- Gold is weakening. The question for analysts and gold-bugs is whether this is a temporary retracement or a more serious change in direction.

- Global monetary policy appears to be turning more hawkish — with interest rates so low, there is limited room for further downward movement

- The dollar has strengthened against a basket of other currencies, making the metal more expensive for non-US investors

- Geopolitical risk is currently being marked at relatively low levels. However, some of the hot spots are diarised to flare up in the near future, but for now, the perception is that they are at least manageable.

- These three factors together are creating a headwind for the metal.

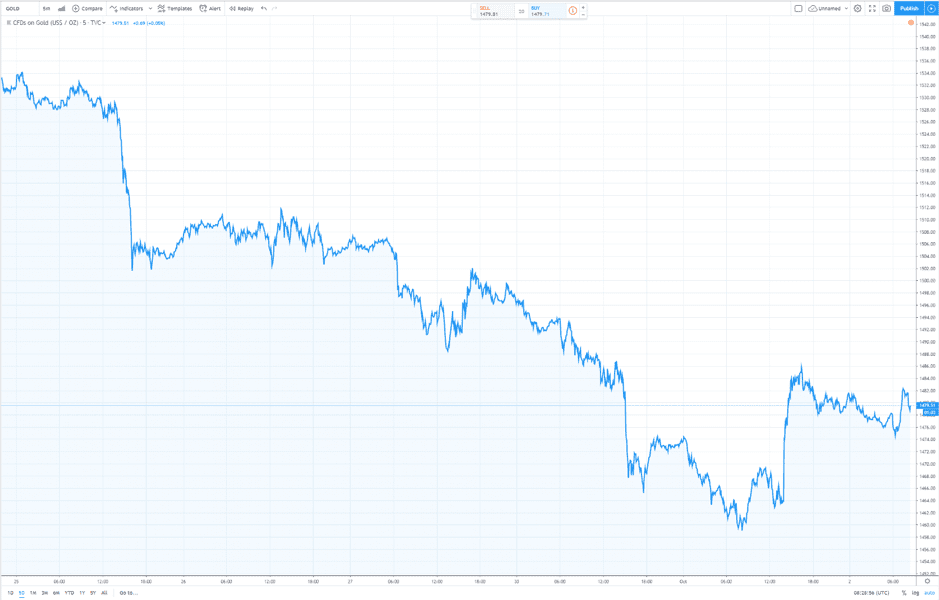

Over the last five days, investors have backed away from gold as the fears that were driving them into the asset recede.

GOLD (TVC:Gold CFD) — Five-day price chart

The $1,459 price, which was printed on Monday, marks a two-month low. The bounce through Tuesday shows that bears are not going to have things their own way, but at the same time, the bulls will be finding reasons to doubt if the upwards break through the trend line is confirmed.

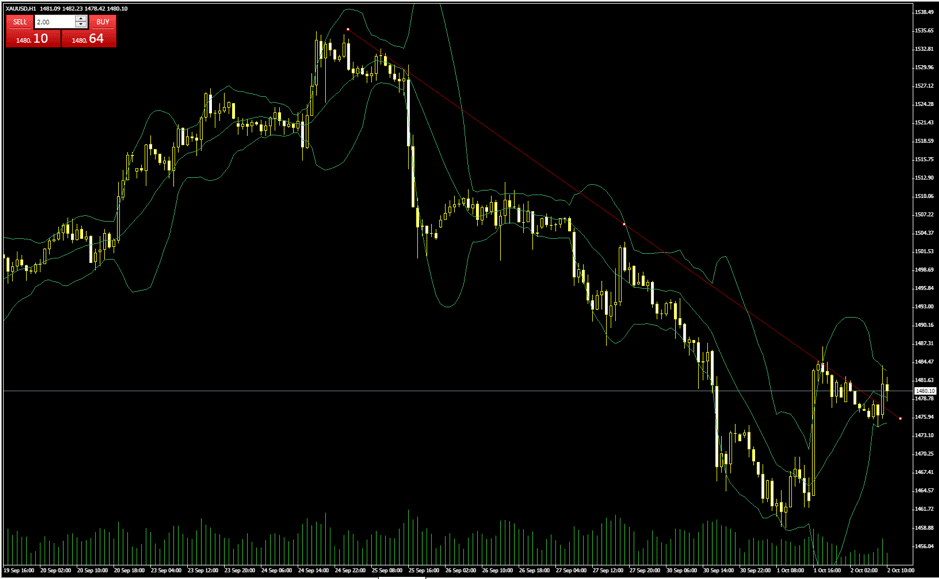

XAUUSD — Price chart — 26th September–2nd October

The relative volatility will be offering opportunities for those traders operating with short-term holding periods but also needs to be viewed from a longer-term perspective.

Gold printing ‘two-monthly lows’ is, of course, a bearish headline and whilst the underlying price action for gold still points to upwards movement, other indicators are also showing some weakness. Possibly most relevant is that the monthly RSI has declined below the 70 level.

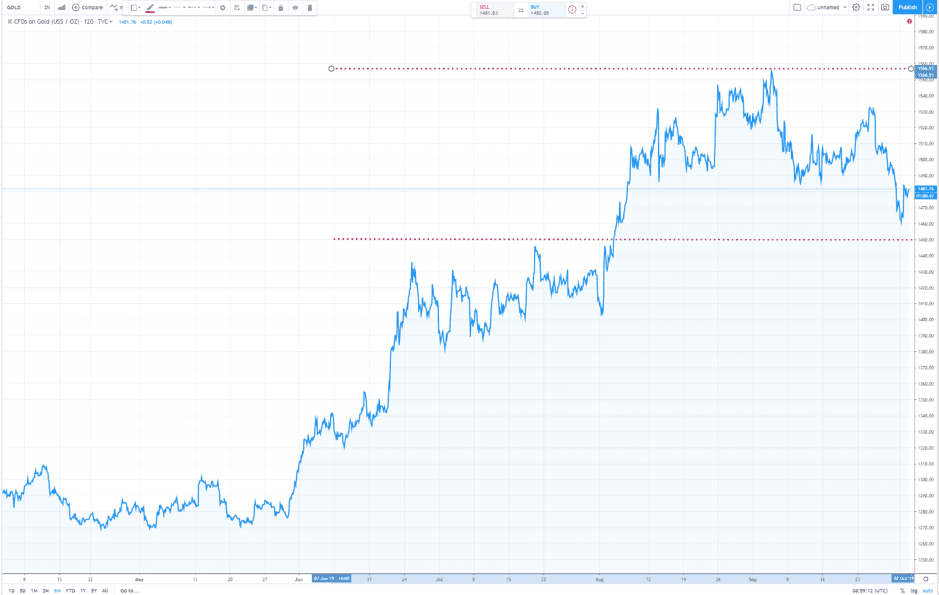

Significant support and resistance levels will be keenly watched. With the perception of geopolitical risk constantly changing, there is some chance that price might hit the $1,450 support, or try to once more break through the resistance at $1,557, which is the level that marks the recent highs. These two price marks are being seen as key levels.

GOLD (TVC:Gold CFD) — Six-month price chart

Monetary policy

The three main drivers of current price action are monetary policy, the strength of the dollar and the many and varied threats to international trade and the global economy. Speaking with industry site Kitco.com, CEO of Abitibi Royalties, Ian Ball, focused on the monetary policy element. He said:

“I think gold is going to go higher, but it’s not going to go in a straight line. I wouldn’t be surprised if we retest $1,400 or lower because you have to consolidate, but what’s going to be the driver is going to be U.S. monetary policy.”

Source: Kitco

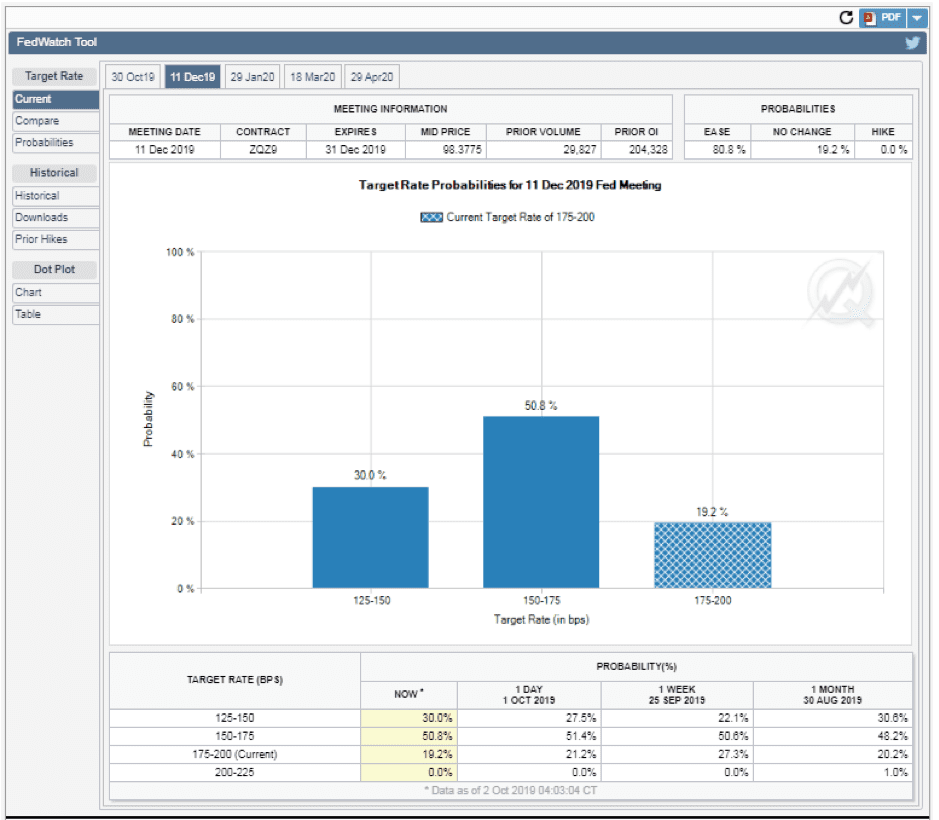

Markets appear to be pricing in a reduced likelihood of further interest rate cuts, particularly by the US Federal Reserve. The CME Fed Watch tool reports a 50.8% likelihood that there will be one more 25bp cut in US interest rates between now and the end of the year. Lower interest rates reduce the opportunity cost of holding gold and also lead to a stronger dollar. The strength in USD can act as a barrier to investors who hold their assets in a currency other than dollars, which is the currency in which the metal is denominated.

CME Fed Watch — 11th December 2019 target rates

Jeffrey Christian, managing partner of CPM Group said:

“The Fed said they’re going to be very cautious about lowering rates since it’s not clear that we really need to, which was taken as a confirmation that there’s a fair bit of potential growth before getting concerned about recession. So people backed away from some of the fears that drove them into gold on a short-term basis.”

Source: CNBC

The intra-day slide in gold prices on Monday was at one point -2.10%, which marks a significant shift in investor perception. The Fed turning more hawkish is acting as a long-term underlying influence on price. The sharp drop on Monday is triggered more by news of improving, or at least non-deteriorating, trading relations between the US and China.

Negotiation tempo

The stand-off between the US and Chinese governments is creating an environment where even unsubstantiated reports can move the price of gold. Friday saw the Washington administration dismiss reports that had suggested the White House was considering delisting Chinese companies from US stock exchanges. The good news for Sino-US relations was bad news for gold.

China is in the grips of its largest annual holiday period, and with communication between the two parties likely to be limited, there is less chance of provocative gestures being made. Golden week officially ends on 7thOctober, and the tempo of negotiations may take some time to pick up. Analysts have suggested that last week’s news of the impeachment of President Trump provides an incentive to the Chinese negotiators to slow down the talks. Even stalling for just two months would likely shed some light on whether President Trump will be able to weather the storm and provide countless opportunities for his bargaining position to be weakened.

Risk-on

The geopolitical climate is also currently relatively calm. Saudi oil production has been restored within a fortnight of the military attacks on its refineries at Abqaiq. The Stena Impero oil tanker, which has been held by Iranian authorities since July, is slowly and painfully working through the process of being released. Furthermore, the threat of Argentinian sovereign default is being conveniently overlooked until the general election campaigns there culminate on 27th October.

As 31st October approaches, the term ‘Brexit means Brexit’ currently translates as both a no-deal Brexit and a last-minute deal Brexit being possibly. Each are as likely as the other to disrupt the markets. The third option of a delayed Brexit might do little more than delay the inevitable and can expect to be priced somewhere near the other two options.

Of the price drivers mentioned, the monetary policy element is the one that changes over a longer time period. Geopolitical risk can be adjusted in an instant, but a move from hawkish to dovish comes after weeks and months of comment and action by central bankers. If US monetary policy, in particular, is tightening up then it could be that the $1,450 support is tested before the $1,557 resistance.