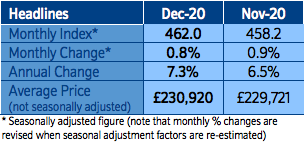

UK housing stocks are climbing on Wednesday after a report by building society Nationwide said UK house prices grew 7.3% in 2020, the highest rate for six years.

Shares of Taylor Wimpey are up 1.12%, Hammerson +1.05%, Persimmon +0.81%, Barratt Developments, +1.38%, Redrow +0.73%, and Purplebricks +1.73%.

It had been expected that house prices would fall when the coronavirus pandemic took hold back in March, causing the housing market to grind to a halt. However, policy measures and changing preferences have seen housing demand remain solid.

“The furlough and Self Employment Income Support schemes provided vital support for the labour market, while a host of measures helped to keep down the cost of borrowing and keep the supply of credit flowing,” Nationwide said in its report.

“The stamp duty holiday also stimulated housing demand, by bringing forward peoples’ home-moving plans. Lenders also responded by offering payment holidays to borrowers impacted by the pandemic, helping people stay in their homes rather than potentially being forced to sell.” Nationwide added.

However, the building society did warn that the outlook for the market remains highly uncertain, with housing market activity likely to slow in the coming quarters.

England saw the highest growth amongst the four UK nations, with prices rising by 6.9%.

“All regions in England saw prices rise over the year, within a fairly narrow range of 5% to 9%. The Outer South East region, which includes cities such as Brighton, Southampton and Oxford, saw a significant change in fortunes – prices were up 8% in 2020, following a 1% decline in 2019,” Nationwide said.