Shares of EasyJet PLC (LON: EZJ) soared 10% after the low-cost carrier said the demand has been better than expected in July.

The airline said it had only 117,000 passengers in the three months ending June 30, a decrease of 99.6% compared to the same period in 2019. As a result, revenue went from £104 million to £7 million in the quarter.

EasyJet moved to a £324.5 million loss from a £174.2 million profit the prior year. Despite the horrific numbers, the low-cost carrier noted an uptick in demand for holiday travel.

“I am really encouraged that we have seen higher than expected levels of demand with load factor of 84% in July with destinations like Faro and Nice remaining popular with customers,” Chief executive Johan Lundgren said in a statement.

“Our bookings for the remainder of the summer are performing better than expected and as a result we have decided to expand our schedule over the fourth quarter to fly c.40% of capacity”.

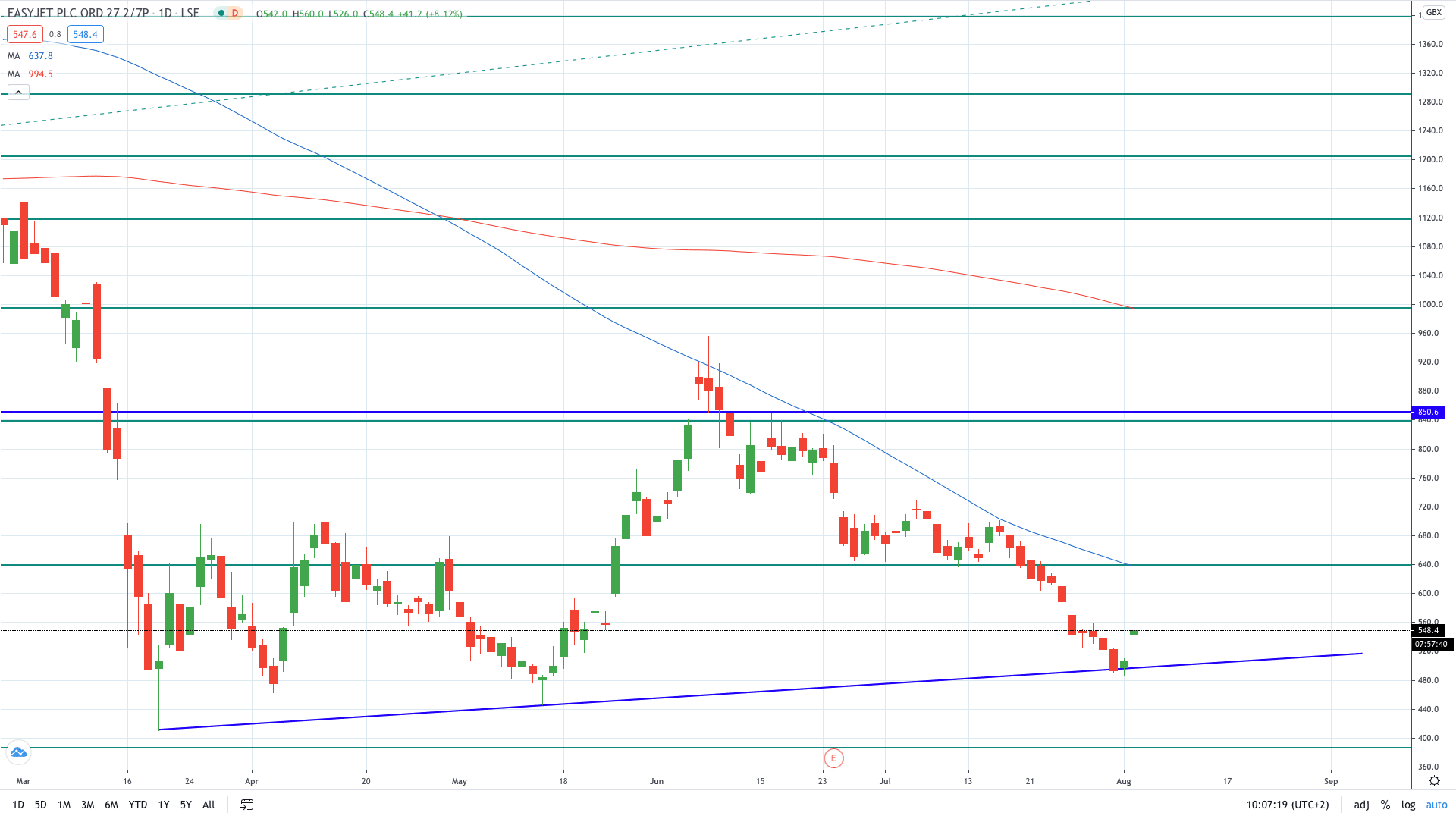

EasyJet share price surged over 10% to trade at 560p. The buyers will now eye a move to 640p where the next resistance line sits.

- Read more about why EasyJet share price plunged in June

- Learn how to trade stocks on this free demo account

- Learn Stock Trading Strategies