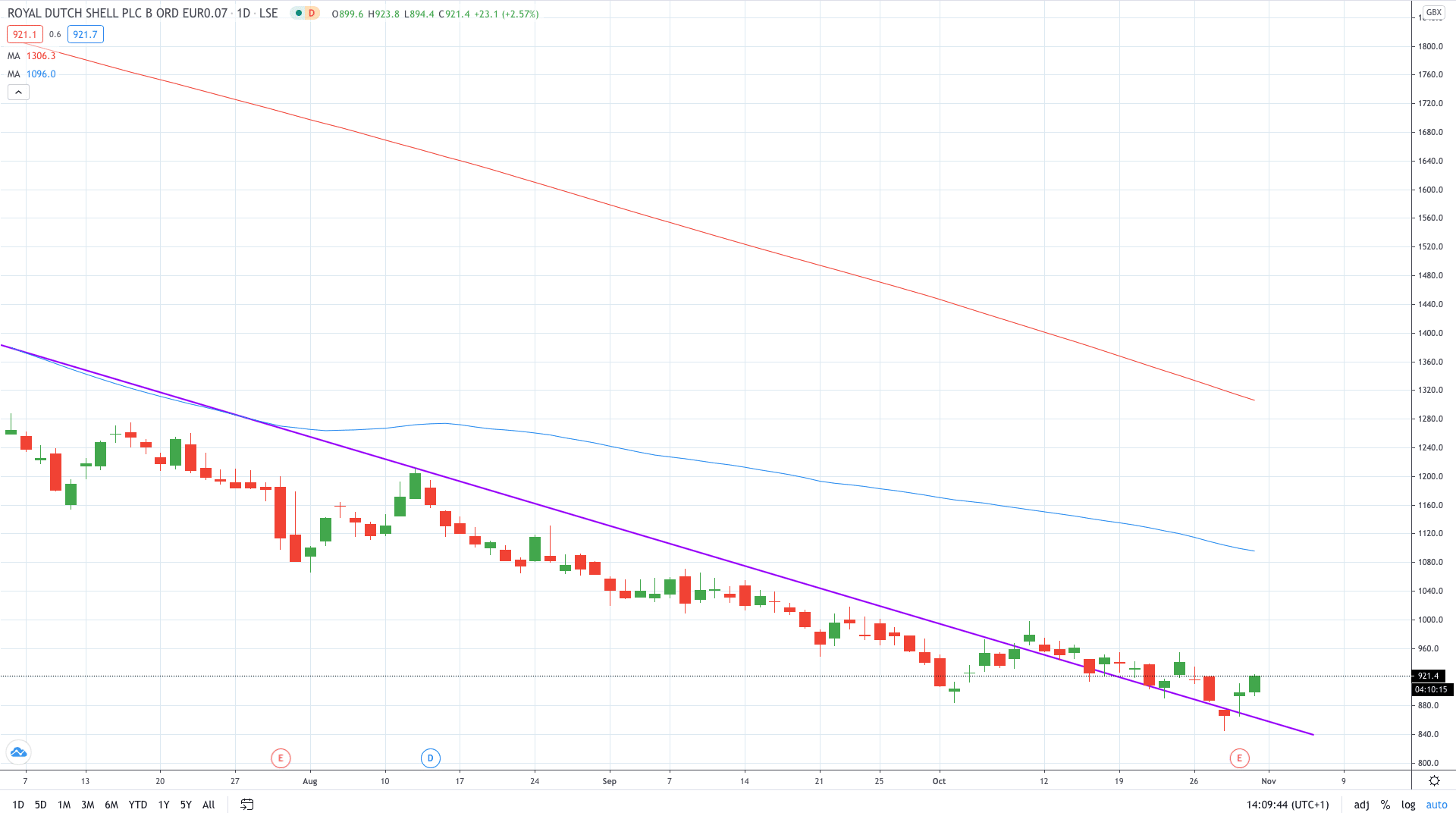

Shares of Royal Dutch Shell PLC (LON: RDSB) rose over 2.5% on Friday after the oil giant increased its quarterly dividend, prompting Barclays to upgrade the stock to “Equal-weight”.

Shell swung to a profit of $489 million from losses in the last quarter but still representing a 92% decline from the prior year. Following the return to profit, Shell increased quarterly shareholder distributions to 16.65c.

“We are starting a new era of dividend growth,” CEO Ben Van Buerden told reporters.

After reinstating dividends analysts at Barclays upgraded the stock to “Equal-weight” from prior “Underweight” and maintained its 1,500p target price.

“On our own numbers we expect Shell to hit its new target net debt level at the end of 2021 with the potential for US$2-6bn extra returns to shareholders per year beyond this,” Barclays’ analysts said in today’s note.

“We believe there is more to come from Shell strategically, but it is the combination of the establishment of a financial framework together with the potential cash generation we see that leads us to lift our rating to Equal Weight. We see close to 70% potential upside to our 1500p.”

Shell share price trades over 2.5% in the green on the day as the buyers recover from setting an all-time low of 845.1p on Wednesday.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan