Key points:

- Boohoo is scheduled to post its interim results Wednesday

- The online fashion retailer's shares are down significantly this year

- Current headwinds do not suggest any surprises

Boohoo (LON: BOO) is scheduled to post its interim results on Wednesday, September 28, and with its share price down 69% in 2022, and over 85% in the last 12 months, investors will be hoping for a hint of positive news. On Tuesday the online fashion retailer announced that its new Chief Financial Officer, Shaun McCabe, will take up his new role on October 2, 2022.

However, investor focus is almost certainly on tomorrow's scheduled release. Unfortunately, the current economic environment doesn't indicate there will be much to cheer for.

Inflation

As we all know, the primary driver of a consumer spending decline, inflation, has surged this year. While overall, it eased slightly in the latest reading — it was primarily driven by a decrease in energy prices. Food and apparel inflation both rose.

This will have, of course, impacted consumers. For example, online fashion retail competitor ASOS said, in a trading update for the year ended August 31, that it saw “good growth in June and July,” but sales in August were “weaker than anticipated” due to the “impact of accelerating inflationary pressures on consumers and a slow start to Autumn/Winter shopping.”

ASOS also said it remains cautious about the outlook. Given Boohoo is in the same boat, it would be no surprise to read similar comments. Furthermore, over the weekend, The Times reported that Boohoo was cancelling and deferring orders from suppliers due to the cost of living crisis. The publication said a supplier of the fashion firm told them, “Boohoo has cancelled a load of orders. We are just here to do the fast stuff and when they don’t need it, they just stop it in its tracks.”

Search Trends

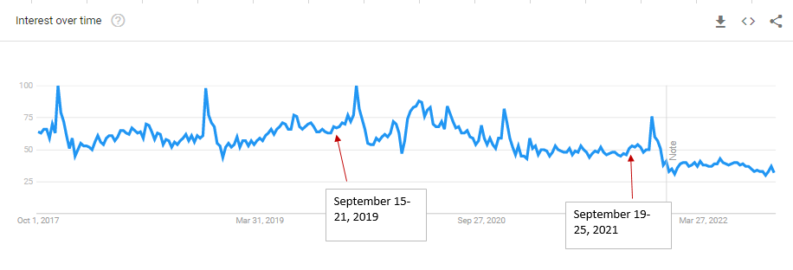

One of the metrics that can be used to assess recent demand for a product or company is Google Search Trends.

Even though there hasn't been a dramatic decline in search interest for Boohoo itself (other than a fall over Christmas 2021 as pandemic restrictions significantly eased), it has edged lower in recent years.

It currently sits at 32, compared to 46 in September 2021 and 63 in September 2019 (a value of 100 represents peak popularity).

However, while that suggests current demand has been pressured, we also need to look at data so far this year as a representation of how Boohoo sales may have performed. Looking at the chart, we can see search interest was somewhat stable at the beginning of the year but began to dip in July — suggesting a similar path to ASOS sales.

Elsewhere, we can also see search interest in other Boohoo-owned brands, such as Debenhams, Burton and PrettyLittleThing, has declined in recent months, implying that inflation is weighing heavy on demand overall.

Short Sellers

Although it has not impacted how the business has performed (but certainly an indication of expectations), it is interesting to note that Boohoo, according to Short Tracker, is the most shorted London-listed stock.

The short position is said to now be 9.7% of the share issuance, up from the 8.6% reported earlier this month. Marble Bar Asset Management LLP and CapeView Capital LLP have the largest short positions in Boohoo at 2.15% and 1.87%, respectively. The fact it is still the most shorted London-listed stock means that despite the significant downside already, investors see Boohoo shares continuing their decline. In addition, at the end of August, Barclays cut its price target on Boohoo shares to 37p from 45p, maintaining an Underweight rating.

However, those positions go against US hedge fund Citadel, which has built a 5% stake in the online fashion retailer.

Bottom Line

Overall, current economic headwinds suggest there won't be any upside surprises in its interim results, and the expectation is for it to be in line with guidance, if not slightly below. Although investors seem to be anticipating a continued fall in Boohoo's share price, so a miss cannot be ruled out. Nevertheless, the overall focus will be on its future and the company's expectations.