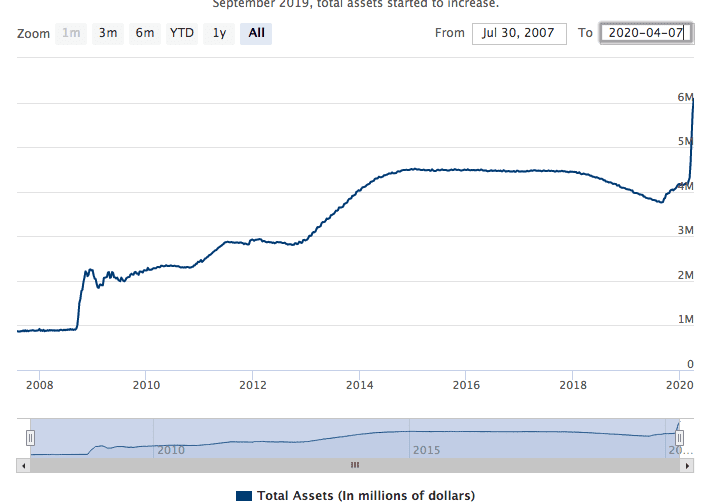

As the Fed and other central banks globally have cut interest rates to almost zero, expanded its balance sheet by over 50% and boosted liquidity in the market. The question has arisen once more as to whether Bitcoin can genuinely be a “safe haven” asset in times of trouble.

As the spread of the COVID-19 virus started to impact financial markets, we saw nearly all asset classes sell-off, including traditional havens like gold. The other asset to be affected was Bitcoin which saw a sharp fall in its price. It resulted in people dismissing the cryptocurrency as a safe asset in times of market volatility.

However, since that initial move down at the beginning of March, we have seen both Bitcoin and gold make tremendous gains.

So, is Bitcoin a safe haven?

As the supply of BTC is restricted, the theory is that if traditional currencies lose value, then Bitcoins price should rise.

However, I feel that it should be looked at differently.

I believe that the recent sell off was due to a lack of US dollar liquidity in the market. Once the Fed injected more cash, we saw Bitcoin rise again. The theory is that more dollars available means more money to be able to buy into cryptocurrency assets.

So my conclusion is that no, it isn't a safe haven asset, but that's not to say that it couldn't or won't become one soon.