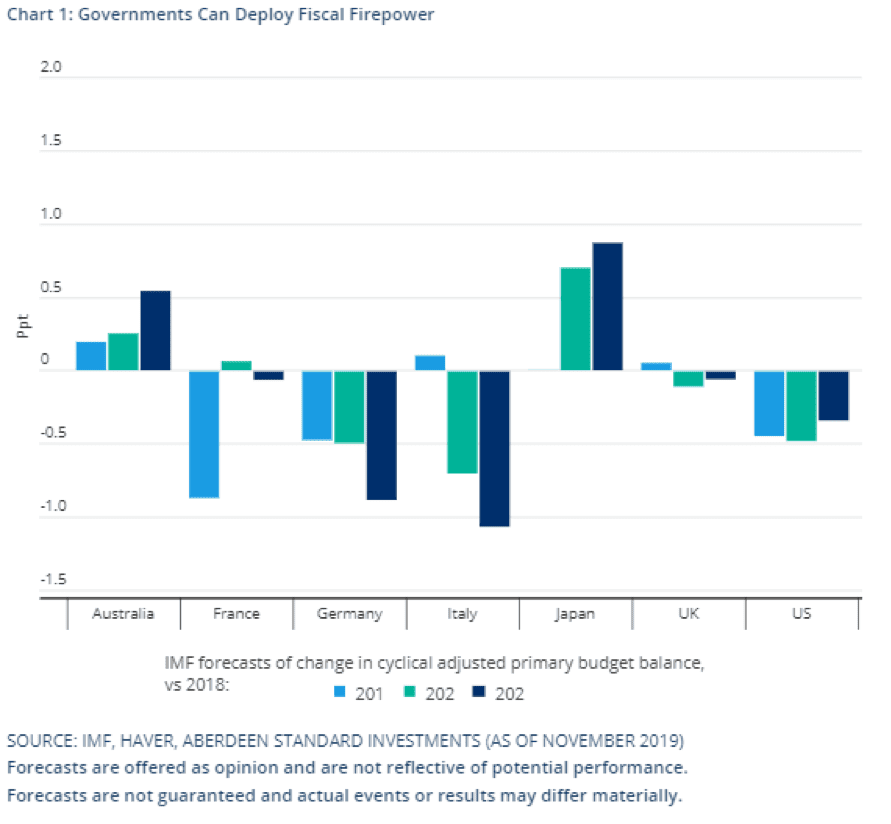

- The introduction of increased fiscal activity could be something of a game-changer.

- As governments increase spending and cut taxes, the relative strengths of monetary and fiscal policy will become apparent.

As the financial markets approach year-end, many are scaling up preparations for 2020 investment strategies. One recently released report from Aberdeen Standard Investments (ASI) offers the views of Andrew Milligan, its Head of Global Strategy. Milligan and ASI offer the argument that the coming year will bear many of the characteristics of the closing one.

It’s always prudent to remember that “past performance is no guarantee of future results.”The ASI report isn’t necessarily predicting another 30% gains in equity markets (SPX500 YTD + 29.24%) over the next 12 months — although this could be one of the ‘outlier’ results to the upside.

The more pertinent point made by the report is that 2020 may look very similar to 2019. The rolling over into the next decade holds psychological importance, but there are currently few triggers in place likely to cause any dramatic change and a lot of those risk factors are already known. The US-China trade dispute is the most important driver of the global economy and other political tensions remain. There is one new factor to consider. Fiscal stimulus looks set to be a buzz word for 2020.

Push & pull

Increased government borrowing and spending as a policy idea is benefiting from the political forces in the major economies that see the approach as increasingly attractive. There are reasons for fiscal policy being approached as ‘plan b’ — only now that monetary policy has to some extent run its course.

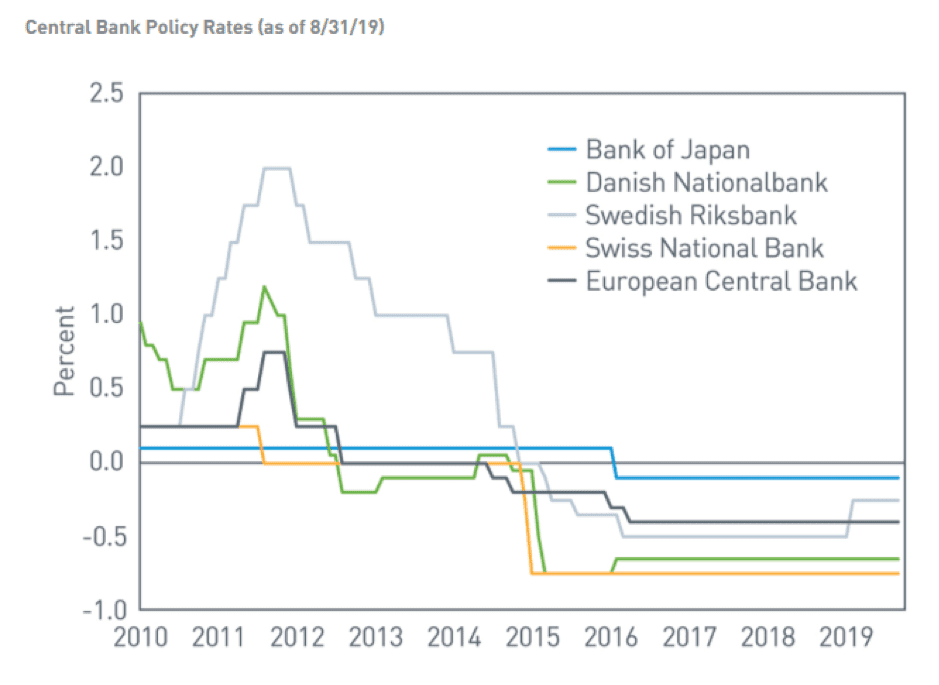

A reduction in global interest rates was seen in 2019. Some economies now operate negative rates and even those that still have positive base rates have spent the last 12 months creeping closer to zero. The US, Australia and the UK have the most room to manoeuvre, but even they are reaching a point where further cuts may not bring about the intended stimulus.

The main benefit of monetary policy is the speed with which the economy and markets react to policy adjustments. Through 2019, the financial markets have dutifully considered the ‘guidance’ and interest rate announcements provided by central bankers. Equity, fixed income and forex markets have reacted rapidly and with a degree of decorum as each bank has, in turn, shared its analysis.

The ASI report suggests how this is going to change in 2020:

“Plans are afoot for spending increases or tax cuts in China, Europe, the UK, and especially Japan (see Chart 1). The net effect may still be moderate as it takes time to boost infrastructure spending.”

Source: Aberdeen Standard Investments

It also flags up that the major weakness of fiscal policy and that possibility that its net effect could “still be moderate as it takes time to boost infrastructure spending.” (Source: Aberdeen Standard Investments)

Tax cuts also take time to filter through into changed economic behaviour. The response times of fiscal policy look glacial compared to those associated with monetary policy. In 2019, the guidance given prior to rate cuts being officially confirmed tended to be clear enough so that the markets priced in the rate changes and made gradual moves to appropriate levels, even before any rate changes were officially announced.

Overshooting

The lag between policy announcement and effect could cause some overshooting in the economy. The increased noise from jobs numbers and inflation reports would then increase the volatility of the markets in 2020. The ASI report may be correct in that there appears little reason that 2020 won’t ultimately look much like 2019. But if fiscal levers are being pulled, then there may be more radical price moves on the way. Milligan said:

“On a cyclical basis, there will undoubtedly be periods of heightened volatility in markets in the coming year… Just as in 2019, a complicated mix of economic, corporate and political signals will create short-term buying and selling opportunities.”

Source: Aberdeen Standard Investments

If the “mix of economic, corporate and political signals” (source: Aberdeen Standard Investments) carries more weight and less accuracy, then the peaks and troughs of the market will be exacerbated. An annual return of 30% might not be the most likely outcome for a buy-and-hold equity investor in 2020. But adjusting risk through the year and buying the dips could help investors maximise their returns.

Another reason there may be increased price volatility is that the markets currently show a short-term move into riskier assets, as ASI highlights:

“For much of 2019, portfolio managers were looking for diversifiers which could protect portfolios during more volatile periods.”

Source: Aberdeen Standard Investments

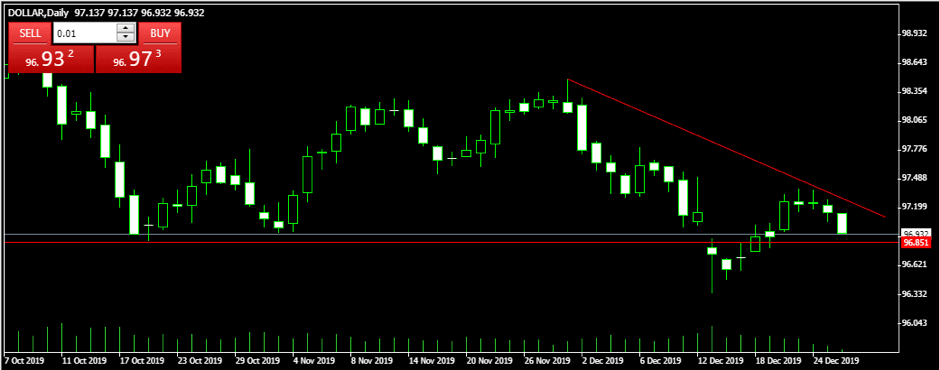

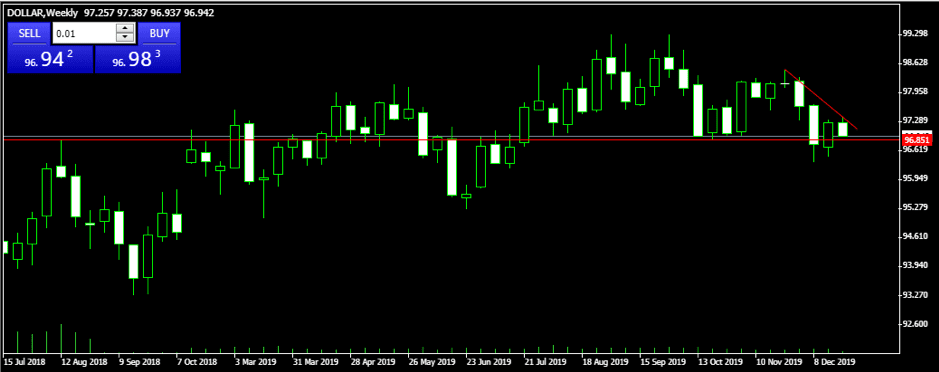

Government-backed fixed-income assets and stable currencies such as the Japanese yen, US dollar and Swiss franc saw their prices rise in 2019 as the markets maintained a degree of caution. The ASI report notes that in the run-in to the year-end funds have rotated into equities and out of ‘diversifiers.’ In historical terms, the forex markets traded through 2019 with reduced volatility and this might pick up in 2020. Yen, Swiss franc and the US dollar might be trading wider downward channels as traders look to move into riskier assets but flip-flop according to news reports.

The daily price chart of the DOLLAR index shows recent USD weakness. Support levels at 96.332 and 95.248 will be significant barriers to further downward movement, but if they should break, there is some room for further falls.

USD — DOLLAR index — daily candle, October 2019 – December 2019:

USD — DOLLAR index — weekly candle, July 2018 – December 2019:

Conclusions

If rates were higher than they currently are, and if there was capacity for banks to put through further cuts, then that would almost certainly be the approach taken. Fiscal stimulus may not be a bad ‘plan b’ to have at your disposal. However, it is a ‘plan b.’ The lag-time will be a significant driver of market volatility if, as expected, governments around the world ramp up their fiscal policy measures in 2020.