Shares of Barratt Developments tumbled over 3% in Friday morning trading after it was announced that the company is under investigation…

Barratt Developments, along with Countryside Properties, Taylor Wimpey and Persimmon Homes are all being investigated by the UK Competition and Markets Authority after they stated that they had found “troubling evidence” in the leasehold housing sector.

“We have found worrying evidence that people who buy leasehold properties are being misled and taken advantage of,” said the CMA's Chief Executive, Andrea Coscelli.

Several concerns are being looked into, from homeowners having to pay escalating ground rents, people being lied to about the cost of converting their leaseholds to freeholds, misleading information and unreasonable fees.

Barratt has responded to the investigation, stating that “the Group is committed to putting its customers first and will continue to cooperate with the CMA.”

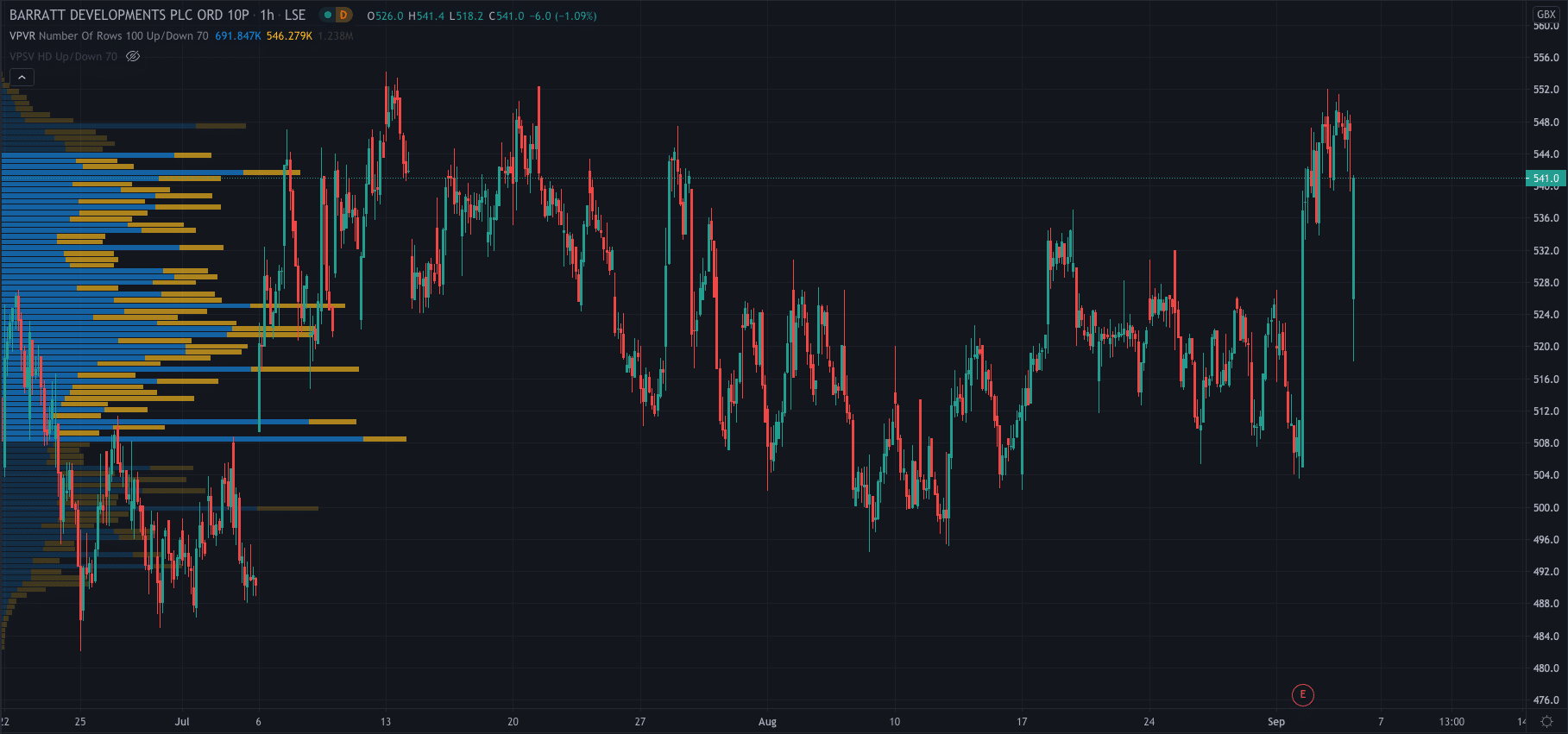

BDEV share price…

Shares in Barratt developments fell over 3% immediately after the open today, down to 518p. However, its share price looks to be rebounding and is now trading at 540p, up 0.11%.

The CMA is now looking to launch direct enforcement action…

“We'll be looking carefully at the problems we've found, which include escalating ground rents and misleading information, and will be taking our own enforcement action directly in the sector shortly,” said Coscelli.

- PEOPLE WHO READ THIS ALSO READ: CAPITA SHARE PRICE SURGES 15.5% ON TAKEOVER RUMOURS

- TRADE STOCKS WITH PLUS500