- British Steel – employer of thousands in politically sensitive parts of the UK may be rescued from bankruptcy by Chinese firm Jingye Group.

- The UK manufacturer of relatively hi-tech products has been in insolvency since May 2019 as it struggled to operate in a perfect storm of global pressures.

- For now, those close to the UK firm are just relieved that they may continue to fight another day.

- The challenges that British Steel faces look unlikely to be significantly diminished, meaning that the motives of the Chinese firm might be brought into question at some stage.

British Steel looks set to announce that its future has been secured by a rescue package from Chinese firm Jingye Group. Not much is known about the Chinese buyer, which appears to have business interests including tourism, hotels and real estate. The people of Scunthorpe and Teesside, where British Steel employs 4,000 staff, are become familiar with unlikely bidders looking to take over the firm. The summer months saw a subsidiary of the Turkish state military pension fund consider buying the firm. The motives of the new bidder are for now of secondary importance at least as stakeholders in the steel manufacturer look to keep it alive. It is, however, possible that the challenges facing the firm are so acute that the purchase may be an attempt to asset strip the intellectual property of the UK firm.

The firm now known as British Steel is radically different from the group that had approximately 268,000 employees when it was formed in 1967. The modern version of the entity specialises in the ‘long products’ division, which includes such items as rail lines and girders and operates out of three main sites – two in the UK and one in France. This division has been rationalised and sold on several times.

More recently, a combination of reduced global demand, high company indebtedness and dumping by Chinese manufacturers saw the Tata Group agree to sell the long products division to Klesch Group in 2014. At that time, the division employed approximately 6,500 workers and was operating with 2.8 million tonne per/annum capacity.

As a salutary reminder to all who are excited by Monday’s news of a new bidder, the sale by Tata to Klesch Group stalled and then collapsed, and in 2016 the ‘long division’ was sold to Greybull Capital for a nominal £1.

The period from 2016 to 2017 raised hopes as 2016-17 financial statements showed British Steel reporting a profit of £47m before tax. A 3% pay cut that had been agreed with the workforce was reversed.

The challenge facing British Steel is trying to compete against Chinese manufacturers that sell their product on the global market at prices lower than cost value. Support from the Chinese state takes many forms and can involve indirect mechanisms that take advantage of loopholes in international trade regulations. With steel production being politically sensitive, it is a risk that the Chinese state is willing to take, but the real cost is actually felt by non-US manufacturers that are priced out of artificially priced markets.

Global trade

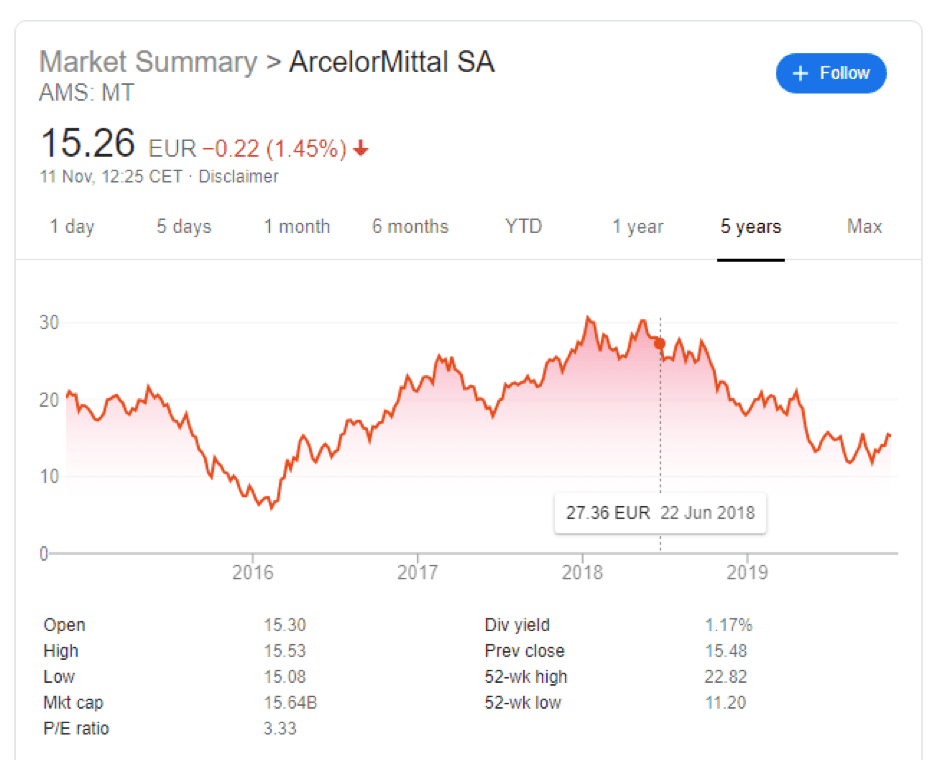

The fate of British Steel and other listed firms is inexorably linked to the much higher-level US-China trade talks.

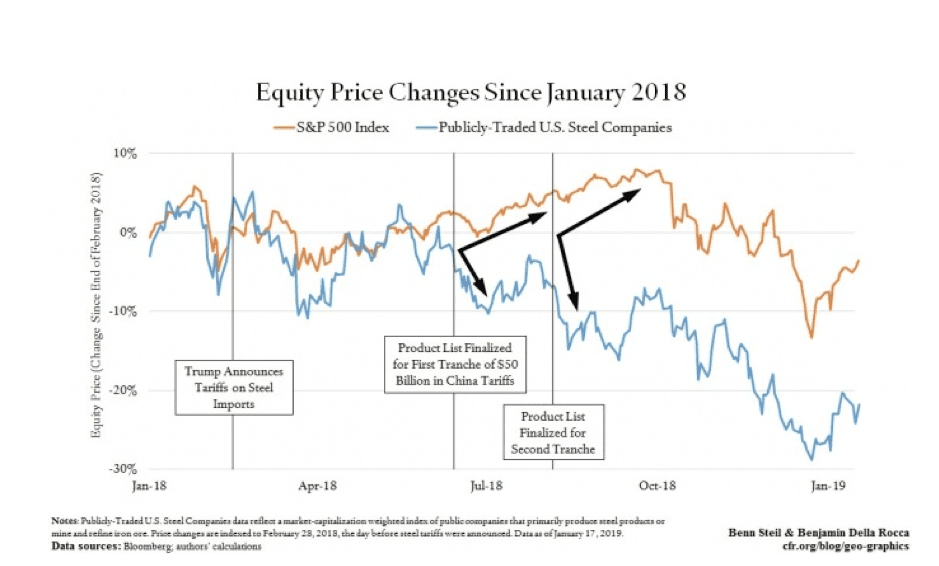

The US has responded to the unfair playing field by levying tariffs of 25% on Chinese imports. Reuters reported:

“The EU Commission, which conducted an investigation, said import volumes into the EU increased significantly from March 2018, when the United States imposed tariffs of 25 percent on imports of steel.”

Source: Reuters

The EU responded, and in February 2019 also placed a quota on imports – the policy approach being to restrict the supply of steel into the EU so that the global surplus caused by US tariffs was not dumped into European markets. Imports into the EU in excess of the quota level are subject to a 25% tariff.

The trade war between the US and China is also a drag on global economic growth. Not only do tariffs and quotas make it harder to navigate the global market for steel, but they also reduce total global demand.

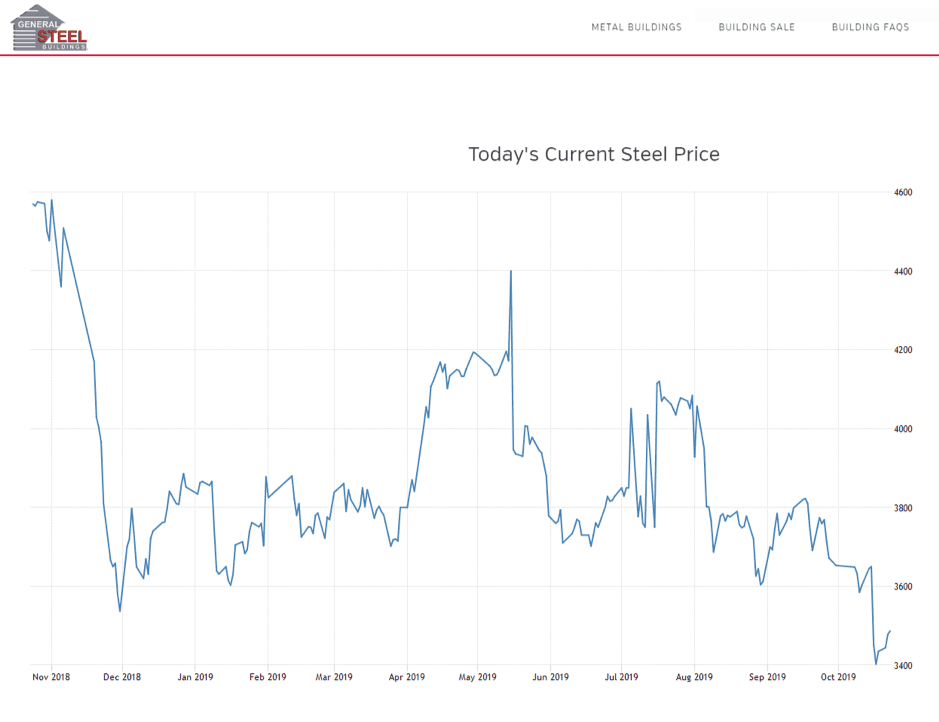

Steel market

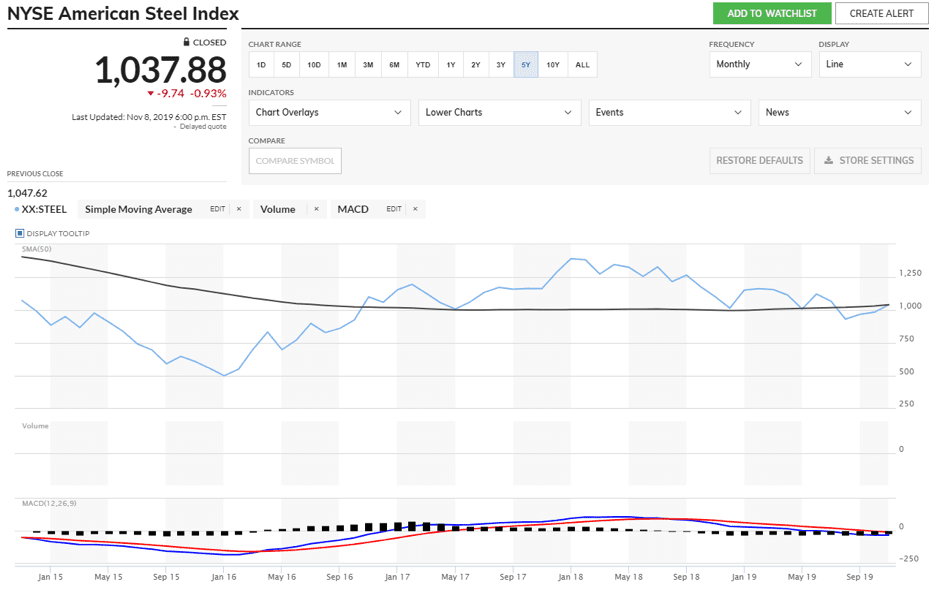

The financial markets have been trading within a relatively wide price range. Between 3rd October and 7th November, the S&P 500 has traded within an 8% spread. This short-term volatility off the back of political events – mainly the US-China trade talks – is proof that the economy and the markets are two very different beasts. The steel market and the firms operating within it form a portal to the fundamentals of the economy. Analysis of the NYSE American Steel Index sheds some light on the long-term health of the ‘real’ economy – though one distorted by Chinese dumping and global over oversupply. It also offers investors the chance to gain exposure to the market with less ‘single stock’ risk.

NYSE American Steel Index (ICE:XXSTEEL) – five-year price chart

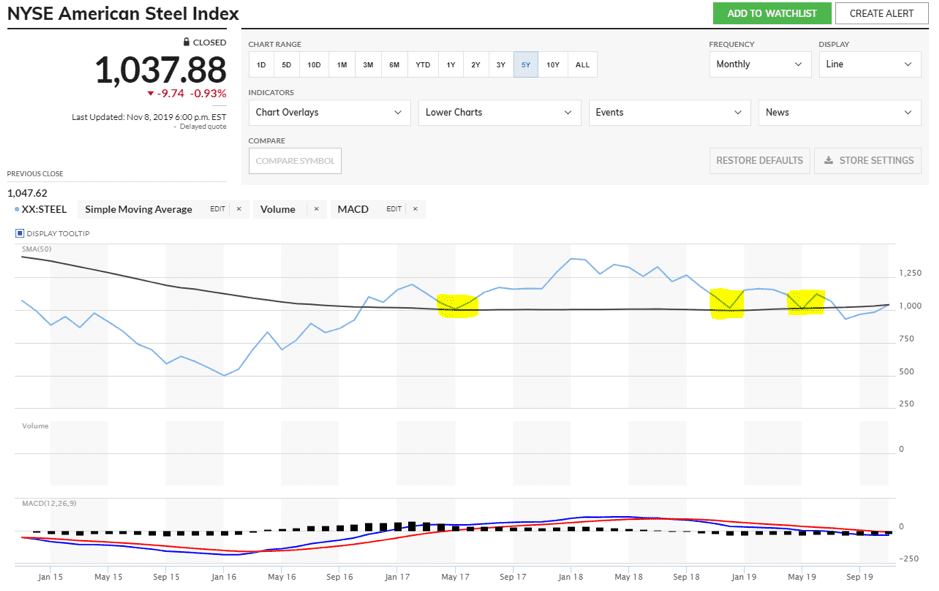

The five-year price chart for the NYSE American Steel Index has the price of the index coming up to, and looking like it’s going to cross, the 50 SMA. It is worth noting that waiting for this move to be confirmed might be prudent. There are three occasions when it has formed a key support level to price and, of course, may provide a similar degree of resistance.

NYSE American Steel Index (ICE:XXSTEEL) – five-year price chart – with SMA Support notes

Source: MarketWatch

Motives

The purchase by Jingye Group could be a play on global economic demand picking up. Should the global steel indices be about to pick up (as the 50 SMA above suggests), then British Steel should be equipped to benefit from those gains. The firm generated a profit only a few years ago, and as Jingye Group doesn’t currently have a division manufacturing that type of steel, the buyout could possibly fit in with a growth plan.

A longer-term risk is that the buyout is a case of asset stripping of IP. The UK plants apparently require infrastructure upgrades totalling hundreds of millions of pounds, and it might be that the technical knowledge and production are ultimately transferred back to China. For the stakeholders in British Steel, that is a problem to face another day.