Shares of Ceres Power Holdings plc (LON: CWR) have broken out of the ascending triangle we identified in our last article and appear to be headed higher.

We have previously covered some of the concerns affecting the company’s share price, including the significant amounts it has to spend on research and development activities to keep up with evolving industry trends.

The clean energy company’s shares fell as momentum stocks that led the markets higher in 2020 started losing favour with most investors who turned to largely ignored value stocks such as utilities and energy stocks.

It seems like the buyers are back in control of Ceres Power shares, given the rebound that ensued after the shares bottomed in March this year and started heading higher. The stock did not rise in a straight line and has had multiple pullbacks up to now.

Finally, the shares have broken out of the ascending triangle and are trading above the resistance level. The shares have recently pulled back and are about to retest the level before kicking off a popper rally.

However, nothing is guaranteed in the markets, and we could see the price break below the resistance level and head lower.*

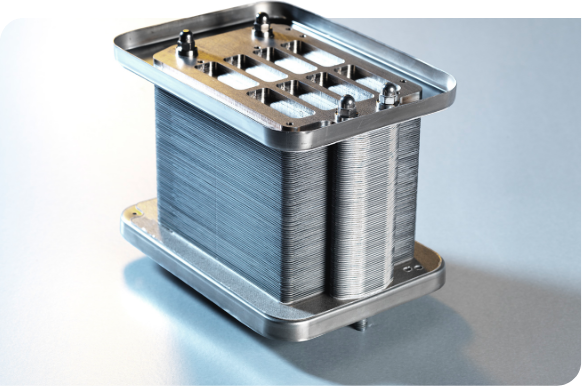

Earlier today, Ceres Power received this year’s Queen’s Awards for Enterprise for its role as a clean energy leader and excellence in International Trade. The company has a unique fuel cell and electrochemical technology that can provide clean power for homes, businesses and the transport sector.

The company’s technology can also generate green hydrogen and future fuels to help solve the climate change problem and accelerate the world’s transition to clean, affordable energy.

Ceres Power share price.

Ceres Power shares have broken out of the range identified earlier and could be headed higher.