Shares of Ocado Group PLC (LON: OCDO) gapped 2% lower today in London after Barclays’ analysts downgraded the stock to “underweight”.

The bank’s analysts are questioning whether the recent surge in share price is justified from the business perspective. Accordingly, the market cap of £16 billion was “excessively generous” as it doesn’t correspond to Ocado’s market share.

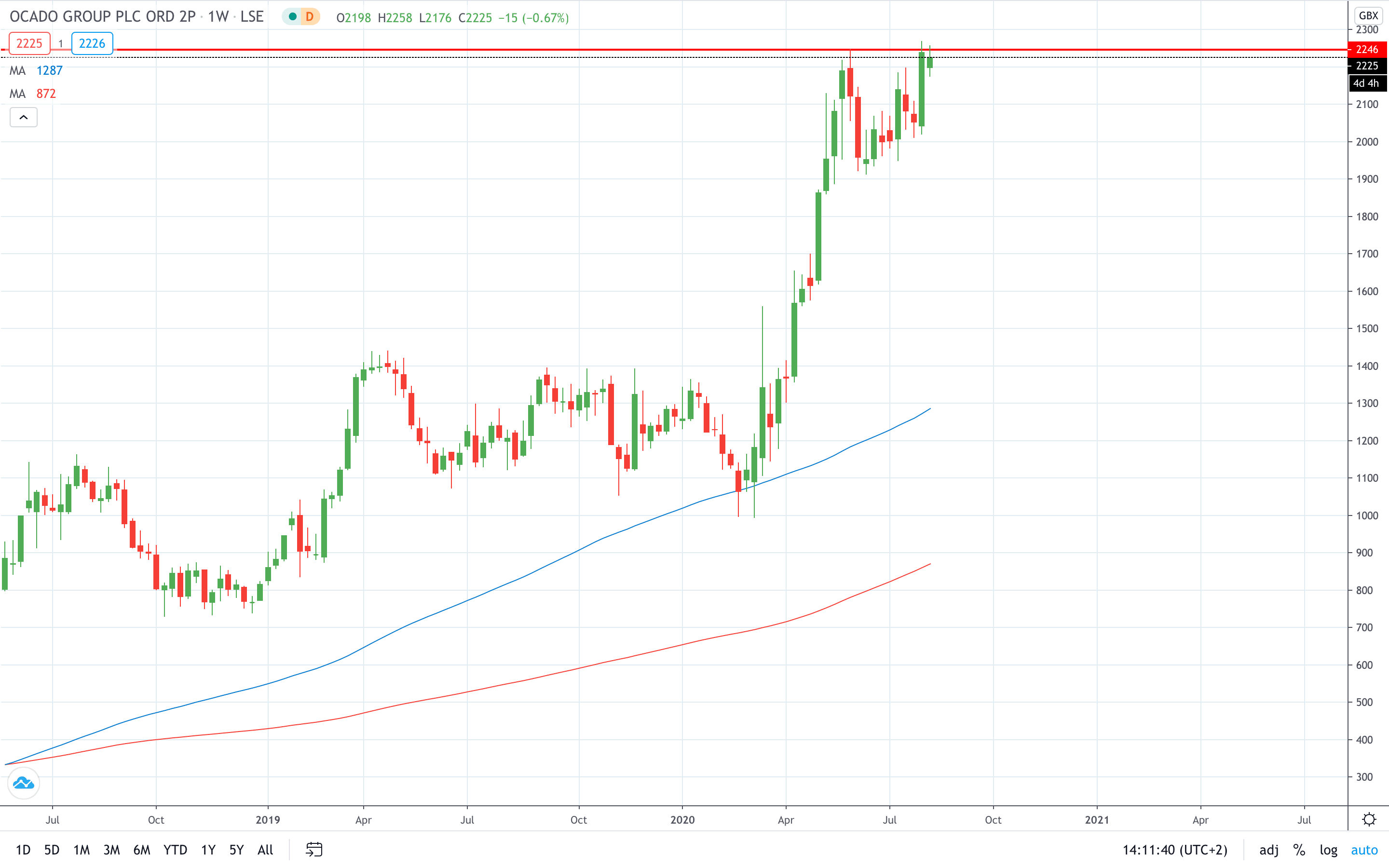

Still, Barclays’ analysts raised Ocado’s stock target price to 1,600p from 1,200p. This is a discount of over 28% compared to last week’s closing price of 2240p.

The bank’s assessment of Ocado is opposite of Peel Hunt, who raised the stock price target to 2400p last week.

The recent surge in price saw Ocado stock hit an all-time high on Friday. Shares are trading 87.4% higher since the beginning of the year.

- Read more about why Ocado share price slipped lower in June

- Start learning about stock trading strategies

- Learn from experts on risk management in trading