- The Saudi oil producer’s IPO is forcing a lot of market participants to step out of their comfort zone.

- The firm will be listed on the not widely used Tadawul bourse in Riyadh. Investors will face the prospect of being minority shareholders in a firm where the floated stake will represent only 1.5% of the firm’s entire value.

- Updates over the weekend suggest the price of the listing will be within the range of most analyst valuations, but leaning towards the upside.

- CNBC has reported from the streets of Riyadh to offer an insight into local sentiment and finds a lot of Saudis keen to express loyalty to the state through engagement in the IPO.

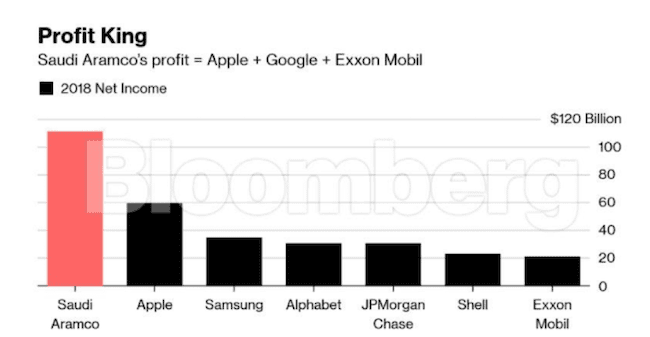

- Another selling point, more pertinent to international investors, is the incredible cash flow and profits generated by the firm.

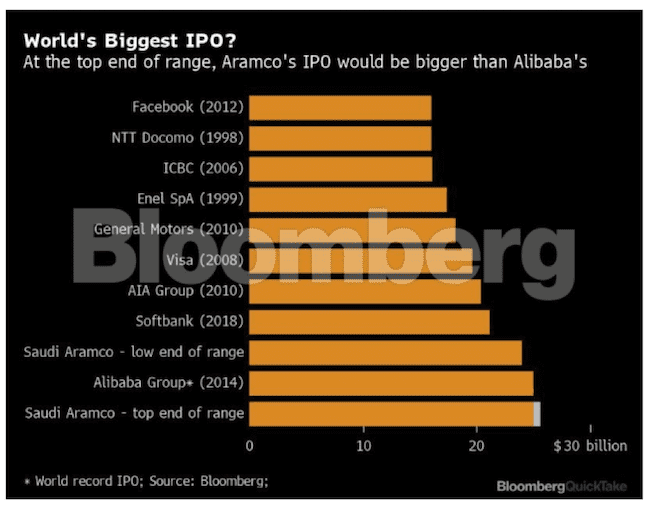

Saudi oil firm Aramco, the most profitable company in the world, looks likely to set the target price of its initial public offering (IPO) at a level that will tempt a range of global investors. Retail investors are set to be offered 0.5% of the firm’s equity and institutional investors the remainder in this first release of equity. The value of the shares on sale looks set to be somewhere in the $25bn range, which will value the entire firm near the $1.7tn mark. Put into perspective, the record for the largest stock market flotation is currently held by Alibaba (NYSE:BABA), the world’s largest retailer and e-commerce company, which placed $25bn of stock into the NYSE in 2014 and valued that firm at $231bn. Aramco might not have the cutting-edge credentials of BABA, but it does look well-positioned to generate substantial returns for its shareholders. Interestingly, the IPO may find support from investors who feel they have to, as much as they want to, be involved.

Aramco has business operations firmly founded in the Saudi kingdom. However, the shares on offer look set to catch the eye of investors across the globe. Retail broker IG is already making preparations for its clients to be able to buy and sell the new name.

News released on Sunday puts the valuation of Aramco somewhere near the $1.7tn mark. The indicative price range for the 3bn shares on offer is 30 Saudi riyals ($8.00) to 32 riyals. This puts a value on the IPO up to as much as 96bn riyals ($25.60 billion). While the Saudi Crown Prince Mohammad bin Salman bin Abdulaziz Al Saud (MBS) may have been hoping for a total valuation closer to $2tn, Reuters still considers the valuation near to the top end of the range.

Analysts have valued the company in the $1.2tn to $2.3tn range. That relatively wide range in value does itself give a clue that investors have various motivations for wanting to be involved. Many buyers will be considering a long-term investment, but with some whip-saw price action expected, there is room for bulls and bears to make profits on shorter-term trades.

Home front

CNBC reports of Sunday fleshed out the feeling in the kingdom itself. Retail investors in the Saudi kingdom appear to be overcome with a mix of enthusiasm and patriotism. The country has within the last three months been subject to a terrorist attack, widely attributed to the ‘great enemy’ Iran, which took all Saudi oil production offline for the best part of the week.

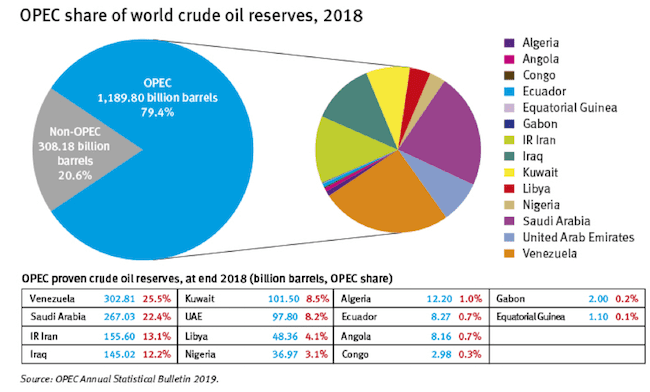

The terrorist attack, which took all Saudi production offline, meant that 5% of global supply went offline as well. This points to one of the major selling points of the firm. Aramco has access to the second-largest amount of oil reserves in the world (268bn barrels). It also has the lowest marginal extraction cost at $8.98 per barrel, which compares to the UK where the marginal cost is $44.33. The terrorist attack may have hammered home the geopolitical risk of the operation, but for the Suadi populace, it turned the long-awaited and often delayed IPO into something of an act of patriotism.

Reuters summed up the mood by referencing a tweet from Saudi columnist Anwar Aboalela:

“Participating in the Aramco IPO is a national duty for whoever can afford it.”

Source: Reuters

Senior Muslim clerics have given the green light to investing in the IPO. Sheikh Abdullah al-Mutlaq, a royal court advisor, said investing in Aramco is permissible. He noted:

“It (Aramco) is a pillar of the Saudi economy… I think even the scholars, we will participate in it.”

Source: Reuters

Even those Saudis who are less enthusiastic about the sale still appear likely to participate. Reuters reported Uber driver Abu Moshen who said:

“Aramco will be a winning horse… I will subscribe only because of the expected gains but I remain against the sale, especially to foreigners.”

Source: Reuters

A global stock

Mr Mohsen’s reluctance to sell off the family silver may be a valid point, but it appears to discount that the Saudi government’s budget deficit desperately needs to be reigned in. The country also needs to diversify its business interests from being so reliant on oil income. The ‘foreigners’ who don’t have quite as much exposure to the sector look the best bet in terms of outside investors.

Even so, the international investment community is experiencing a movement away from oil stocks. It might be that Aramco’s aim is to set a price at a level that encourages investors to rotate out of one oil firm and into theirs. A list price of 30 to 32 Saudi riyals might do it, but from first reaction that price might be too high a number for some.

Investors from Riyadh to the Rockefeller Tower have a couple more weeks before they need to make a decision. The indicative price has so far split the market and it’s those with an emotional attachment who look most likely pull the trigger at these levels. There are notes of hesitancy from other traders but few stating an intention to walk away, yet.