The eurozone is facing a massive crisis, and it is impacting their banks.

Amid the coronavirus pandemic, the European (mainly Italian) banking sector is struggling.

According to an article on the Reuters website, there has been a flood of applications from customers looking to extend loans, debt relief and renew credit lines. And the same is happening in Germany where the outbreak has severely impacted businesses.

The Reuters article mentions one small bank in particular. However, this applies to many banks across Italy, large and small, especially in the north. There are debt default fears and European efforts to help the economy aren't helping.

With the world economy effectively on lockdown, and company revenues plummeting, not looking like they will pick up anytime soon, demand has diminished, and incomes slashed. With some European banks still recovering from the last financial crisis, the virus outbreak couldn't have come at a worse time.

Business sentiment across the region has fallen, and Germany's manufacturing sector is faltering.

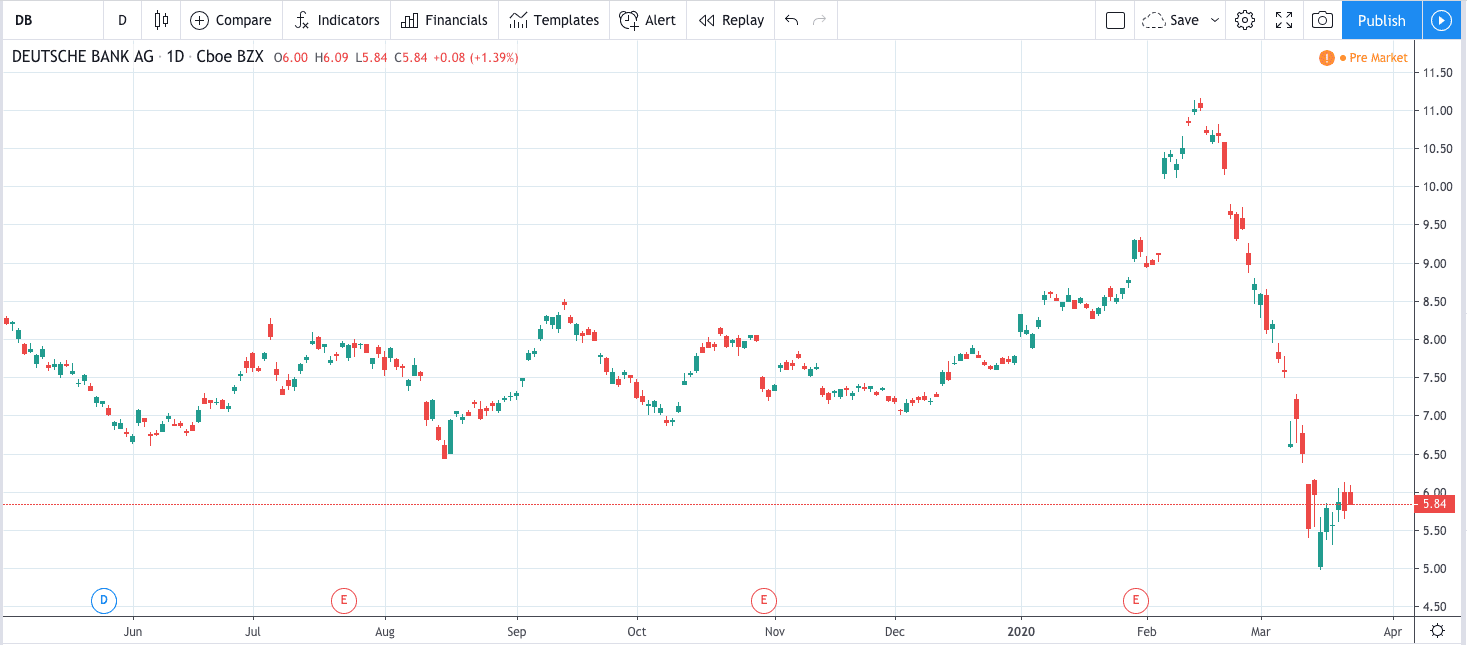

The risk of loan defaults are incredibly high, and even with government help, the banks will still need to eat into their profit, that is if they have any. Share prices across European banks have plummeted in recent times, take a look at Unicredit and Deutsche Bank.

Unicredit is one bank who could be in big trouble and are at high risk. The bank holds a high proportion of non-performing loans, which is troubling.

And, according to a recent article by research company Macrodesiac, the bank owns a lot of Italian government bonds that have an inherent risk, due to liquidity issues. Take a look at what the articles author and founder of Macrodesiac, David Belle had to say:

“What happens if there is a haircut on these Italian BTPs (what if there is mass selling of these Italian Government bonds and yields spike leading to a perceived increase in sovereign default risk)?

Well, in my view, we see that their regulatory capital becomes far, far smaller than what is currently suggested in their books!

This is pretty much a Lehman moment x10.”

If you are unsure as to what he is referring to when talking about Lehmann, then have a search on Google. It would be a catastrophe for Italy and Europe.

Italian and European banks are at risk, and that risk is growing, the longer the coronavirus pandemic continues. The eurozone could be facing the most significant contraction in GDP since it was formed and the outlook as of now is bleak at best.