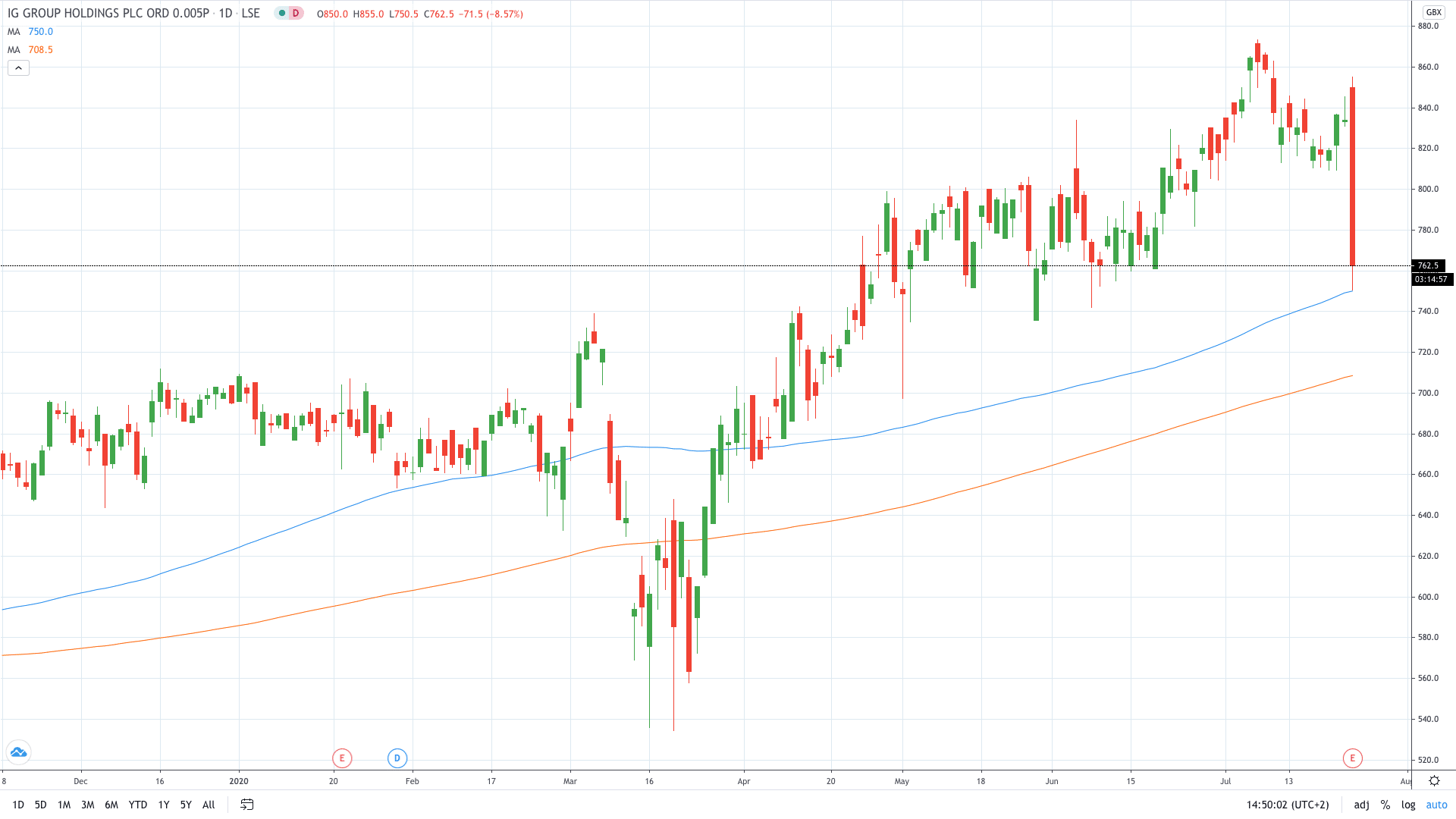

Shares of IG Group Holdings PLC (LON: IGG) plunged 9% today despite a boom in trading volume reported by the London-based provider of financial services.

As a result, IG reported a significant rise in annual profit and revenue amid the “record” performance in the fourth quarter. The trading firm said it made a pretax profit of £295.9 million, up 52% from £194.3 million a year ago.

“This reflected the unprecedented level of client trading activity from the sustained period of volatility across global financial markets triggered by the Covid-19 pandemic and other macro events,” IG said.

Net trading revenue jumped 36% to £649.2 million, compared to £476.9 million on a year-to-year basis. As a result, IG reiterated its commitment to pay a dividend.

“Capital, funding, and liquidity remain very strong, supporting further investment in growth and the dividend payment. The board reiterates its intention to maintain the 43.2 pence per share annual cash dividend until the group's earnings allow for progressive dividends,” said IG.

IG share price tumbled 9%, most likely on profit-taking activities. This month, IG stock price hit the highest levels recorded since September 2018.

- Start learning more about strategies for online stock trading

- Learn how to trade stocks