- Glastonbury, the world’s largest outdoor festival takes place this weekend

- 135,000 attendees spend on average over £400 each

- A symbol of both the popularity of the music industry and how changing consumer appetite brings challenges to the companies in the sector

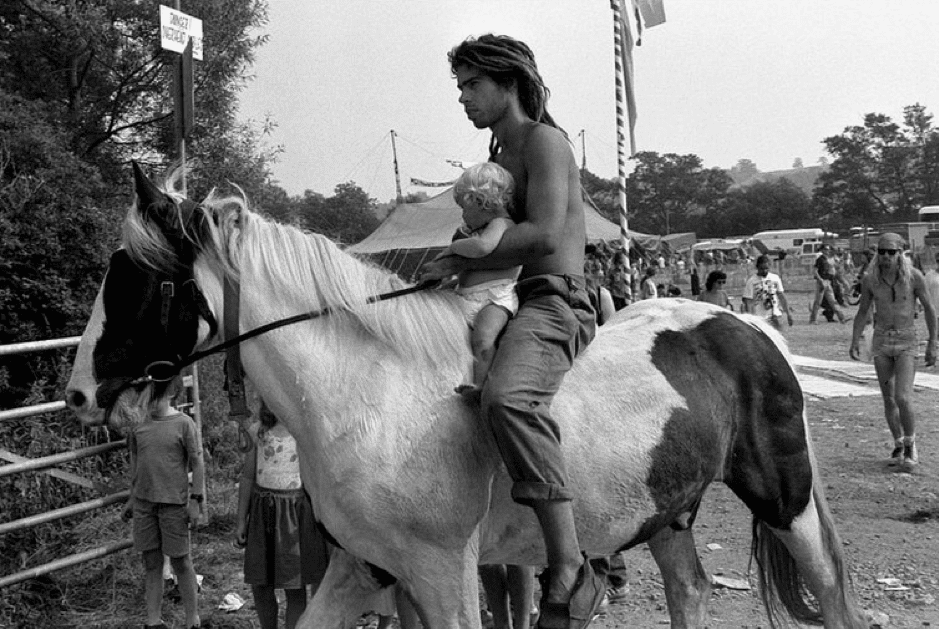

The first Glastonbury festival was held in 1970 when people paid £1 to enter. By 1981, it still only drew attendance of 18,000 but by 1989 the ticket price went up from £8 to £28 and recorded attendance was 65,000. Actual attendance was likely to be much greater because the perimeter fence was notoriously porous. This was of course Thatcher’s Britain and a range of entrepreneurial individuals were known to charge entrants a fee to gain access through ‘their’ gap in the fence.

By 2019, the perimeter had been made secure by an eight-mile long, 20 foot high fence which is temporarily erected to surround the festival site. Given the added security measures, for this year’s event, the 135,000 tickets priced at £248 each all sold out within half an hour of being released.

Alternative system

From holes in the fence to #veganhour, the festival provides a forum for new ideas and experimentation. Whilst a capitalist business model dominates most of the global economy today, it is not without its weaknesses. Glastonbury was borne out of and thrived in an ‘alternative’ mind-set. It can still claim to throw up some interesting ideas of how ‘business’ can be done, but weighed against that is that it has become a more mainstream operation.

The financial rewards of this are significant. In 2017, organiser Emily Eavis said of the charitable donations made:

“We try to give £2m a year,” Emily Eavis added. “In a wet year it's harder because it costs more, but we give as close to £2m as we can.

“That's why we're not commercial, in that respect. We're not in the same bracket as everyone else when it comes to paying artists massive fees.”

The fee paid to performers is typically less than might be considered ‘market price’. Founder Michael Eavis reported in 2017 that the fee once paid to Coldplay was £200,000.

“Although it sounds a lot, they could have charged me far more,”he said. At the other end of the spectrum, Oasis were suggested to have been paid upwards of £1m when they performed at Reading and Leeds festivals in 2000.

There is obviously some non-monetary benefit for performers to be associated with such a high profile event. The festival does also make donations to charities and the occasional ‘fallow year’ when there is no festival maintains the event’s eco-credentials.

There exists a range of quirky statistics about the operation. Those not fortunate enough to secure a ticket can instead scoff at some of the contradictions associated with running a music festival.

A favourite on Twitter at the minute is that thousands of vegans are setting up pitch on the site of a working dairy farm.

Another Tweet thread asks how the high profile relationships with broadcasters are managed and priced. The coverage of the festival by the BBC and the ‘feel-good’ factory conveyed obviously comes at a material cost. The question raised, again on Twitter is how is this accounted for, particularly when free TV licenses for over-75s have just been scrapped?

Good business

The festival business model is actually high risk. The unpredictability of the weather explains why the company behind the party, Glastonbury Festival Events, maintains a cash pile of more than £10m. Various smaller festivals are possibly less well managed and certainly, with less brand recognition, are no longer in operation.

The Glastonbury buffer is revealed in its most recent accounts. Made up to a year end of March 2018, Glastonbury Festival Events made a post-tax profit of £1.43m, held cash reserves of £10.6m and made charitable contributions of £2.1m.

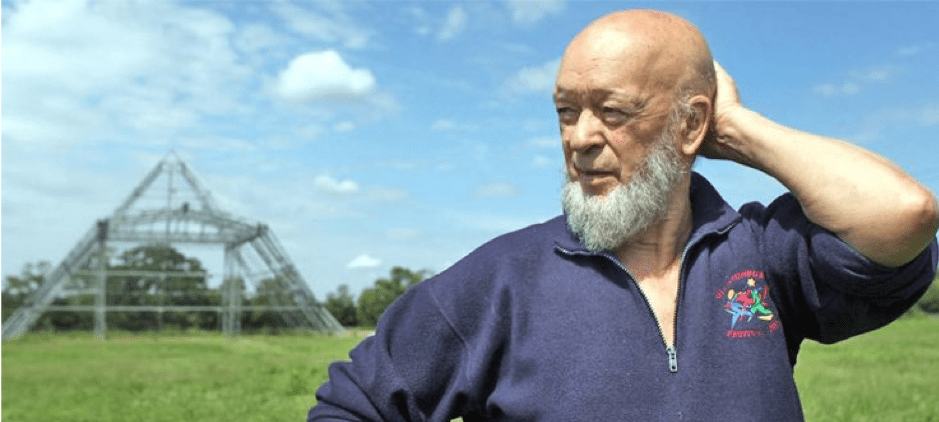

The cash pile is significant but is sourced via what is still something of an alternative business model. The festival’s founder, Michael Eavis, is this year giving away 500 free tickets to trainee nurses in the Mendip area of Somerset. The region, in which the festival is located, is suffering from a shortage of nurses. Such good deeds bring to the fore the laws of karma rather than those of economics, and the festival is mainly run by volunteers. Some 2,000 stewards are organised by the aid charity Oxfam. In return for their work at the festival, Oxfam receives a donation.

Changing tastes

What lessons if any can the music corporations take from the grass-root support, the people who might, or might not be buying their music?

Streaming sites such as YouTube, Spotify and Apple Music have worked hard at monetising the changing nature of music consumption.

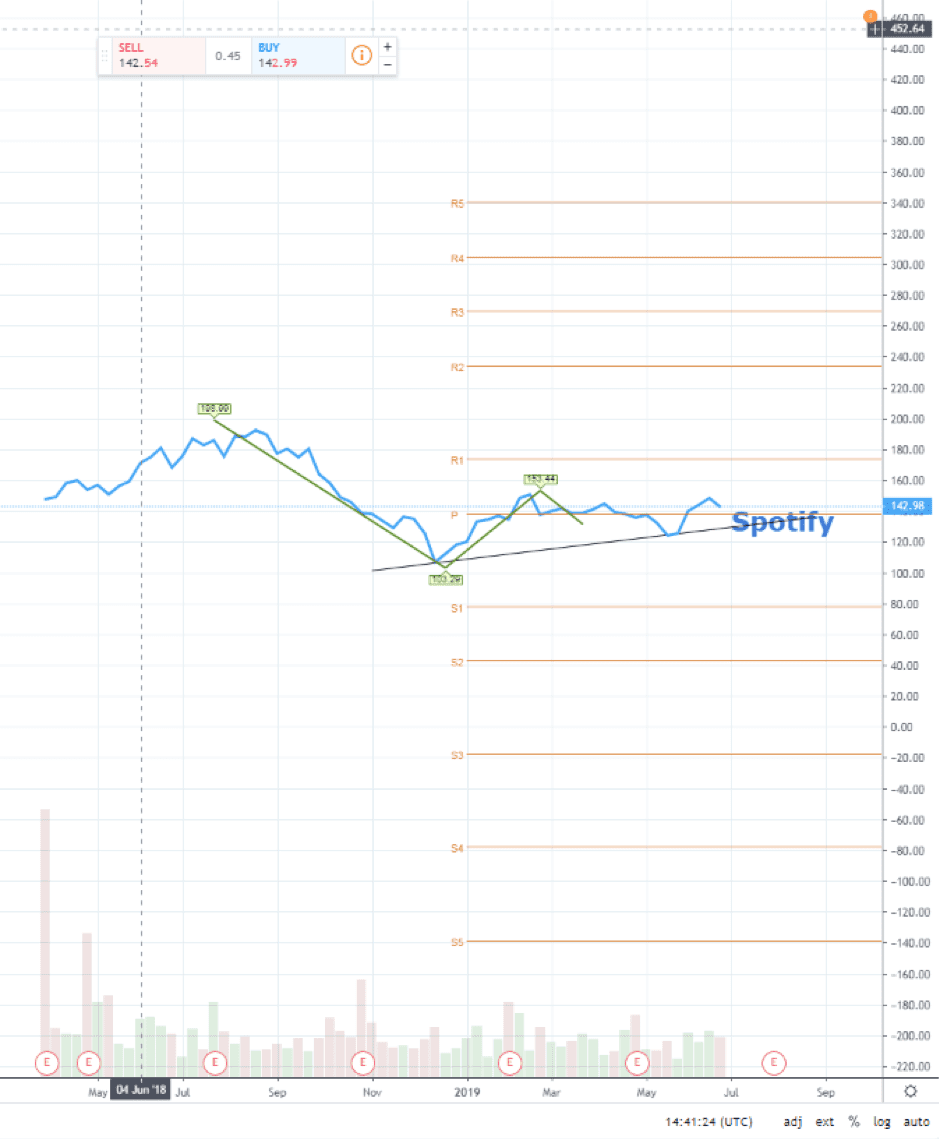

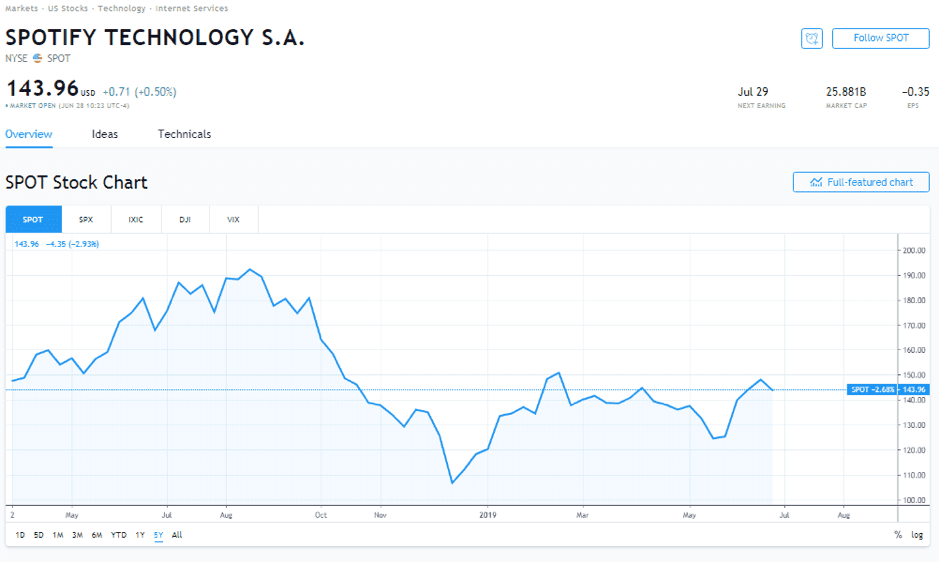

Spotify launched in 2008 and had an extended gestation period before listing on the stock markets in April 2018. Trading opened at the $165 level but the share price has since then fallen away to $143.65

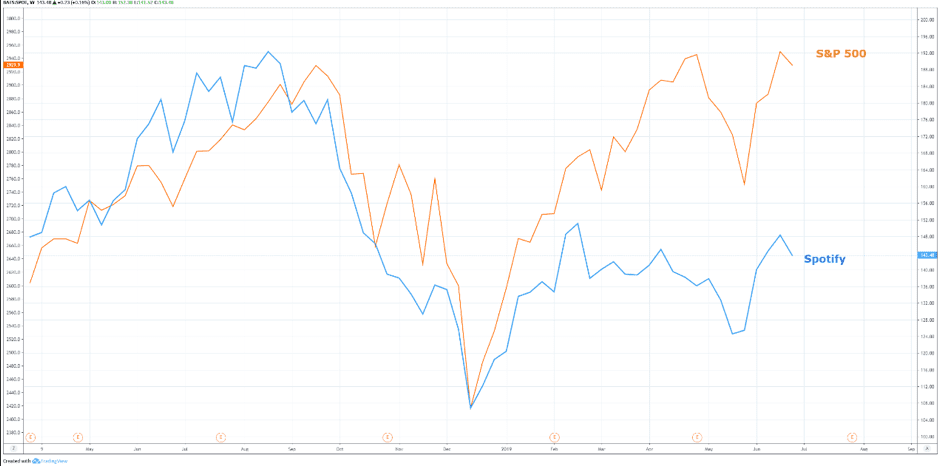

The chart comparing Spotify share price to the S&P 500 Index illustrates how the music streamer has underperformed. Over the time period, the S&P 500 is up +12.5% whilst Spotify posted a -12.9% negative performance. The firm is far ahead of its competitors in terms subscribers. In April 2019, it reported paid subscribers had increased by 32% and monthly active listeners had reached 217 million. Apple Music by comparison has 56 million paid subscribers.

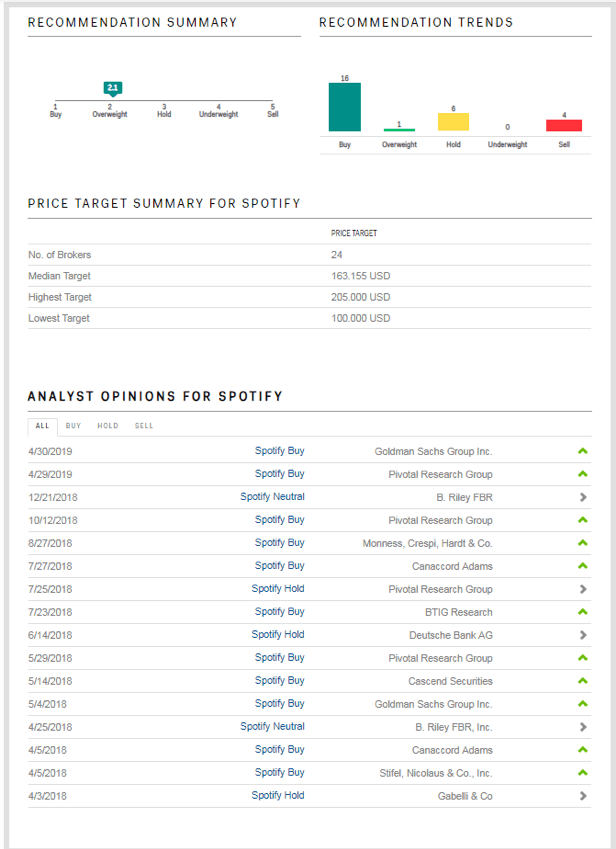

The weak share performance of SPOT has led to a range of analysts sticking to their view that the stock is worth holding.

Of the analysts that have updated their reporting since September, the Business Insider website reports that three of the four have moved to a ‘Buy’ status and the fourth is a ‘Hold’. A total of 16 out of 27 analysts rate the stock a ‘Buy’.

SPOT is currently trading above the Pivot Point and nearing the 50% retracement levels associated with the share price fall from the highs of August 2018 and low of December. The upward trend line and Pivot Point both offer logical paces to place a stop-loss on a long position.