Shares of BP PLC (LON: BP.) jumped 8% today despite the reported loss of $16.8 billion for the second quarter. The oil giant has also halved the dividend payout by 50% to 5.25 cents per share for the quarter.

BP reported a loss of $16.8 billion on the back of the $10.9 billion of impairments. Crude oil prices went into the negative territory for the first time in history amid the collapse in demand.

The underlying replacement cost – a proxy for net profit – came in at negative $6.7 billion, compared to a $2.8 billion profit a year ago.

“These headline results have been driven by another very challenging quarter, but also by the deliberate steps we have taken as we continue to reimagine energy and reinvent bp,” Bernard Looney, CEO of BP, said in a statement.

The oil giant presented a new strategy that aims to cut oil and gas production by 40% by the end of the decade.

“Energy markets are fundamentally changing, shifting towards low carbon, driven by societal expectations, technology and changes in consumer preferences,” added Helge Lund, BP chairman.

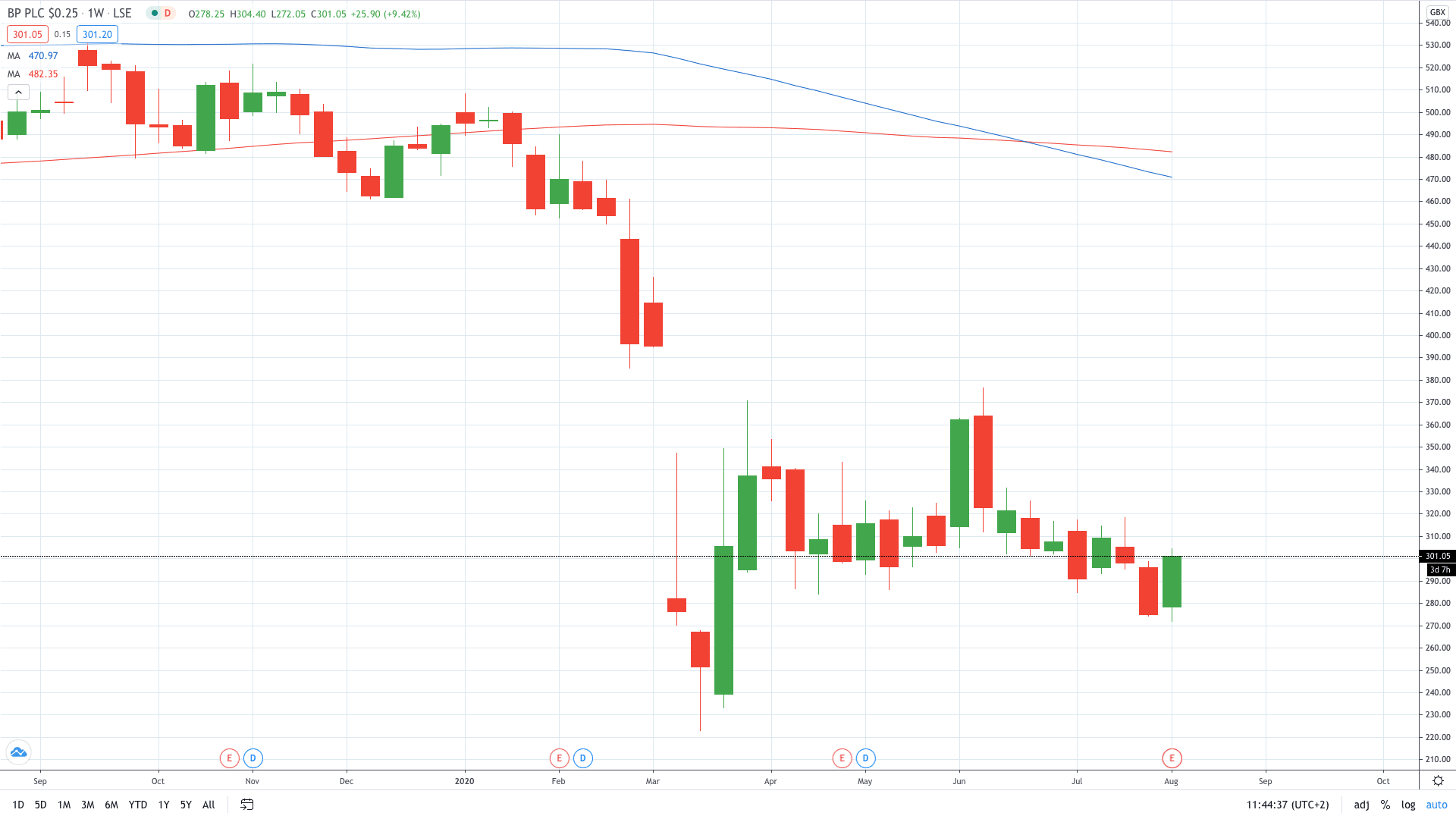

BP share price gained 8% on a new strategy that can make BO more diversified and sustainable in the long run. Shares of BP are now trading above 300p again after printing a 4-month low yesterday.

- Trade stocks on this free demo account

- Learn stock trading strategies

- Learn from experts on risk management in trading